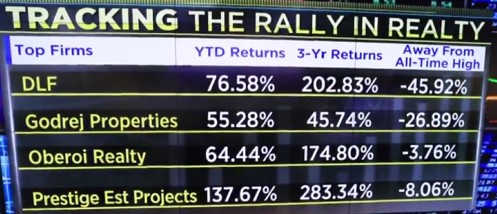

The imminent fall in interest rates will benefit realty stocks. Stocks were languishing & have only now reached a 14-year high. However, several like DLF, Godrej, Oberoi are way below earlier highs implying huge upside potential. Experts say realty sector can generate huge wealth

#EditorsRoundtable | Nifty Realty Index hit a 14-year high this week. But stocks are yet to reach earlier highs.@nimeshscnbc decodes the data.#markets #StockMarket #NiftyRealty pic.twitter.com/MIZ9QqEfuS

— CNBC-TV18 (@CNBCTV18News) December 15, 2023

#EditorsRoundtable | Nifty Realty Index hit a 14-year high this week. But stocks are yet to reach earlier highs.@nimeshscnbc decodes the data.#markets #StockMarket #NiftyRealty pic.twitter.com/MIZ9QqEfuS

— CNBC-TV18 (@CNBCTV18News) December 15, 2023

Thanks @nimeshscnbc for sharing our views in this week's #EditorsRoundtable

2023 belonged to PSE'S while 2024 can be dominated by Realty names as this sector can generate huge wealth in the next couple of years. https://t.co/BK9wZugQ1I pic.twitter.com/FtataTSpKZ

— Rahul Sharma (@rahul2506) December 16, 2023

According to a report in NDTV Profit, HSBC expects 2024 to see strong launch momentum due to an increased confidence in the continuation of the cycle.

| DLF | Hold | 740 | 12 |

|---|---|---|---|

| Godrej Properties | Hold | 2,040 | 7 |

| Oberoi Realty | Reduce | 1,310 | −8 |

| Prestige Estates | Buy | 1,270 | 15 |

| Sobha | Buy | 1,240 | 22 |

The strength of residential demand should continue in 2024 due to affordability, limited supply and a strong pipeline, HSBC said.

Despite the residential real-estate cycle being strong for three years, HSBC reiterated that the next year would also continue to witness sales growth, according to a note.

HSBC expects consolidation to continue as branded developers are set to increasingly use a joint-development route to bring their projects faster to market, even at the cost of paying a slight premium to landowners.

There are some segments that have lacked pricing discipline. But the larger market has remained affordable due to the salary growth witnessed in the past three years, resulting in demand remaining strong, it said.

Preference for new and larger-sized apartments and community-housing projects continues to see pricing growth, driving demand ahead of expected price rises, according to HSBC.

The brokerage maintains a ‘buy’ rating on Sobha Ltd. and Prestige Estates Projects Ltd.; ‘hold’ on DLF Ltd. and Godrej Properties Ltd.; and ‘reduce’ on Oberoi Realty Ltd. It has also raised the target prices.

Outlook

Investors are benefiting from the wealth effect and the momentum of their recent property performance should keep the demand strong well into 2024, according to HSBC.

It expects 2024 to see strong launch momentum due to an increased confidence in the continuation of the cycle. Pace of new launches, preference for new construction and rebuilding product pipelines are the key themes.

“With the companies having much lower leverage, investors will watch out for their ability to sustainably scale up their business via new launches and business development, while exercising capital discipline.”