Earnings a tad below estimate; favourable risk-reward

As against the expectations of low double digit PAT growth at Nifty level, for Q3FY25, PAT growth at Nifty stood at steady 8% YoY. On the topline front, at the Nifty level, growth remained single digit at 6.5% YoY. Earnings for the quarter was supported by the financials pack (Banks & NBFC’s) amidst muted show by the manufacturing sub-segment. Ex-banks & NBFC’s, topline and PAT growth at Nifty is pegged at 5% & 2% respectively. For manufacturing segment, encouraging thing was operating margins coming in at a six-quarter high at 18.9% (up 100 bps QoQ), primarily driven by benign commodity prices. In Midcap domain, earnings growth outperformed at ~15% YoY given the turnaround at a leading global agrochemical players and Oil Marketing Company. In Small caps space, excluding the MFI & Small banking finance companies, earnings growth came in at 5.4% on YoY basis, however this domain underperformed. For the listed universe, PAT growth came in broadly steady at 9% on YoY basis.

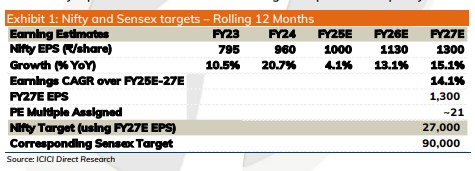

With election led uncertainty behind us and growth-oriented Union Budget in place we expect corporate earnings to resort to double digit earnings trajectory starting FY26E. With Nifty down ~12% from life time highs and mid & small caps down ~15-20%, we believe valuations have become more reasonable and present market provides extremely lucrative opportunities for long term wealth generation. Encouragingly, global and domestic interest rate cycle has started its downward trajectory & should support equity valuations going forward. We believe any dips should be used to build a long-term portfolio of quality stocks.