According to an article in Finshots, the Multi Commodity Exchange (MCX) has a virtual monopoly commanding over 90% market share in oil, metals and agricultural produce. The number of its active unique clients has soared from 3.5 million in 2020 to over 10.5 million today. The average daily trading volume of these commodity options contracts has soared from just ₹2,300 crores to ₹52,600 crores during this period too. The more the clients trade, the more money MCX makes.

HDFC Securities has explained the fundamentals thus:

“Commodity options: powering growth

MCX has registered strong growth in options volume in the last two years; total options ADTV has increased from INR 19bn in Q1FY22 to ~INR 490bn in Q1FY24. Options volume is now ~70% of the total derivatives volume and accounts for ~41% of MCX revenue in FY23E. The growth in MCX options volume is triggered by (1) the higher margin in crude futures contracts which made options trading attractive, (2) the steep rise in commodity options traders, up ~173% YoY, and (3) the launch of new options contracts and increase in volatility. Crude and natural gas contracts account for ~85% of the options volume because they are cash-settled and have decent liquidity. We believe that the next phase of options volume growth will be led by the launch of mini contracts and the launch of index options contracts (approval received from SEBI). NSE index option is ~95% of the total options volume and a very popular product category in India. We expect the options volume/premium to grow at a CAGR of 44/31% over FY23-25E and account for ~55% of total MCX revenue. Options revenue is generated on the premium collected and the premium growth is lower than notional volume as the premium-to-notional ratio comes down gradually with increase in volume.”

However, MCX does not have its own software and relies on a third-party company called 63 Moons Technologies to run the show. It pays 63 Moons a fixed fee and even a percentage share of revenues for the tech.

In the latest quarterly renewal of the license, 63 Moons charged MCX a whopping sum of Rs 125 crore. The previous years’ figures were ₹67 crores and ₹87 crores. The annual software bill will be Rs 500 crore.

Noted expert Deepak Shenoy described the situation as one of “corporate arm twisting“.

If you want to see how corporate arm twisting works in a free market: MCX just had to renew the software contract with 63 moons for 125 cr. per quarter, for two quarters. (That's as much money than MCX makes per quarter!)

"We wish to inform you that to ensure all Stakeholders…

— Deepak Shenoy (@deepakshenoy) June 29, 2023

Anil Singhvi, the editor of ZEE Business, did not mince words in slamming MCX for the mismanagement of the entire issue. He rightly pointed out that TCS, given its expertise as a global developer of sophisticated software, is unlikely to be at fault. Trading platforms and software are not unique and are also available off the shelf. It is only a question of customising it to meet individual requirements and making it compatible with the existing software. He also hinted that there may be more to the episode than meets the eye and probably some sort of a hidden understanding between the two players. He also pointed out that the stock price of 63 Moons had spurted even before the formal announcement, implying that there was insider trading at play. The stock is up 125% in the last month.

Experts like Morgan Stanley are also disappointed with the sorry state of affairs and recommended an underweight stance on the MCX stock.

#CNBCTV8Market | MS maintains Underweight call on MCX as transition of technology platform to TCS is further delayed pic.twitter.com/uQHAtdORVw

— CNBC-TV18 (@CNBCTV18Live) June 30, 2023

TCS software system ready for MCX, TCS awaits approval from concerned departments. Shift likely in September 2023

