Is SBI a better investment than HDFC Bank?

It is well known that Saurabh Mukherjea is vehemently opposed to investing in PSU Bank stocks. In fact, he had once argued that PSU Banks should not even be listed on the Bourses.

Saurabh Mukherjea raises some interesting issues on PSU stocks.

One ques: Shd some PSUs should be listed at all. The ques was raised by YV Reddy on PSU Banks. Since PSBs will always be a vehicle of govt policy, should they be listed? https://t.co/DIC4s4tZXp via @BloombergQuint

— Ira Dugal (@dugalira) February 24, 2020

He has also contemptuously described SBI as a “passing wave” meaning that its outperformance against HDFC Bank is not sustainable and will wither away.

However, other experts have a dramatically opposite view. “The next 10 years will be the decade of the PSU banks. It is very easy to find a Baroda or a Canara or a PNB to give you a 50% or a 70% return from here“, Sanjay Dutt of Quantum Securities has declared.

Save this tweet. Next 5 years, SBI will outperform HDFC Bank and ICICI Bank. Won't be surprised if the current price exceeds that of HDFC Bank…

Note – No investment and no positions….

— Sanjay Dutt (@thesanjaydutt) December 3, 2020

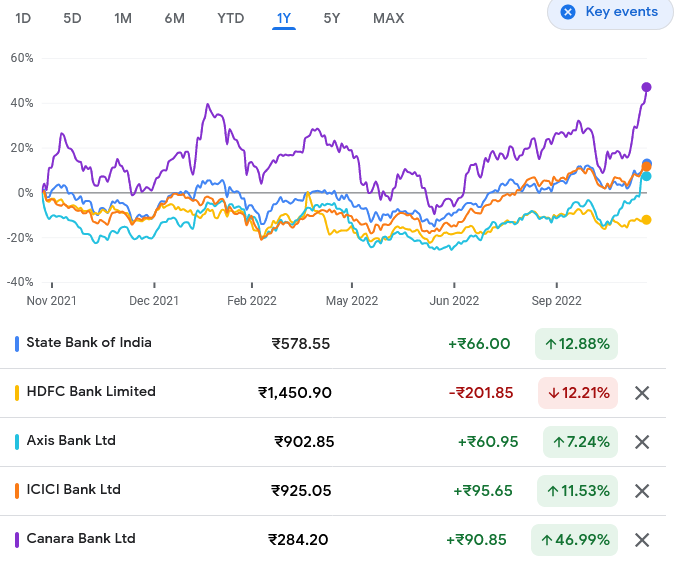

Anyway, as of now, HDFC Bank is underperforming SBI. On a YoY basis, SBI is up 12% while HDFC Bank is down 12%.

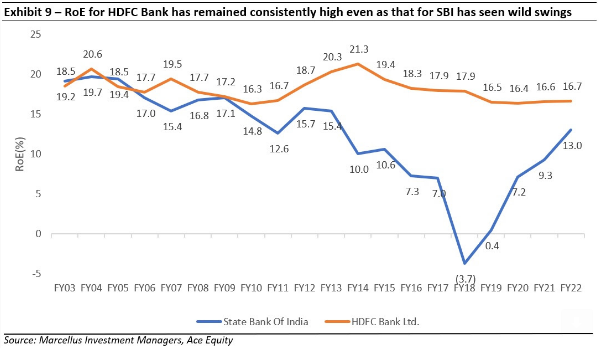

The outperformance is a “temporary phenomenon” because HDFC Bank’s RoE is both higher and much more consistent compared to SBI

In his latest newsletter, Saurabh and his Team Marcellus have dealt with the HDFC Bank vs SBI issue in a no-holds-barred manner.

He has pointed out that the central tenet of long-term stock price compounding for lenders is that it happens in line with the Book Value Per Share (BVPS) compounding. BVPS compounding in turn is dependent on the bank’s RoE as well as the multiples at which equity capital raises are done over a cycle. Specifically, banks which are able to raise equity capital at higher P/BV multiples, deliver greater BVPS compounding for their shareholders.

The outperformance of SBI as compared to HDFC Bank is a divergence of the aforementioned tenet and is a “temporary phenomenon“, it is claimed.

“In the recent past the P/BV multiple for HDFC Bank has retreated while the same has risen for SBI. However, HDFC bank has continued to enjoy a P/BV multiple which is almost 2-3x that of SBI on a cross cycle basis. Such a wide differential in P/BV multiple is on the back of 50% higher RoE for HDFC Bank (18.1%) vs. SBI (12.2%) indicating the ability of the private lender to compound its BVPS (and its hence share price) at a much faster pace than the state owned lender,” it is explained.

Saurabh has also emphasized the seminal point that the high RoEs of HDFC Bank have not been generated on the back of high leverage (i.e. higher debt:equity ratio) but rather is a result of high RoAs. The RoA for HDFC Bank has actually increased over the last 20 years from 1.4% to 1.9% whereas for SBI it has consistently remained below 1.1% touching lows of even -0.2% in FY18.

It is also stated that not only are the absolute levels of RoA much higher for HDFC Bank, but they’re also much more consistent (implying lower volatility).

At the end of the detailed discussion, Saurabh has assured that though the stock price performance of HDFC Bank has remained subdued since FY19 end with a CAGR of 10%, its fundamentals have continued to grow at a healthy pace with a 5-year EPS CAGR of 20%. “As in the past, the dissonance would resolve in the future as the stock price performance catches up with underlying fundamentals,” it is confidently asserted.