Margin blues persist for now

Havells’s 3QFY25 print is a mixed bag as healthy revenue (+11% YoY) and gross profit growth (+15% YoY) was offset by higher employee cost (+23% YoY) and other expenses (+12% YoY; relocated SG plant to another existing location). While the ECD segment sustained strong growth (+15% YoY; +16% CAGR), margins got impacted on account of deepening R&D and distribution aspects of the business.

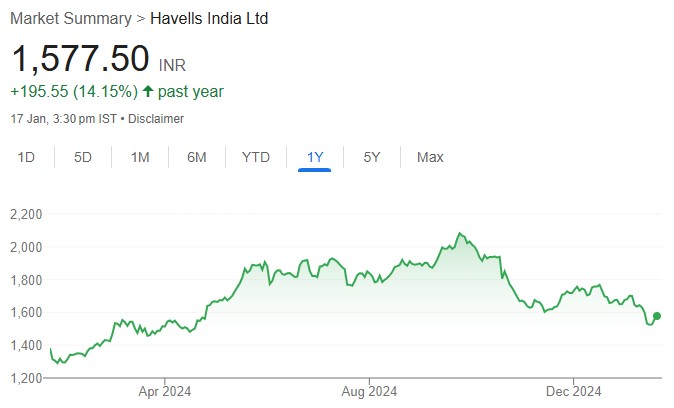

Consumer sentiment remained positive aided by festivities while industrial and projects trend stayed robust in 3QFY25. We are cutting FY25–27E EPS by 5–9% due to a delayed margin recovery. We now reckon FY24–27E revenue/EBITDA/PAT CAGR of 15%/19%/20% with a revised Mar-26E TP of INR1,940 (earlier INR2,000) on 55x FY27E EPS; ‘BUY’.

Mixed bag; C&W leads underperformance

Revenue grew 11% YoY (2% below our estimate) led by strong growth in ECD and Lloyd (+15% YoY) and Switchgears (+11% YoY; strong project-related demand), partially offset by weak Cables & Wires (+7% YoY; we reckon flat-to-single digit decline YoY in wires volume) and Lighting (double-digit volume growth, negated by price erosion). EBITDA increased 11% YoY as healthy growth in gross profit (+15% YoY; gross margin up 110bp YoY) was offset by higher employee cost (+23% YoY) and other expenses (including one-time relocation charges). Lloyd revenue rose 15% YoY with a contribution margin expansion of 540bp YoY to 12.8%. WC days stood at 43 days (mainly on account of inventory pile-up).

People and infra investments drag operating margins in near term

Havells continues to invest in human resources (employee cost up 25% YoY in 9MFY25; 9.1% of revenue versus 8% pre-covid) and A&P in order to expand its category depth/presence and distribution reach. We believe these investments are likely to see stability in coming quarters, thereby paving the way for margin normalisation as growth trajectory improves in medium term. Hence, we expect Havells EBIT margin to improve to 10.4% in FY25E (8.9% in 9MFY25; 13% in FY19).

Poised to benefit from ensuing consumption recovery; retain ‘BUY’

We argue Havells has been gaining market share in most categories over past several quarters (exhibit 6). Moreover, we reckon it is well placed to sustain this trend on the back of recovery in consumption demand and real estate along with sustained industrial sector capex. We estimate revenue/EBITDA/PAT CAGR of 15%/19%/20% over FY24–27 with a Mar-26E TP of INR1,940 (earlier INR2,000) based on 55x FY27E EPS. Retain ‘BUY’; Havells stays our preferred pick in Consumer Durables coverage.