Parag Parikh, the veteran value investor, is a renowned authority on behavioural finance. He has written two bestsellers on the topic called “Value Investing and Behavioral Finance: Insights into Indian Stock Market Realities” and “Stocks to Riches: Insights on Investor Behaviour”

In his latest article, Parag Parikh points out that investors make investment decisions which are distorted by their own biases. The two biases that come into play are the ‘Availability‘ bias and the ‘Representativeness‘ bias.

Parag Parikh points out that in the “availability” bias, investors make decisions based on the information that is readily available to them. So, when investors are constantly bombarded with the warning that “Mutual funds are subject to market risk…“, they have a fear psychosis and they associate “volatility” in the market with “risk”. So, they buy stocks nervously and without proper conviction. Also, they panic at the slight hint of trouble.

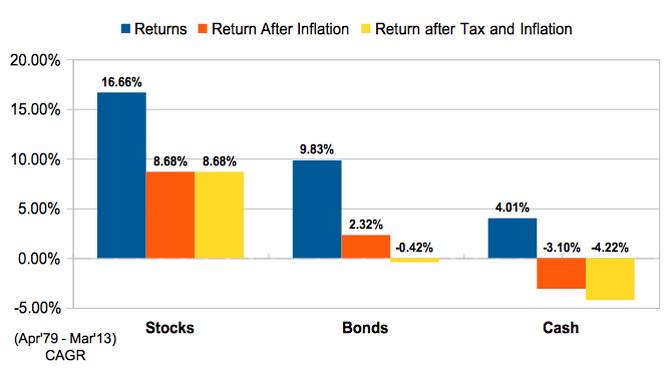

On the other hand, if investors are educated with the information that “Equities create wealth over the long-term and outperform other asset classes”, their outlook towards equities changes and they buy stocks with a proper attitude of holding it for the long-term.

(Chart showing the equities outperform even after taxes & inflation – image credit: Parag Parikh)

Parag Parikh also points out that the other great disservice done by the mutual fund industry is to flood investors with multiple scheme choices (real estate, infrastructure, close ended, mid cap, small cap, growth, value, etc) This confuses the investor and he suffers a decision making paralysis. He falls prey to the unscrupulous marketing techniques of the mutual funds and invests in “fancy” schemes.

“The right investing process and the ability to hold on for the long term is the way to wealth creation. Not chasing fancies” Parag Parikh says in a firm tone.

He also makes the interesting point that by nature, investors are not “risk averse” because if they were so, they would have never bought stocks. Instead, they are “loss averse” and this attitude compels them to sell winner stocks quickly while holding on to losers. This is also the reason why they are loath to buy stocks when the market is down and prefer fixed income over equity.

Parag Parikh has also talked briefly about other biases like “mental accounting” in which investors imagine that dividends and bonus are “free money” and some sort of bonanza. They don’t understand that the dividend comes out of their own pocket. This fallacy is exploited by mutual funds.

Parag Parikh’s advice echoes the similar advice offered by Warren Buffett in his latest newsletter where he quoted Shakespeare “The fault, dear Brutus, is not in our stars, but in ourselves”.

how about celebrity bias where retail investors blindly follow celebrity investors and give them god like status?