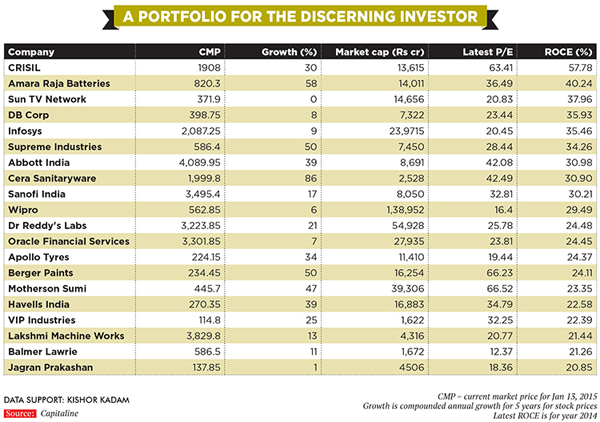

In compiling the model portfolio, Forbes India took a combination of high returns on capital employed (RoCE) with a relatively low price-earnings (P/E) multiple. It is pointed out that there will be times when the P/E multiple might appear expensive but if a company has a sustainable growth path, investors should keep buying.

Forbes has given the example of Berger Paints which, in the last five years, has compounded its profits by 15 percent. This, coupled with a RoCE of 24 percent, has seen the stock compound at 49 percent a year for the last five years. The story repeats itself with Havells India, another outperformer.

Investors are advised to stick to quality in this market and the move will eventually pay off.

Hi Vidhi, your articles are much appreciated but I find it cumbersome to download attachments. This one has the list right here, and I was able to read it, I have to skip the ones that require downloads bcos I use a phone for internet. Thanks for your efforts.