TOP PICKS

June 2024 2

“Feel Good” Factor in the Air; Style Rotation Remains Critical for Alpha Generation The Axis Top Picks Basket delivered an excellent return of 5.4% in the last three months against the 2.5% return posted by Nifty 50, thereby beating the benchmark by a wide margin of 2.9%. Over the last one year, the basket has gained 43.2%. Moreover, it gives us immense joy to inform you that our Top Picks Basket has delivered an impressive return of 284% since its inception (May’20), which stands well above the 143% return delivered by the NIFTY 50 index over the same period. In light of this, we continue to believe in our thematic approach to Top Picks selection.

The results of the Current Loksabha elections are due on 4th Jun’24. Exit polls published after the last phase of voting on 1st Jun’24 unanimously predicted the clear majority for the ruling party NDA and forecast the third term for PM Modi. The average of all the Exit polls forecast 370+ seats for the ruling party NDA. The Indian market is likely to give a thumbs up with benchmark indices likely to head towards newer highs. India VIX, which went up by almost 91% in the last one month from the level of 13 to 24, could see some cool-off after these spectacular results.

If the Loksabha results on 4th June materialize as per the Exit Poll direction, our country is likely to enter a “Golden Phase” of political stability and policy continuity. The Indian economy is in a sweet spot of growth and remains the land of stability against the backdrop of a volatile global economy. With this expectation of political stability and policy continuity, the prospects of the Indian economy appear notably brighter and more promising in the upcoming years. We further believe that policy continuity is a crucial element for the continuation of the current macro cycle. The focus of Modi 3.0 will likely continue on developing the country’s public infrastructure such as roads, water, metro, railways, defence, digital infrastructure, and green technologies. Its overall focus would also be on creating more jobs and achieving investment-driven growth. Furthermore, the private Capex, which has been sluggish for the last several years, is expected to receive a much-needed push in the upcoming years.

While the macro set-up is positive, the fundamentals for Indian corporates have also improved. Profitability across the board has improved significantly, Cumulative and rolling net profit of the NSE 500 universe for the last 4 quarters (till Q4FY24) has touched an all-time high level of Rs 13.5 Lc Cr with lossmaking sectors turning positive and significantly contributing to the net profitability. Moreover, ROE for the broader market is improving after a muted performance for several years. Asset quality of the banking sector – both private and PSU, has improved significantly over the last couple of years. Thus, against this context, the Indian equity market is likely to trade at a premium valuation as compared to the other emerging markets.

We believe the market fundamentals will continue to be driven by “narrative” in the near term. The market will continue to find direction based on 1) “Feel good” factor on policy continuity, 2) Pre-Budget expectations, 3) Progress of Monsoon, 4) Development on the CAPEX agenda, 5) Fiscal consolidation path, and 6) Expectation of rural recovery in the second half. In light of the above developments in view, we believe style and sector rotation will play a critical role in the alpha generation moving ahead. Moreover, with a strong catch-up by Midcaps and Smallcaps in the last couple of months, we still believe the margin of safety in terms of valuations for these segments at current levels has reduced as compared to that available in Largecaps. Keeping this in view, the broader market may see some time correction in certain pockets in the near term and flows will likely shift to Largecaps. Based on this, we believe Nifty 50 could see a new high in the near term. In any case, the long-term story of the broader market continues to remain attractive and in this context, two themes – ‘Growth at a Reasonable Price’ and ‘Quality’ look attractive at the current juncture. Hence, we recommend investors to remain invested in the market and maintain good liquidity (10%) to use any dips in a phased manner and build a position in high-quality companies (where the earnings visibility is quite high) with an investment horizon of 12-18 months. We foresee FY25/26 NIFTY Earnings at 1094/1234 after Q4FY24 with a growth rate of 10%/13% respectively.

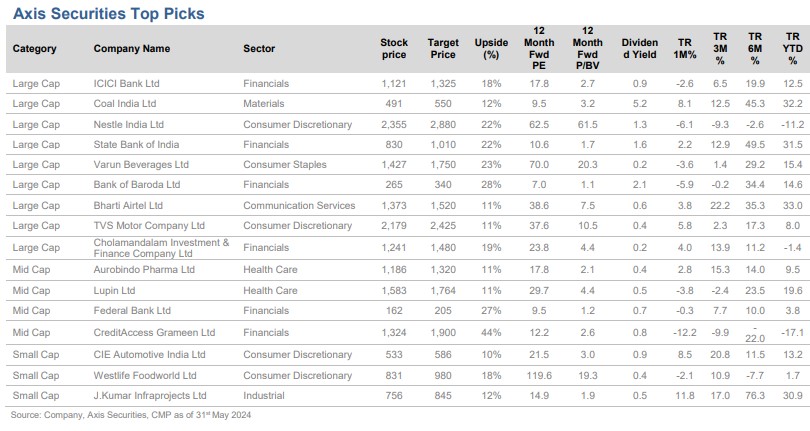

Keeping these latest developments in view, we have made some changes to our Top Picks recommendations. This includes booking Profit in PNC Infra and JTL Industries adding Cholamandalam Invest and Finance and J Kumar Infra to the recommendations. Our modifications reflect the changing market style and shift towards the ‘Growth at a Reasonable Price ‘theme. Our

Key Themes

Outlook 2024: The Indian economy continues to be a ‘star performing’ economy as against other emerging markets. Moreover, we firmly believe that it is likely to continue its growth momentum in 2024 and remain the land of stability against the backdrop of a volatile global economy. Consistently strong corporate earnings have meant that Indian corporates have been on a stronger footing than ever. Furthermore, corporates in need of capital have managed to raise capital,

In our base case, we roll over the Nifty target to Mar’25 to 24,600 by valuing it at 20x on Mar’26 earnings. While the medium to long-term outlook for the overall market remains positive, we may see volatility in the short run with the market responding in either direction. Keeping this in view, the current setup is a ‘Buy on Dips’ market. Hence, any market correction on account of global challenges will be an opportunity to add to the equity investment. We recommend investors to remain invested in the market and maintain good liquidity (10%) to use any dips in a phased manner and build a position in high-quality companies (where the earnings visibility is quite high) with an investment horizon of 12-18 months.

Based on the above themes, we recommend the following stocks: ICICI Bank, Coal India, Nestle India, State Bank of India, Lupin ltd, Aurobindo Pharma, Federal Bank, Varun Beverages, TVS Motors, Bharti Airtel, J Kumar Infra, CIE Automotive India, Bank of Baroda, Westlife Food world, CreditAccess Grameen and Cholamandalam Invest and Finance