HINDWARE alias Hindware Home Innovation is a favorite stock amongst expert investors and FIIs though it is a small-cap with a full market capitalisation of Rs. 3388 crore and a free-float market capitalisation of Rs 1626 crore.

As of 30th September 2023, Sunil Singhania’s ABAKKUS GROWTH FUND-1 and ABAKKUS GROWTH FUND-2 held a massive chunk of 3178341 shares worth Rs 148.74 crore at the CMP of Rs 468.

MUKUL MAHAVIR AGRAWAL, also a noted investor, holds 10,00,000 shares.

Amongst the FIIs MATTHEWS EMERGING MARKETS SMALL COMPANIES FUND holds 7,28,123 shares, INDIA INSIGHT VALUE FUND holds

7,98,000 shares while AL MEHWAR COMMERCIAL INVESTMENTS L.L.C. (NOOSA) holds 15,52,479 shares. Another FII named COHESION MK BEST IDEAS SUB-TRUST holds 10,50,000 shares.

Two HNIs named GANESH SRINIVASAN and MANAV GUPTA also have big holdings.

DSP SMALL CAP FUND holds 21,08,209 shares.

The promoters hold 51.32% of the equity capital.

Investors’ presentation

The latest investors’ presentation sheds light on the business prospects of the Company. It is stated that the Plastic Pipes & Fittings division (TRUEFlO), is the fastest growing plastic pipes and fittings brand in India

There are 2000+ SKUs already being offered and many more being added. TRUFLO aims to be amongst the top 5 CPVC players in 3 years

In-house manufacturing allows for better efficiencies & end to end logistics and supply chain control. The Company offers CPVC pipes for hot and cold-water plumbing applications, along with lead-free UPVC pipes, SWR pipes, PVC pipes for potable water, column pipes and overhead water storage tanks.

Currently, the business has 300+ active distributors with more than 30,000+ dealers/retail outlets

The Market Size is a mammoth ₹22,000 crore.

Buy for target price of Rs 637 (34% upside)

Nuvama has recommended a buy of Hindware Home Innovation for the target price of Rs 637 on the following rationale:

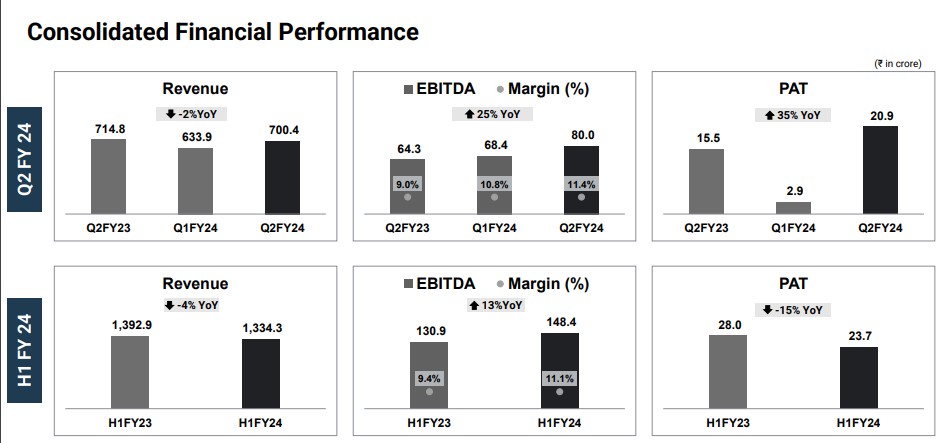

“From being a manufacturer of just one product, HINDWARE has grown significantly to gain market leadership in sanitary ware and is a major faucet ware player. We are optimistic about its medium to longterm growth prospects given its: i) strong positioning in bath ware, ii) greater presence in pipes and fittings and consumer appliances, iii) comprehensive product portfolio, iv) strong brand recall, and v) wide and expanding distribution reach. With a constant focus on product innovation, a timely ramp up in pipe capacity, and a positive demand outlook, it is expected to deliver strong overall growth. However, due to lower-than-expected numbers in H1FY24, we trim our FY24/FY25 PAT estimate by 17%/14%. We maintain ‘BUY’ with a revised TP of INR637 (earlier: INR672).”