Nightmare on Dalal Street after Sensex plunges 1100 points

Today, the stock markets recorded the biggest losing streak in recent memory.

The Bank Nifty, which comprises of the choicest private and PSU banking stocks, crumpled like a leaf.

It lost 725 points, constituting 3.43%.

The Sensex and Nifty lost 1102 points and 335 points, comprising nearly 3%.

Even the Midcap Index, which was supposed to surge in the wake of the buying frenzy of Mutual Funds, lost 2.6%.

Naturally, everyone in Dalal Street is sporting a glum face.

“Blood bath in Dalal Street. Heavy losses everywhere,” a trader remarked, echoing the sentiments of other investors and traders.

Blood bath in Dalal Street. Heavy losses everywhere. pic.twitter.com/tLOD4zPxwG

— P R Sundar (@PRSundar64) September 24, 2020

#MarketAtClose | Market slips for 6th straight day to record the biggest losing streak in 7 months; Sensex & Nifty post biggest single-day fall in 4 months, Nifty Bank in 2 months pic.twitter.com/Fx5IuIgw34

— CNBC-TV18 (@CNBCTV18Live) September 24, 2020

Even the Dow Jones and the S&P 500 are plunging to new lows.

Stocks hit session lows; Dow tumbles 1.5%, Nasdaq falls 2.5% https://t.co/sig2GviDtj pic.twitter.com/z8IlhY6wiq

— CNBC Now (@CNBCnow) September 23, 2020

All Trump sees is Wall Street. The only metric of the American prosperity for him is the Dow Jones

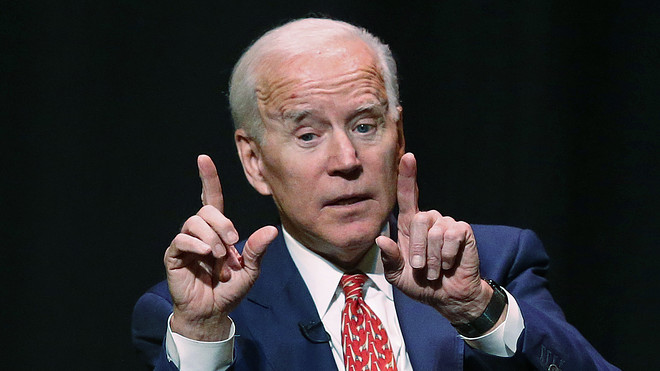

For some reason, Joe Biden, the contender for the post of US President, has equated the stock markets with Billionaires.

That is why he constantly attacks the stock markets whenever he attacks Donald Trump, his rival.

“I view this campaign as being between Scranton (an industrial hub) and Park Avenue (i.e. Wall Street),” he said in a chilling tone.

“All Trump sees is Wall Street. The only metric of the American prosperity for him is the value of the Dow Jones. He looks down on people who work with their hands ..,” Biden said.

Biden: All Trump sees from Park Avenue is Wall Street. That’s why the only metric of the American prosperity for him is the value of the Dow Jones. pic.twitter.com/dI2Vxd73ip

— Acyn Torabi (@Acyn) September 18, 2020

The worrying aspect is that Biden’s rhetoric is meeting with approval from many voters.

Biden is sounding good

— Movie Guy (@WormsUSA) September 18, 2020

Working class Joe.

— Morehouse (@art_morehouse) September 18, 2020

Right wing Republicans like Trump are the elitists with their gold toilets looking down on others from Park Avenue. Trump only cares about the stock market which is why he let 200K Americans die because he didn't want to "panic" the Dow Jones.

— Ray King (@king_of_ray) September 18, 2020

However, some sensible persons rightly pointed out that the middle class people also have investments in the stock market and so torpedoing the stock market is a short-sighted move.

The Dow affects everyone who has a 401K which is most of America including blue collar midwest American workers. We are middle income..little lower but we feel the effects of a good stock market/Dow. You can't be that ignorant of how that all works, can you ?

— Mary Truka (@trukama) September 18, 2020

I pledge to raise the tax on capital gains

As part of his rhetoric against the stock market, Joe Biden has promised to impose crippling tax on capital gains.

