Kenneth Andrade’s OLD BRIDGE FOCUSED EQUITY FUND is an Open-ended Equity Scheme investing in maximum 30 stocks (Multi Cap). Its priorities are to buy enduring business models with emphasis on limiting capital losses, which is why emphasis is given on buying at the right price and value.

By doing this, a margin of safety is built in to protect the portfolio even if the estimates are on the wrong side.

According to the latest fact sheet, the Fund is looking for the following in terms of the investment process:

MonopoIistic/ ConsoIidators of the Industry

– Preference for consolidating businesses

– Companies gaining market share with no change in capital employed

– Companies with lowest cost in their industry

– Leaders at the end of consolidating cycle usually end up with higher market share and pricing power

Capital Efficient Business

– Companies that migrate upwards from a low RoE

– Look for capital employed to be controlled

– Cash flow positive nature of the business with Iow gearing

Low Financial Leverage

– Companies with negligible debt

– Businesses leveraging into an economic up-cycle & deleveraging at the top of the cycle

Low Valuation

– “Out of favour” businesses where current value of the stock reflects its depressed earnings

– EV / Sales

– Market Cap / Cash Profit (Flows)

AUM as of 29th February, 2024

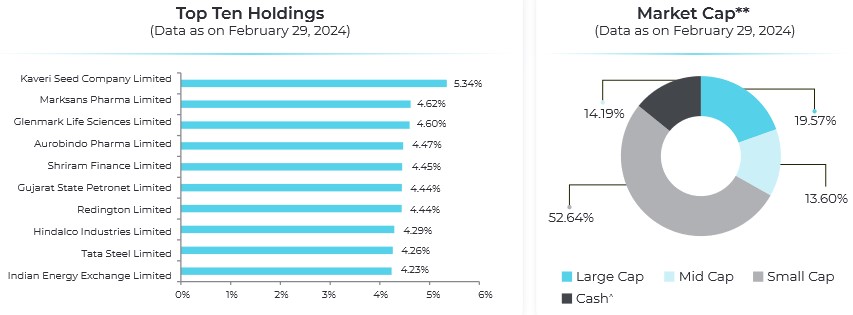

The AUM as of 29th February, 2024 is Rs 179.33 Crores. A sizeable amount of 14.19% of the AUM is in the form of cash and other liquid assets.

Portfolio as on 29th February, 2024

| Portfolio of OLD BRIDGE FOCUSED EQUITY FUND as on 29th February, 2024 | ||

| Sr. No. | Stock | % of NAV |

| 1 | Marksans Pharma | 4.62 |

| 2 | Glenmark Life Sciences | 4.60 |

| 3 | Aurobindo Pharma | 4.47 |

| 4 | NCC Limited | 4.02 |

| 5 | ITD Cementation | 3.94 |

| 6 | Kaveri Seed | 5.34 |

| 7 | Gujarat Ambuja Exports | 2.48 |

| 8 | Shriram Finance | 4.45 |

| 9 | Gujarat State Petronet | 4.44 |

| 10 | Redington Limited | 4.44 |

| 11 | Hindalco Industries | 4.29 |

| 12 | Tata Steel | 4.26 |

| 13 | Indian Energy Exchange | 4.23 |

| 14 | Prestige Estates | 4.23 |

| 15 | Barbeque Nation | 4.16 |

| 16 | Antony Waste Handling | 4.08 |

| 17 | InterGlobe Aviation | 3.55 |

| 18 | Indiamart Intermesh | 3.35 |

| 19 | HCL Technologies | 3.02 |

| 20 | Radico Khaitan | 2.93 |

| 21 | Syngene International | 2.46 |

| 22 | AIA Engineering | 2.44 |

| 23 | Cash & other current assets | 14.19 |

| Total | 100 | |

Very Bullish about Pharma Stocks

As can be seen, Pharma has the highest allocation of 13.69% comprising of three stocks, namely, Marksans Pharma, Glenmark Life Sciences and Aurobindo Pharma.

There is also a holding on Syngene International which is categorized as Healthcare services.

In his latest interview, Andrade explained that Pharma stocks hit the trough in terms of profitability in 2023 and incremental growth is now coming. Pharma companies are addressing international markets, including the US where the profit and pricing is emerging.

He also pointed out that balance sheets are healthy and cash flow generation is at an all-time high.

He explained that Pharma stocks are trading at normal valuations and are not expensive.

It is worth recalling at this stage that Vikas Khemani and Sandeep Tandon are also bullish about Pharma stocks and have advised us to buy them.

“Pharma is a sector for the next three years at least. That is one cycle which is in our favour. It is a very meaningful sector for the market and the index itself. I am very constructive on that sector,” Sandeep Tandon advised.

Bullish about Metals, Mining stocks

Andrade had explained that he is bullish about metal and mining stocks because: “A lot of commodity and steel businesses have been generating enormous amounts of cash and also expanding capacity at the same time”.

“Valuations are as cheap as you can get them in a down cycle with a completely solvent balance sheet. It is a matter of time and patience,” he added.

“We are not taking a call on the cycle because we do not know when steel prices will actually rebound. In CY2024, you will get a reasonably depressed environment as far as commodity pricing is going but this should be the low point in the company’s profitability. They are still reasonably valuable or should I say very valuable,” he stated.

Sandeep Tandon of Quant Mutual Fund is also of the same view and is very bullish about metal stocks. “As a fund house, we are grossly overweight on metals and mining,” he said.

Andrade has added Hindalco, Tata Steel and AIA Engineering to his portfolio as metal and mining bets.

Radico Khaitan will benefit from high per capita consumption of alcohol

Kenneth Andrade had pointed out in his interview that India is amongst the top countries in the world in per capita consumption of alcohol. There will be a rise in the per capita income which will create a premiumisation trend. Where there is a premiumisation of the category, that category has done reasonably well.

He explained that at the bottom end of the consumption pyramid, there is a reverse working in that sense that people are downgrading. They are consuming the same amount of volume but at a lower price point and that is happening at the bottom end of the pyramid.

So, consumption in India is broken up into two extremes, he added. The top end of the consumers are premiumising with volumes and the bottom end of the entire population pyramid is consuming higher volume but at a lower price point, which is creating a margin pressure for a lot of businesses at that end of the consumption spectrum.

Radico Khaitan is the obvious beneficiary of this thesis and has been allocated 2.93% of the AUM.

Bank stocks are conspicuously absent from the Portfolio

Andrade is not fond of Banking stocks. He had revealed that he has not bought any bank stocks in the last five or six years.

“The opportunities we see is in unsecured lending and that is the book which is growing significantly fast and there is some amount of demand plus a higher yield on lending as long as you can control your risks,” he explained.

However the portfolio has a large holding in Shriram Finance, which is a NBFC.

“We like the NBFC space a little more than the private banking space,” he said.

Click here to download Old Bridge Mutual Fund Factsheet February 2024