Set to thrive on “Smart Meters” opportunity…

About the stock: HPL Electric & Power (HPL), incorporated in 1992, is among India’s leading electric equipment manufacturer with a formidable presence across two major segments, 1) Metering & Systems and 2) Consumer & Industrials

• Metering & systems segment contributes ~53% to total revenues (as of FY23) while balance ~47% by consumer & industrials. Company has 7 manufacturing facilities (5 in Haryana & 2 in Himachal) and 2 R&D centers. In meters segment, company has an annual capacity of 11 million units

• Company’s revenue grew by 8.9% CAGR during FY20-23 while EBITDA and PAT have grown by 7.9% CAGR and 10.9% CAGR respectively over the same period. During FY23, company reported revenue & EBITDA of ₹ 1262.0 crore and ₹ 156.9 crore respectively, while PAT increased significantly by 3.9x YoY to ₹ 30.2 crore

Key Investment Thesis:

• Well positioned to capture significant share in enduring “Smart Meters” opportunity: We believe that the ‘Metering & Systems’ segment will be the key growth driving segment for HPL in the coming period. Govt is targeting installation of 25 crore smart meters nationwide, with an ambition of firming transmission & distribution network and reducing the distribution losses. With an annual meter capacity of 11 million units (Utilisation at 70- 75%), HPL already commands the market leader position in domestic electric meters market with ~20% market share. The company’s order backlog stands at ₹ 2000+ crore (70%+ is contributed by smart meters) as of Nov-2023 (1.5x TTM revenues), ensures medium term revenue visibility

• Strong manufacturing & R&D capabilities with comprehensive product portfolio: With strong design, development & manufacturing capabilities led by backward integrated manufacturing facilities & R&D centers, company has been able to diversify its product portfolio which now covers a wide range of low-voltage electric products including metering solutions, switchgears, lighting products, wires & cables, solar solutions and modular switches. Company remain focused on improving its infrastructure, technology and market reach to maintain its consistent growth and strong position in smart meter, switchgear and wire & cable segments

Rating and Target Price

• HPL is well positioned to witness healthy growth led by strong demand arising in smart meters segment. Moreover, switchgear & wire & cable segments too is poised to grow considerably in the coming period. We estimate revenue, EBITDA and PAT to grow at 19.7%, 28% and 53% CAGR respectively over FY23-26E as against single digit growth over FY20-23

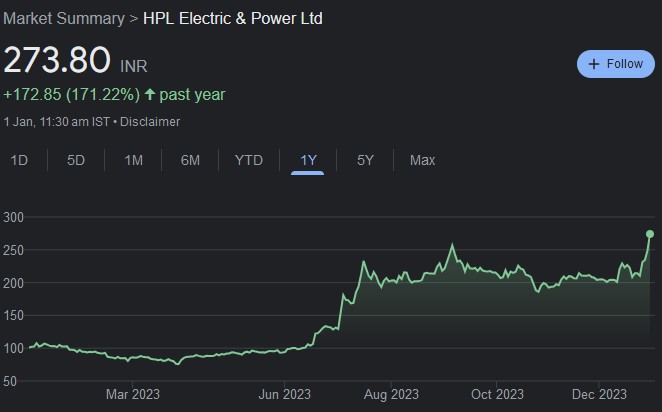

• We recommend BUY on HPL Electric & Power with a target price of ₹ 305 per share (based on 18x FY26E EPS)

Click here to download the research report on HPL Electric & Power