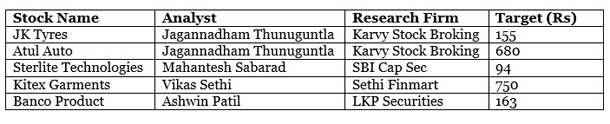

Kshitij Anand of ET has spoken to leading experts like Amit Nigam (Peerless Funds Management), Tushar Pendharkar (Right Horizons Financial Services), Jagannadham Thunuguntla (Karvy Stock Broking), Mahantesh Sabarad (SBI Cap Sec), Vikas Sethi (Sethi Finmart) etc and collated their advice on the stocks to buy:

(Image Credit: ET)

JK Tyres Ltd: Target price Rs 155

JK Tyres relates to the auto and the tyre side of the business, because if the economy picks up, the auto demand picks up. JK Tyres has been doing extremely well and rubber prices coming down is a clear blessing. The overall demand is also doing extremely well despite the recent debut for Monday’s hike in the rubber import duty.

We do not see there should be much change in the overall picture even though there is 5% additional import duty. We still feel that the imports will keep coming up considering the domestic rubber prices are still way higher than the import prices. So I feel JK Tyres eventually may see Rs 145-150 may be sometime this year.

Atul Auto Ltd: Target price Rs 680

Atul Auto has been doing well and in terms of the variant there is a little bit of postponement, but I do not see that should be a major worry in terms of the overall performance.

The company should be posting good numbers even in the March end quarter. Overall, the auto demand is there to take care, thanks to the recovery in the economy. Rs 680 is very much likely on Atul Auto.

Sterlite Technologies Ltd: Target price Rs 94

Sterlite Technologies is actually a play on the digital India story wherein a lot of internet connectivity is getting established so will require the hardware for that. Sterlite is into making optical fibre cables and we like the story related to that.

Sterlite also makes conductors for power lines, which is essentially ordered out by PGCIL, and they have been participating in various PGCIL tenders which have of late picked up. They will see a small rise in the conductor business and thirdly they are also into grid line.

We are seeing earnings CAGR of something like 70% in the next three years. So the stock appears very cheap when you look at its FY17 earnings, just about 12.7-13 times, and that is why there is a buy. So a target price here is 94.

Kitex Garments Ltd: Target price set Rs 750

The company is a mid-sized company from the textile space. This is the world’s third largest manufacturer of infant wear and it caters to almost all the leading international brands. The company plans to launch its own brands. In addition to that it plans to cater to the US market through the e-commerce channel, which would be hugely positive.

The company has a pretty strong balance sheet. It has a high operating profit margins, high ROE and has done exceedingly well over the past two-three years. I feel over the next few years we could see impressive growth from the company, and so I am bullish on the stock and I feel my target in about a year’s time would be Rs 750 on the stock.

I feel if you were to give around four to five years to the stock, this would surely turn out to be a multibagger. I actually feel it could be another Page Industries in the making.

Banco Product: Target price Rs 163

Banco being the major supplier of radiators and gaskets to the CV industry is considered to be one of the prime beneficiaries of the MHCV turnaround witnessed currently. The MHCV industry has been growing at a hefty pace of 15% YTD FY15.

Going forward, as interest rate cycle has turned favorable and several stuck-up infrastructure projects are expected to get restarted along with new projects. LKP expects the MHCV segment to witness an accelerated growth.

In line with improved expectations on both volumes as well as margin front, clean balance sheet and improved return ratios, LKP expects the stock to perform handsomely going forward.

This may also lead the company to dole out more in terms of dividends. The company is currently trading at just 9.2x estimated FY17E forward earnings and should be accumulated with a one-year target price of Rs 163.

SO METICULOUSLY SHORTLISTED ALL THE FOUR !!

SO “SHARP “THEIR CALLS

All these stocks had become multibaggers already, why they are recommending at this steap valuations???, I think SKM egg products is the multibagger which i am tracking, is there anybody who can comment on this?

multibagger in making skm egg prdt