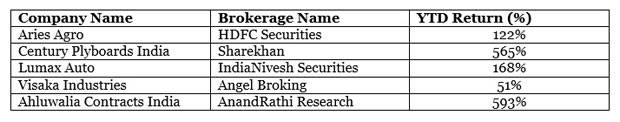

Kshitij Anand of ET has collated a list of five less-known names from different brokerage firms, which belong to either the mid or small cap sector. These stocks are said to have the potential to become multibagger stocks in the near future:

Aries Agro Ltd: HDFC Securities recommends ‘buy’ and add on declines

Aries Agro Ltd (AAL) is a leader in nutritional products for plants, and manufactures a wide range of products under 65 brands of plant nutrients crop protection chemicals. Its diversified product portfolio and wide distribution network enables it to have an upper edge over its peers. Its product mix with multiple products targeting various strata of farmer is a huge entry barrier.

The company currently stands in a very strong position to grab the opportunities in the micronutrients segment in the agriculture industry. Going ahead we feel that the company could enhance its topline and bottomline substantially because of expected growth in the demand for its products.

The experienced management, higher capacity utilization, widespread network, further scope for spreading across the nation and higher utility of its products could act as a trigger for AAL to grow in the coming years.

Century Plyboards India Ltd: Sharekhan maintains ‘buy’

Century Plyboards (Century) is a leading player in the fast growing plywood and laminate segment, with an overall share of 25 per cent of the organised plywood market, which is estimated at Rs4,500-4,800 crore.

The organised plywood and laminate segment is growing at healthy double digits due to an improving demand environment and a shift towards branded products. The brokerage firm believes that it can grow ahead of the industry, at 22% CAGR, over the next three to five years.

Century is a high-quality consumer play with a dominant market share in a fast growing niche segment. Consequently, Sharekhan expects the stock to command a premium valuation and outperform the broader market over the long term. We initiate coverage on the stock with a Buy rating.

Lumax Auto Technologies Ltd: IndiaNivesh Securities maintains ‘buy’

Lumax Auto Technologies (LATL) is a supplier of key components to the two-wheeler and the passenger car industries. Its key customers include Bajaj Auto, Piaggio, Honda Motorcycles and Scooters, Maruti Suzuki, Toyota and Tata Motors. Strong tie-ups with these OEMs will entail large business opportunities in the next few years.

In spite of weak environment for auto OEMs, LATL’s revenues stayed flattish in the past couple of years. However, EBIT margin weakened due to impact of higher depreciation and interest costs related to new plants .

From here on, the research firm expects strong volume growth coupled with margin expansion in the next couple of years. With comfortable D/E of 0.2x and robust ROCE of over 17%, they find current valuations attractive.

Visaka Industries Ltd: Angel Broking maintains ‘buy’

Visaka Industries (VIL) is engaged in two businesses – building products (cement asbestos products and fibre cement flat products like V-boards and V-panels) and synthetic yarn.

It has an installed capacity of 7,52,000 MT of cement asbestos products with a strong network of 6000 plus stockists / dealers across India. With consumer and business confidence improving in building products segment and sustainable performance of its synthetic yarn segment, the brokerage firm expects the company to post a strong performance going ahead.

Angel Broking expects the net profit to grow at a CAGR of 81 per cent over FY2014-16E to Rs 39 cr. At the current price, the stock is trading at a valuation of 5x FY2016E EPS, which we believe is attractive. They initiate coverage on VIL with a Buy rating.

Ahluwalia Contracts India Ltd: AnandRathi initiating with a Buy

Ahluwalia Contracts India, (AHLU) is sharpening its focus on government contracts as they are more scalable and highly predictable in terms of execution. Its exposure to the private sector has, thus, reduced from 85% to 48%. Going forward, the company aims to maintain the public-private mix at 60:40.

The company is swiftly moving towards a significant turnaround in operations, with margins rising from 4.3 per cent in FY14 to 11 per cent in FY17. Return ratios are expected to increase from lower single digit to higher twenties over the period.

The brokerage firm initiates coverage on the stock with a ‘buy’ rating. A major operator in the building segment, AHLU has a good track record of execution. Its strong order book of Rs 32 billion (3.2x TTM revenue) covers 80 projects in more than 15 states.

best buy sunshield chemical