We estimate revenue CAGR of ~17% over FY25-28E with EBITDA margin improving gradually to...

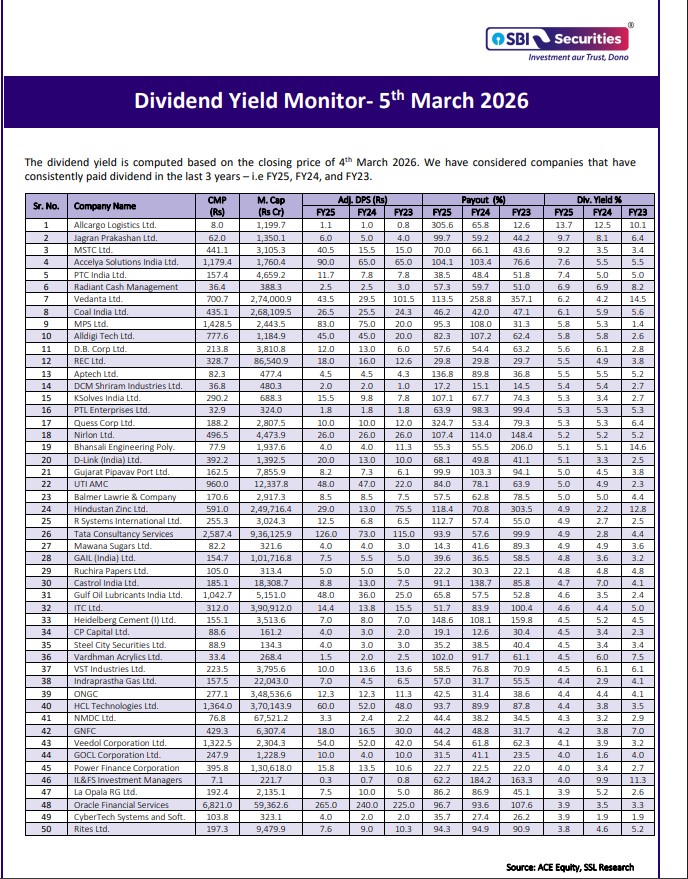

The dividend yield is computed based on the closing price of 4th March 2026

High Dividend yield of up to 6.2%

Investors may benefit from maintaining a balanced approach, focusing on quality companies aligned with...

RACL has recently announced an ambitious capex plant amounting to ~₹77 crore for FY27E,...

Apar has repurposed its cables portfolio to dominate niche segments and export markets

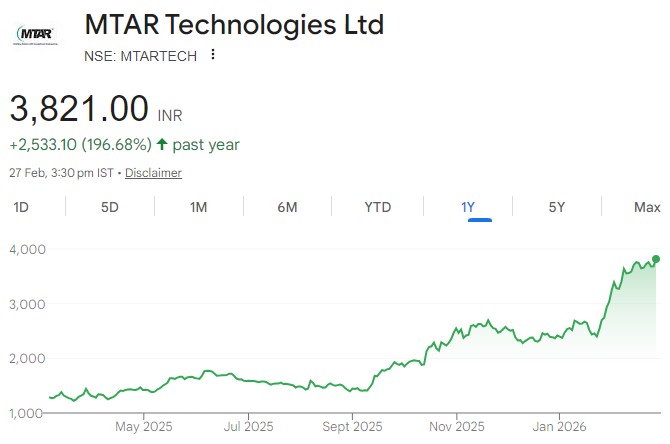

MTARTECH is firmly positioning itself as the indirect beneficiary of the global AI infrastructure...

Outlook for the wind industry is positive over the medium to long term, given...

ZF combines high margin technology products with a stable and growing aftermarket business, providing...

Asset quality remains a key strength for Capri Global, supported by its predominantly secured...