Key highlights of the 2QFY25 Result

Highest ever quarterly sales volumes

During 2QFY25, revenues from operations declined 5.4% YoY on account of steep fall in raw material prices. However, EBITDA/PAT during the quarter increased by 57.7%/72.0% YoY to Rs 42.2 cr/Rs 18.1 cr respectively. EBITDA/t in 2QFY25 stood at Rs 3,429/t vs 2,665/t in 2QFY24, up 28.7% YoY. This was primarily due to the company accumulating a lot of fix price orders/contracts which aided to mitigate Rs 600 – Rs 700/t inventory loss. Further, no additional discounts were given to dealers and distributors.

Volume, EBITDA/t & % Share of Value-added products (VAP) guidance:

For FY25E/F26E/FY27E, we have assumed sales volume of 0.5 mnt/0.6 mnt/0.8 mnt respectively. We expect its blended EBITDA/t to increase to Rs 3,497/t/Rs 3,915/t/Rs 4,153/t in FY25/FY26/FY27 respectively from Rs 2,967/t in FY24 on the back of increase in % share of value-added products to 50%+ in FY26 on a blended basis.

Growth drivers to boost the blended EBITDA/t and % share of VAP:

The upcoming new capacities are majorly focused on value-added products (Gujarat, Sanand (Unit 2, Phase 2) and Sikandrabad) and are likely to be operational by end of FY25. This will aid in margin expansion and achieve 50%+ share of value-added products by FY26.

Fund raise through QIP:

The company successfully completed the fund raise through QIP of Rs 500 cr, backed by strong interest from institutional investors. It issued and allotted 2.7 cr equity shares at Rs 185.5/share each to eligible Qualified Institutional Buyers (QIBs).

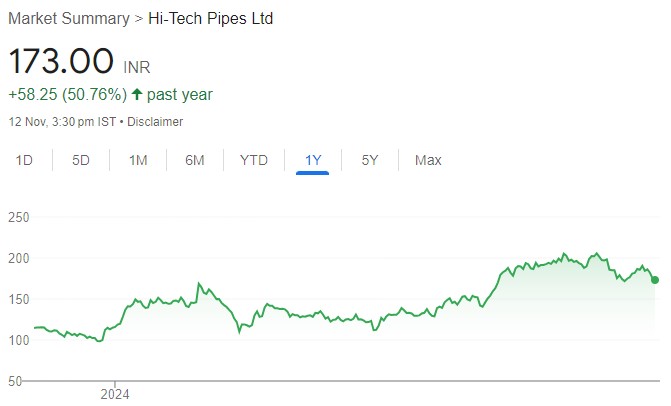

Maintain BUY with Price Target Rs 215.0/-

We believe, Hi-Tech pipes has mammoth growth prospects in the structural steel tubes space given its (a) Capacity expansion from 0.58 MTPA in FY23, 0.75 MTPA in FY24 to 1 MTPA in FY25E, (b) Transition from generic products to value-added products, (c) Product portfolio enhancement on back of Solar torque tubes, color coated roofing sheets and (d) Healthy demand for structural steel tube over medium and long term (Budgeted Allocation for Jal Jeevan Mission of Rs 70,163 cr in Budget 24-25). At the CMP of Rs 175.3, the stock is currently trading at a P/E of 45.4x/26.1x/18.0 of its FY25E/FY26E/FY27E EPS of Rs 3.9/Rs 6.7/Rs 9.8 respectively. We assign a higher P/E multiple of 22x and retain our BUY rating on the stock with price target of Rs 215 thus providing an upside potential of 22.5%.