Company Overview:

TBO Tek Limited is a top travel distribution platform operating in 100+ countries. The company’s platform connects suppliers (hotels, airlines, car rentals, cruises, etc.) and buyers (travel agencies, tour operators, etc.) through a two-sided technology platform. The company simplify the business of travel by allowing suppliers to display and market their inventory to a large global buyer base. Buyers can easily discover and book travel for various segments such as leisure, corporate, and religious travels etc. The company is committed to provide buyers with a comprehensive travel inventory according to the needs of their customers.

Key Highlights:

1. Revenue model: (A)B2B Rate Model: The company receive inventory from suppliers at a special B2B rate. The company apply a certain mark-up on this rate and pass this price on to Buyers. (B) Commission Model: The company’s suppliers fix the price at which they want to sell to the end traveller. The company receive commission on each such transaction from the supplier, part of which they retain and part of which they share with the buyer.

2. Platform creating value for both buyers and suppliers: The platform seeks to address various issues experienced while making travel bookings which provides sticky revenue source. It gives real time access to global travel inventory (hotels and airline) to buyers at the same time suppliers get instant access to a global buyer base without making any additional investments in technology or manpower.

3. Platform creating network effect with interlinked flywheels to enhance the value proposition for partners: The company’s platform provides instant access to a global network of partners for suppliers and buyers. As the buyer base grows, the company conducts more transactions, attracting more suppliers. This leads to better pricing, wider product ranges and higher supply volumes. By analyzing search data, the company prioritizes onboarding suppliers from the most interesting destination markets to their source markets. This creates a virtuous cycle of network effects, resulting in more transactions and an enhanced partner base.

4. Capital efficient business model with a combination of sustainable growth: The Company has developed a capital efficient business model with operating leverage and strong cash generation. The company has been generating positive operating cash flow for FY22/FY23/9MFY24 at Rs 48.1 cr/ Rs 204.4 cr/ Rs 200.6 cr respectively. The company generates RoE and RoCE of ~42% and ~50% respectively as of FY23. The fixed asset turnover ratio is in double digit (15x for FY23).

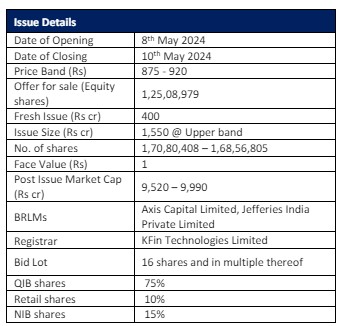

Valuation: The company is valued at a P/E multiple of 70.7x of its upper price band based on FY23 earnings on post issue capital while on 9MFY24 annualised adjusted EPS, the company is valued at 46.0x. The company plans to raise Rs 400 crore through fresh issue, for investment in technology, data solutions, and sales and marketing infrastructure. The company’s revenue has registered a CAGR of 174% from FY21 to FY23. Global Tourism industry is expected to grow at the CAGR of 8.2% from FY23 to FY27, which will give an edge to the company’s growth. While comparing the valuation with its close peer (Rategain Travel), the company looks fairly priced. We recommend to subscribe the issue for long-term investment horizon.

Click here to download TBO Tek Limited IPO Note by SBI Securities