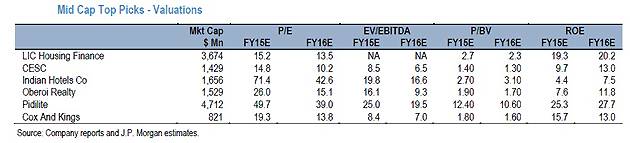

ET has stated that the said six stocks are based by JP Morgan on a bottom-up analysis on the basis that earnings revisions are likely to be positive and valuations could continue to see upward revisions.

LIC Housing Finance Ltd:

Key fundamentals supporting the stock should be strong growth in individual housing loans coupled with build-up of project/LAP book which should lead to some margin improvement.

Interest rate declines will likely get passed on; however it will also be beneficial for loan growth which should accelerate back to over 20 per cent levels.

CESC Ltd:

Regulated earnings should get a boost post the completion of the Haldia plant. Resolution of PPA issues in Chandarpur and improvement in operating trends of subsidiaries (First Source/ Spencer) should aid consolidated earnings.

Indian Hotels Company Ltd:

JPMorgan expects supply side pressures in the industry to start easing and ARRs to start inflating. Government policy on tourism/online visas can be a game-changer for the industry. Operating leverage in the business means growth in EBITDA is highly sensitive to growth in Revenue PARs.

Oberoi Realty Ltd:

In JPMorgan’s view, this company is best positioned to benefit from a pick-up in the Mumbai residential market which is down 70 per cent from the highs. Launch of 3 large residential projects along with liquidation of unsold completed inventory in projects should make F16/17 one of the best years in terms of pre-sales for the company.

Pidilite Industries Ltd:

Declining input (VAM prices) should give significant headroom to either drive higher top line growth or capture higher margins. Business should continue to deliver double digit volume growth, and any pick-up in industrial activity in H2 should be added positives.

Cox & Kings Ltd:

Balance sheet de-leveraging and improved growth outlook for UK & India business should see both operating and financial leverage flow through to earnings over the next 2 years, driving improvement in ROEs. Listing of UK business is a source of additional upside risk in medium term.