India is amongst the top countries in the world in per capita consumption of alcohol. So, Liquor stocks are a good buy

Kenneth Andrade pointed out that India is amongst the top countries in the world in per capita consumption of alcohol. There will be a rise in the per capita income which will create a premiumisation trend. Where there is a premiumisation of the category, that category has done reasonably well.

He explained that at the bottom end of the consumption pyramid, there is a reverse working in that sense that people are downgrading. They are consuming the same amount of volume but at a lower price point and that is happening at the bottom end of the pyramid.

So, consumption in India is broken up into two extremes, he added. The top end of the consumers are premiumising with volumes and the bottom end of the entire population pyramid is consuming higher volume but at a lower price point, which is creating a margin pressure for a lot of businesses at that end of the consumption spectrum.

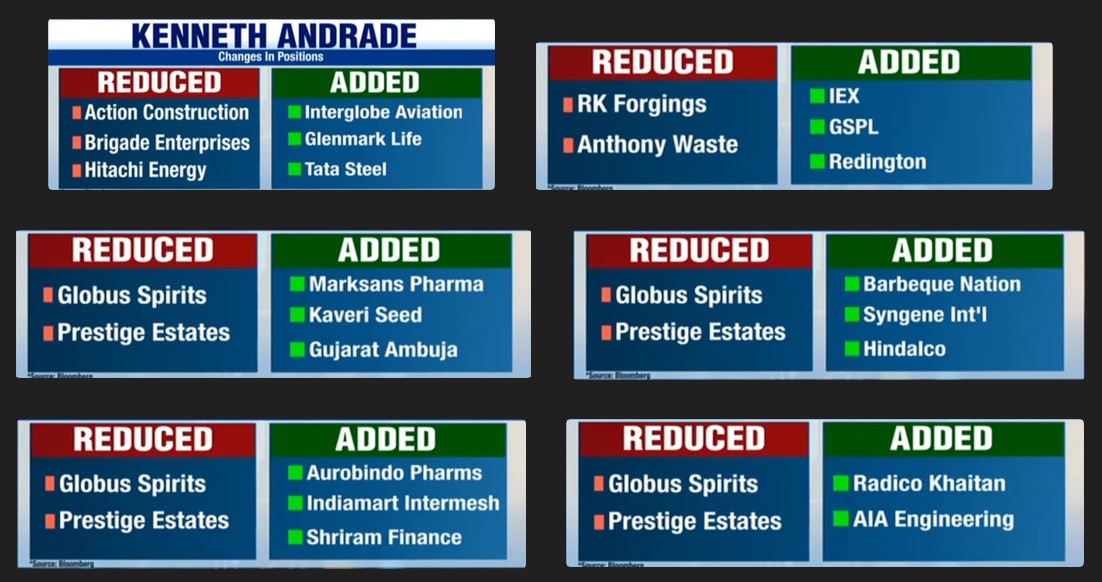

Kenneth fairly revealed that he has added Radico Khaitan to his portfolio. However, he has simultaneously reduced his holding in Globus Spirits.

Metal stocks are very reasonably valued and are a good bet

Sandeep Tandon of Quant Mutual Fund has already alerted us that he is very bullish about metal stocks. “As a fund house, we are grossly overweight on metals and mining,” he said.

Andrade endorsed this theory. “A lot of commodity and steel businesses have been generating enormous amounts of cash and also expanding capacity at the same time,” he said.

“Valuations are as cheap as you can get them in a down cycle with a completely solvent balance sheet. It is a matter of time and patience,” he added.

“We are not taking a call on the cycle because we do not know when steel prices will actually rebound. In CY2024, you will get a reasonably depressed environment as far as commodity pricing is going but this should be the low point in the company’s profitability. They are still reasonably valuable or should I say very valuable,” he explained.

He also disclosed that he has added Tata Steel and AIA Engineering to his portfolio as metal and mining bets.

Pharma Stocks are the largest holding in the portfolio. They are good buys now as cash generation is at all-time high

Andrade has added a number of pharma stocks to his portfolio such as Glenmark Life, Marksans Pharma, Syngene & Aurobindo.

He explained that Pharma stocks hit the trough in terms of profitability in 2023 and incremental growth is now coming. Pharma companies are addressing international markets, including the US where the profit and pricing is emerging.

He also pointed out that balance sheets are healthy and cash flow generation is at an all-time high.

He also revealed that Pharma is his largest holding in portfolios. And they do not trade at very abnormal valuations. They are higher on their baseline but they do not trade at very abnormal valuations.

It is worth recalling at this stage that Vikas Khemani and Sandeep Tandon are also bullish about Pharma stocks and have advised us to buy them.

“Pharma is a sector for the next three years at least. That is one cycle which is in our favour. It is a very meaningful sector for the market and the index itself. I am very constructive on that sector,” Sandeep Tandon advised.

Avoid Banking stocks

Andrade revealed that he has not bought any bank stocks in the last five or six years.

He also pointed out that he has a large holding in Shriram Finance, which is a NBFC.

“We like the NBFC space a little more than the private banking space,” he said.

“The opportunities we see is in unsecured lending and that is the book which is growing significantly fast and there is some amount of demand plus a higher yield on lending as long as you can control your risks,” he added.

“So that is where we are tending to navigate our portfolios or tending to look at companies or businesses in that spectrum”.

I am interested for daily call

Please call me