Joe Biden has pledged to raise the capital gains tax if elected this November. So what would that mean for your money? @robtfrank has the details. pic.twitter.com/kWbkV2OzpP

— CNBC (@CNBC) September 18, 2020

According to a report in CNBC, Biden has proposed increasing the top tax rate for capital gains for the highest earners to 39.6% from 23.8%.

This will be the largest real increase in capital gains rates in history.

Experts warned that the proposal would have disastrous consequences.

“An increase in the capital gains rate would always lead to sales of equities and securities prior to the effective date of the increase,” an expert named Roger Altman stated.

“My decision to liquidate yesterday did not come lightly, but JoeBiden’s tax plan makes it too risky to hold until post-election. Biden intends to raise capital gains rates from 20% to 40%! A Biden win could spur a major sell-off as people look to cash out while they still can,” another knowledgeable person stated.

My decision to liquidate yesterday did not come lightly, but @JoeBiden's tax plan makes it too risky to hold until post-election. Biden intends to raise capital gains rates from 20% to 40%! A Biden win could spur a major sell-off as people look to cash out while they still can.

— WallStreetBets[god] (@WSBgod) September 23, 2020

Joe Biden’s plan to increase the capital gains tax could lead to a large-scale sell-off of stocks, according to economic analyses. https://t.co/Wi8OOykWxR

— CNBC (@CNBC) September 21, 2020

Thankfully, stock markets always surge after the elections, irrespective of who wins

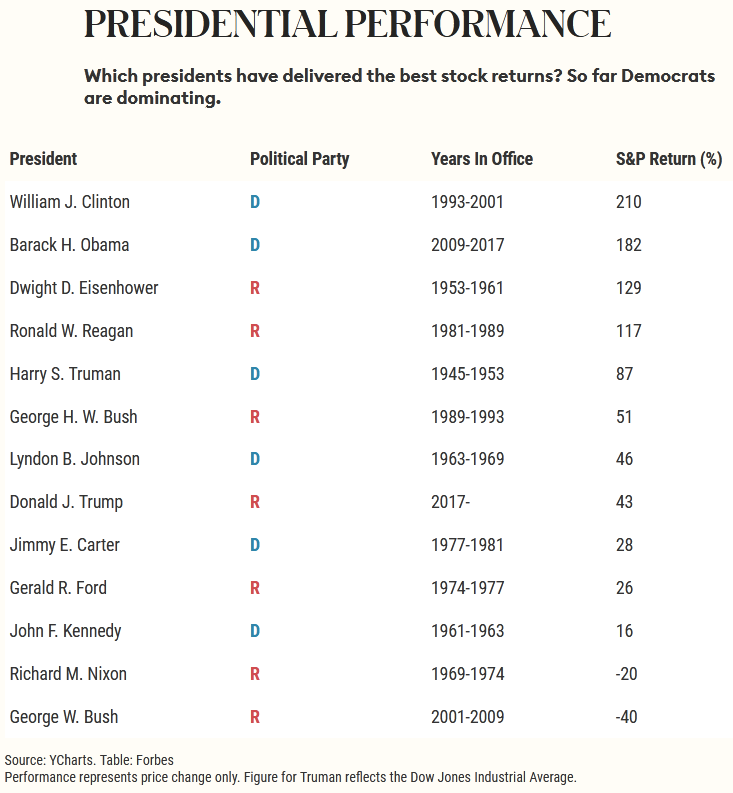

According to research conducted by Forbes, while the stock market is extremely skittish during the elections, it is thereafter indifferent to whether the Republicans are in power or the Democrats – it continues to surge like a rocket over the long-term.

Jeremy Siegel, the author of a bestseller investment classic named Stocks For The Long Run pointed out that obsession of Wall Street with politics is misplaced.

“Bull markets and bear markets come and go, and it’s more to do with business cycles than presidents,” he said.

Other economists and market experts corroborated this viewpoint. They pointed out that over time, the overall direction of the market tends to be driven more by broader factors such as interest rates, economic growth, corporate earnings etc and not by a single tax policy.

They also pointed out that with interest rates so low, investors have no choice but to invest in stocks even if the tax rates are high.

This implies that long-term investors may not have much to worry about. If we can gird our loins and wait out till after the US elections are over, we will once again be able to bask in glorious riches!