PE re-rating far outweighs earning upgrades

After a meteoric rise of benchmark indices in FY24, the bull run continues unabated in FY25, notwithstanding general election-led market volatilities. So far in FY25, the benchmark indices Nifty 50, Nifty midcap 100 and Nifty Small cap 100 have delivered remarkable returns of 9%, 18% and 23% respectively. These performances follow massive returns of 29%,60% and 70% respectively generated by these indices in FY24. Against the backdrop of these unprecedented returns, it becomes imperative to analyse if these are driven by earnings upgrades of companies or simply valuation expansion.

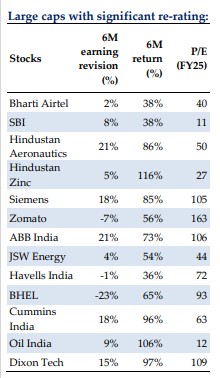

We have analysed the top 500 stocks by market cap listed on Indian bourses and studied their consensus earnings upgrades/downgrades for the past six months. This was juxtaposed with the returns generated by these stocks in the same period. Based upon our analysis, we highlight a list of stocks where returns are much higher vis-àvis earnings upgrades, implying that valuations have rerated significantly in the recent past. These stocks run the risk of multiples contraction in case of any significant earnings disappointment.

Overall, we advise caution and staying selective as risk-reward is increasingly getting unattractive, given stretched valuations across sectors and market caps. While macroeconomic fundamentals remain healthy, we expect a moderation in earnings growth trajectory over FY24-26 (~12% CAGR) compared to the FY20-24 period (~20% CAGR) as the high base catches up across most sectors.

Key highlights:

▪ 32%, 47% and 39% stocks of Nifty 50, Nifty midcap 100 and Nifty Small cap 100 respectively have re-rated in excess of 20%, adjusted for earning upgrades in the past six months. On the other hand, only 2%, 4% and 9% stocks of these indices respectively have got de-rated more than 10% in this mentioned period, adjusting for earning revisions.

▪ It is worth noting that despite no significant upgrades in earnings of any of these indices at an aggregate level, mid and small-cap indices stocks have delivered ~25% returns (adjusted for earnings revisions) in the past six months. Considering 15% earnings growth for the year (or 7% for half the year), it can be concluded that the remaining 18% returns (i.e.70% contribution) came from PE re-rating. Surprisingly, as per our analysis even stocks with earnings downgrades have seen an average re-rating of 20-40% in the last 6 months.PE re-rating was the sharpest in Industrials and Consumer clusters followed by IT while BFSI, in particular, has seen modest re-rating.

▪ It can be inferred that the majority of the underlying stocks of these benchmark indices have moved ahead of their fundamentals. Hence, they run the risk of multiples contraction in case of any earnings growth deceleration or flow of money slowing down. This analysis is a reaffirmation of prevailing overvaluation concerns in key benchmark indices, more pronounced in mid and small-cap indices, as highlighted in our previous report Valuation of Indices.

▪ Furthermore, sectors such as upstream oil & gas, capital goods & construction, defence, and consumer durables witnessed sharper rerating than others, adjusted for earnings revisions, whereas in the private banks, NBFCs, footwear, life insurance and media sectors, the re-ratings adjusted for earning revisions were among the lowest.