Psychologist Stephen Greenspan has written an Essay in the Wall Street Journal where he raises the pertinent question “Why We Keep Falling for Financial Scams”.

It amuses me that it is not just us ignorant in god-forsaken third world countries who get taken for a ride occasionally by smooth-talking scamsters but even storied and so-called sophisticated investors ……… The Bernard Madoff scam being a case in point. The list of defrauded victims reads like a who’s-who of the financial world. HSBC (1 billion), Royal Bank of Scotland Group PLC ($492,760,000), BNP Paribas, Nomura Holdings and hundreds of others. A full list can be accessed here.

Bernard Madoff was a highly regarded money manager and a former chairman of Nasdaq. Surprisingly, no one realized that he had for years been running a very sophisticated Ponzi scheme which defrauded wealthy investors, charities and other funds of at least a staggering $50 billion.

What is a Ponzi Scheme?

Stephen Greenspan explains that a Ponzi scheme is a fraud in which invested money is pocketed by the schemer and investors who wish to redeem their money are actually paid out of proceeds from new investors. As long as new investments are expanding at a healthy rate, the schemer is able to keep the fraud going. Once investments begin to contract, as through a run on the company, the house of cards quickly collapses.

The scheme gets its name from Charles Ponzi, an Italian immigrant to Boston, who around 1920 came up with the idea of promising huge returns (50% in 45 days) supposedly based on an arbitrage plan (buying in one market and selling in another) involving international postal reply coupons. The profits allegedly came from differences in exchange rates between the selling and the receiving country, where they could be cashed in. A craze ensued, and Ponzi pocketed many millions of dollars, mostly from poor and unsophisticated Italian immigrants in New England and New Jersey. The scheme collapsed when newspaper articles began to raise questions about it (pointing out, for example, that there were not nearly enough such coupons in circulation) and a run occurred.

That is what apparently happened with the Madoff scam, when too many investors — needing cash because of the general U.S. financial meltdown in late 2008 — tried to redeem their funds. It seems Mr. Madoff could not meet these demands and the scam was exposed.

Why the attraction to Ponzi Schemes and the doctrine of “irrational exuberance”

Stephen Greenspan explains that the basic mechanism explaining the success of Ponzi schemes is the tendency of humans to model their actions — especially when dealing with matters they don’t fully understand — on the behavior of other humans. This mechanism has been termed “irrational exuberance,” a phrase often attributed to former Federal Reserve chairman Alan Greenspan. Simply stated, the fact that so many people seem to be making big profits on the investment, and telling others about their good fortune, makes the investment seem safe and too good to pass up.

The Nigerian Scam:

Stephen Greenspan draws parallels between the infamous Nigerian Scam and the Ponzi Scheme.

He explains that a form of investment fraud that has structural similarities to a Ponzi scheme is the inheritance scam, in which a purported heir to a huge fortune is asking for a short-term investment in order to clear up some legal difficulties involving the inheritance. In return for this short-term investment, the investor is promised enormous returns.

He explains that the Nigerian scam differs from a Ponzi scheme in that there is no social pressure brought by having friends who are getting rich. Instead, the only social pressure comes from an unknown correspondent, who undoubtedly is using an alias. He points out that in a Nigerian Scam factors such as psychopathology or extreme naïvete explain the gullible behavior.

There are a number of other “Manias and Frauds” which the learned author has analyzed in detail such as “the Tulipmania” in 1630s involving tulip-bulb speculation in the Netherlands. Another scam was “The South Sea Bubble” in 1700s under which a company promised a monopoly on trade to the Spanish colonies. It lured investors with the promise of riches from abroad. Predictably, prices of shares spiked and then collapsed.

Recent examples are the ‘Dot-Com’ bubble when any company with the words “.com” behind its’ name was able to command incredible premiums.

Stephen Greenspan argues that while social feedback loops are an obvious contributor to understanding the success of Ponzi and other mass financial manias, one also needs to look at factors located in the dupes themselves.

He analyzes four factors in his explanatory model which he claims can be used to understand acts of gullibility, but also other forms of what he terms “foolish action.” A foolish (or stupid) act is one in which someone goes ahead with a socially or physically risky behavior in spite of danger signs or unresolved questions. Gullibility is a sub-type of foolish action, which might be termed “induced-social.” It is induced because it always occurs in the presence of pressure or deception by other people. The four factors are situation, cognition, personality and emotion.

The mind lulls you into a sense of complacency: “Everybody is doing it, so it must be safe”. Also, if “Sophisticated investors like HSBC, Royal Bank of Scotland, BNP Paribas and Nomura Holdings have invested, it must be safe”. “Surely, such large companies must have done their due diligence” is what the mind tells you. “He’s not offering extravagant returns, so he must be legitimate” is another mind-trap.

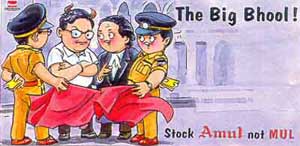

The logic also explains why we get taken for a ride in the stock market. There are several big-ticket scams in the Indian context such as the “Telgi Scam” and the “Harshad Mehta” scam.

Visited first time your web site,excellent, keep it up,as far as Harshed mehta, your comments in scam section let me tell you he had doing nothing wrong in stock market though he has used money of several banks to finance his purchase in stock market. He was also a victim of bear cartel.He invested in blue chip co’s.