Earnings in line; strong retail momentum continues NIM improves ~15bp QoQ; asset quality stable

L&T Finance (LTF) posted ~29% YoY PAT growth to INR6.9b (in line) in 1QFY25. PPoP grew ~19% YoY to ~INR14.7b (in line), while credit costs stood at INR5.4b, translating into annualized credit costs of 2.5% (PQ: 3.2% and PY: 2.6%). Last quarter, it had a one-off impact of ~INR1.75b of additional provisions on security receipts (SRs). Consol. RoA/RoE stood at ~2.7%/11.6%.

Retail assets contributed ~95% to the loan mix (PQ: 94%). Retail loans grew ~31% YoY, fueled by healthy growth in MFI, 2Ws, home loans, and SME. LTF continued to calibrate growth in personal loans, which grew ~11% YoY.

Management anticipates further improvement in the rural business trajectory, supported by positive monsoon trends and improvements in rural cashflows. We model a total loan CAGR of ~25% and PAT CAGR of 28% over FY24-FY26E, with consolidated RoA/RoE of 2.7%/~14% in FY26E.

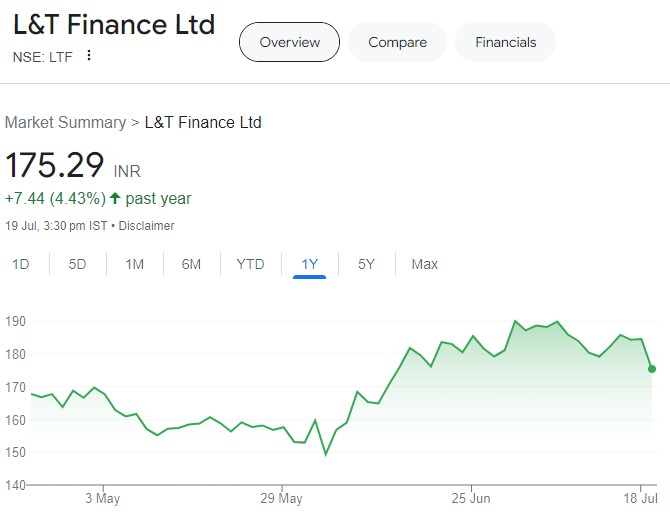

LTF has transformed itself into a retail franchise and would continue to deliver a sustained improvement in profitability and RoA expansion. Reiterate BUY with a TP of INR230 (based on 2.0x FY26E BVPS). Asset quality stable aided by prudent credit assessments and guardrails

LTF has maintained a strong focus on collections. Driven by disciplined credit assessment and supported by stringent internal guardrails, its asset quality remained broadly stable, with consolidated GS3/NS3 at 3.15%/ 0.8%. Stage 3 PCR was also stable at ~75% during the quarter.

Retail GS3 declined ~5bp QoQ to 2.8%, while Retail NS3 was stable at 0.6%.

Management guided that over the next 10-12 quarters, there will be resolutions in the SR portfolio that might result in provision releases and recoveries. We model total credit costs (as % of average assets) of ~2.0%/ 2.1% in FY25/FY26E. NIM expansion supported by an improving retail mix

Reported NIM rose ~15bp QoQ to 9.3%. However, Consol. NIMs + Fees declined ~15bp QoQ to 11.1% in 1QFY25, due to a sequential decline in fee income. 4QFY24 fee had a one-time positive income impact of ~20bp.

Spreads (calc.) rose ~10bp QoQ to ~9%. CoB declined ~10bp QoQ to 6.9%. Management guided that it will maintain yields in a way to prevent any compression in its NIM + Fee income. We model NIMs of ~10% in FY25/26.

Key highlights from the management commentary

Both secured and unsecured businesses of LTF will grow, resulting in a largely stable secured-unsecured product mix. The company is taking a calibrated approach to growing its personal loan portfolio and has also incorporated manual underwriting in its credit decisioning.

Collections and asset quality are holding up well in the MFI business, which is largely an outcome of the discipline in collections and better customer selection. Management does not expect any impact of MFIN directives on LTF’s loan growth or asset quality

Valuation and view

LTF has invested in process automation, security, and customer journeys. This, along with partnerships with e-aggregators, should lead to a stronger and more sustainable retail loan growth. Over the past few quarters, the company has consistently delivered strong growth in its retail loan book.

We estimate a PAT CAGR of 28% over FY24-26, with a consolidated RoA/RoE of 2.7%/~14.0% in FY26. We reiterate our BUY rating on the stock with a TP of INR230 (based on 2.0x FY26E BVPS).