India Equity Strategy

Input cost benefits drive earnings growth; revenue contribution muted

Q3FY24 earnings season saw an overall in-line performance, with wide divergences across sectors and companies. Aggregate revenue/PAT grew by 5%/20% YoY and 4%/-4% QoQ across the HSIE coverage (~224 stocks), with their four-year CAGRs at 13%/18%. There was similar participation by large and midcap categories towards incremental earnings growth as large-cap grew by 20% YoY and midcap grew by 21% YoY. This is in contrast to Q2FY24 when large-cap had dominated earnings. Further, 77% of incremental YoY earnings growth came from only three sectors— energy (33%), auto (24%) and metals (20%)—reflecting heavy lifting by these sectors. Our coverage universe saw strong YoY earnings growth in auto, lending financials (ex-SBI), industrials, energy, cement, pharma, capital markets, and metal sectors. On the other hand, staples, discretionary, IT, and power sectors disappointed. Key stocks contributing to the YoY earnings growth (61% of the total) are Tata Motors, ICICI Bank, IOCL, GAIL, Tata Steel, and JSW Steel. The benefits of softer input costs continued in this quarter as well. We believe support of favourable commodity costs is largely over and FY25 earning growth must be volume-led.

Overall, the auto and energy sectors led the coverage universe’s Q3FY24 PAT beat of 4.8%. Further, there was a decrease in the percentage of companies beating estimates this quarter as names from lending financials, home improvement, chemicals, infrastructure and consumer discretionary missed the estimates.

The changes in earnings estimates were deeply concentrated. 50% and 37% of the earning upgrades were led by the energy and auto sectors respectively while lenders, staples and discretionary were responsible for 14%, 8% and 9% of cuts respectively for FY24. Similarly, auto and energy accounted for 47% and 34% of FY25 upgrades while lenders, IT and staples led 29%,19% and 14% of cuts for the same year respectively. Consequently, the aggregate earnings estimates saw upgrades of 0.9% and 1.4% in FY24 and FY25 respectively.

For the HSIE coverage universe, projected earnings growth for FY24 and FY25 stands at 30.5% and 8.2% respectively. FY23 was an exceptionally subdued earnings year for the energy sector due to the freeze on petrol and diesel retail prices impacting OMCs and windfall tax hurting upstream. So, excluding the energy sector, earnings growths for the coverage universe for FY24 and FY25 stood at 18.9% and 16.6% respectively.

The Nifty 50 index is now trading at ~20.5x FY25 and ~18.1x FY26 consensus EPS, indicating limited upside potential in the next 12 months.

Our preferred sectors are industrial and real estate, metal, power, insurance, cement & building materials, market infrastructure, pharma and gas. We remain underweight on consumer staples, NBFC, chemicals and small banks. We have added weights in steel, media, staffing and cash/InVIT while weights have been reduced in BFSI, industrial/real estate and energy.

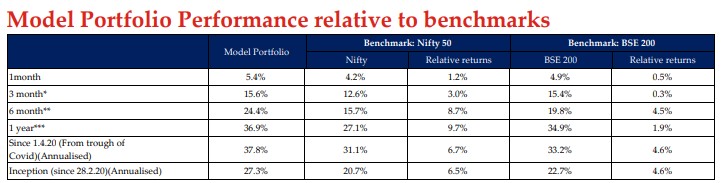

Model portfolio: We maintain a bias toward the economy-facing and value sectors. Key changes in the model portfolio are as follows:

Key coverage inclusions

Torrent Pharma, BSE, Teamlease, Mphasis, Tech Mahindra, Stylam, Sail, Motherson Sumi Wiring

Key coverage exclusions

Bandhan Bank, Star Health, NCC, Alkem, Coal India, IOCL, Somany

Click here to download HDFC Sec India Equity Strategy – 3QFY24 Flipbook