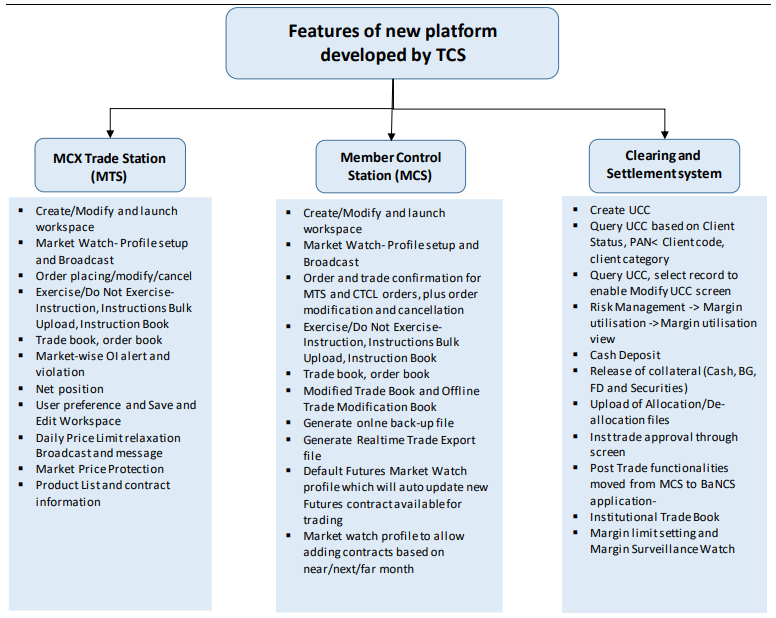

HDFC Sec stated that TCS has developed a new trading workstation—MCX Trade Station (MTS)—and a new member admin terminal—Member Control Station (MCS)—which will be installed and tested at the member’s end. MCX has around 500 members and all members will have to upgrade their CTCL link and install TCS’s MCX member admin terminal.

It is also stated that MCX is actively conducting mock trading sessions on the new platform- most of the members have actively participated in the mock trading and have provided feedback to MCX. The new platform has been tested for ~138 hours (~3 hours/day). It is estimated that the shift will happen in September 23.

Swati Khandelwal of ZEE Business pointed out in her latest update that according to sources, the TCS software system is ready to be put into operation and only a few transitionary issues require to be ironed out. She also stated that now it is only a question of paperwork that requires to be sorted out including approvals from regulatory bodies like SEBI etc and that the trading platform may go live in a couple of months.

When the TCS trading platform goes live, EBIT margin will expand to ~56% in FY25E vs ~27% in FY23E

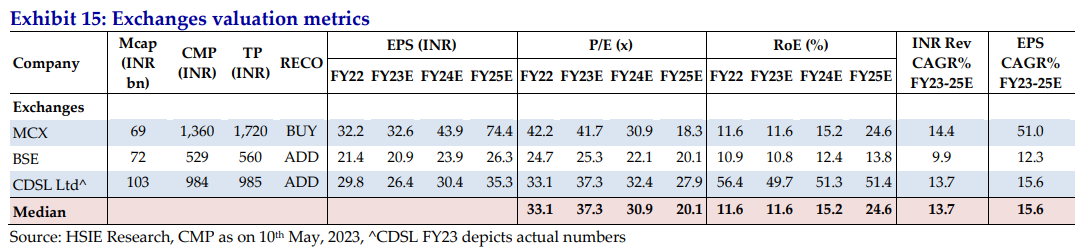

HDFC Securities stated that once the shift happens, the cost structure will change and the incremental revenue generated will flow to EBITDA and lead to margin expansion. The EBIT margin is expected to expand to ~56% in FY25E vs ~27% in FY23E due to lower technology cost and options volume growth leading to non-linearity.

All experts are agreed that MCX has good fundamentals given its stature as a monopoly with 90% market share and the rise in the number of active clients and trading volume. HDFC Securities has recommended a buy on the following logic:

“We remain constructive on the options growth story on the back of continued traction in energy contracts, the launch of new contracts (mini and index options) and the pick-up in bullion volumes. We expect the options revenue to grow 42/19% and contribute 42/45% towards total revenues in FY24/25E. We keep revenue estimates unchanged and change the EPS estimate by -4.1/+0.9% for FY24/25E. We maintain our BUY rating and assign 25x P/E to FY25E core PAT and add net cash (ex-SGF) to arrive at a target price of INR 1,700.”

It is explicit that once the overhang caused by the software issue is resolved, the stock will surge.