Healthy growth momentum to aid valuation…

About the stock: IREDA is a systemically important non-deposit taking nonbanking financial company engaged in financing of renewable sector.

• The company has geographically diversified asset base with term loans outstanding across 23 states and 4 union territories

Q2FY25 performance: IREDA has reported continued strong performance in Q2FY25 delivering 36% YoY growth in AUM at ₹64,564 crore. NII growth came higher at 52% YoY to ₹546.8 crore, led by 16 bps YoY improvement in margins to 3.34%. However, credit cost at 21 bps (annualised) compared to reversal in earlier quarters led earnings growth at 36% YoY to ₹ 388 crore. Asset quality remained steady with GNPA at 2.19%, though NNPA increased 9 bps QoQ at 1.04%.

Investment Rationale

• Government focus on renewables & entry into retail business to aid sustained growth: Government’s focus to increase renewable power capacity from 195 GW (~43% of total installed capacity) in June 2024 to 500 GW by FY30 provides huge opportunity. IREDA being specialised power financiers is expected to play a major role in funding renewable projects. Thus, business growth is expected to remain healthy at ~25-30% CAGR in FY24-30E. Further, foray in retail business (approval received to set up a wholly owned subsidiary) such as PM KUSUM, rooftop solar, EVs, energy storage and efficiency, green technology is seen to aid diversification.

• Capability to borrow at competitive rate remains an advantage: As of June 2024, major proportion of borrowings at ~84% are sourced from domestic avenues. IREDA has been assigned highest “AAA” rating enabling long term borrowings at competitive cost, thereby supporting margins. Higher proportion of floating rate loans could keep margins volatile, amid anticipated reversal in rate cycle could not be ruled out. However, consistent growth in AUM is seen to aid NII growth at ~25% CAGR in FY24-26E.

• Exposure to retail segment and operating leverage to aid profitability: Continued healthy growth in AUM (expected at ~28% CAGR in FY25-26E) is expected to aid profitability owing to benefit from operating leverage. Entering in retail segment is expected to result in improved yields, thus partially safeguarding margins against anticipated reversal in rate cycle. Steady opex and credit cost is seen to keep profitability run rate at ~18-20% CAGR. Return on asset is expected to witness marginal pressure in near term, only to revive back at 1.9-2% ahead.

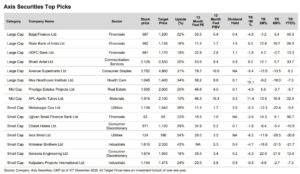

Rating and Target Price

• Continued government’s focus on renewable sector and foray in retail segment is seen to aid business growth and margins aiding delivery of steady return ratio on a sustained basis. Capital raising (approval received) of ₹4500 crore, to make balance sheet for future growth and remain book accretive. Factoring scope of relatively strong business growth, we value the stock at ~6.4x FY26 BV (~43x FY26E EPS) assigning a target of ₹ 280. Maintain Buy rating on the stock.