Launch Pipeline to Drive Performance; Maintain BUY

Est. vs. Actual for Q3FY25: Revenue – BEAT ; EBITDA – BEAT ; PAT – BEAT

Changes in Estimates post Q3FY25

FY25E/FY26E: Revenue: 0%/0%; EBITDA: 0%/0%; PAT: 0%/0%

Recommendation Rationale

• Entry into key micro markets: The company plans to expand into key markets such as Delhi NCR, which offers significant potential and absorption capacity for premium projects. A growing trend toward premiumization in these regions is expected to boost the company’s collections. Oberoi is anticipated to establish a strong presence in these new markets, achieving over 40%-50% bookings within the year of launch. The company is also experiencing strong traction for its new Thane launch, with additional launches anticipated from this project. By FY27E, bookings are projected to exceed Rs 9,000 Cr, driven by launches in Thane, South Mumbai, and Delhi NCR.

• GDV Additions and Annuity Strength: Oberoi has a substantial leasing portfolio in marquee locations, with occupancy levels exceeding 90%. Its current projects include Commerz, Commerz II, and Oberoi Mall, along with recent additions such as Commerz III, the Borivali Skycity extension, and Borivali Mall. The EBITDA margins for these properties are consistently above 90%. The company is expected to attract marquee and high-end clients for its upcoming projects, leveraging its established relationships and strong brand reputation. Overall occupancy for its annuity portfolio is projected to surpass 90% by FY27E. Additionally, its hospitality segment aims to expand its presence in the city, with over 1,000 keys anticipated by FY27E. The office portfolio alone has the potential to generate exit rentals of up to Rs 1,000 Cr by FY27E.

• Strong Cashflows and Low Leverage: The company is expected to fundraise a sum of Rs 6,000 Cr, which is expected to generate a GDV of Rs 70,000-80,000 Cr in the coming years. With a net debt-to-equity ratio of 0.02, the company is well-positioned to raise additional funds if required. Oberoi has always maintained a net debt-to-equity level of 0.4, demonstrating the company’s financial discipline and ability to stay solid even during challenging cycles. Its annuity cash flows are also set to grow, further contributing to its liquidity. This improvement in financial strength enhances the company’s ability to raise capital, supporting strong business development opportunities. Additionally, with a cash-rich balance sheet, the company can comfortably acquire large land parcels.

• Sector Outlook: Positive

Company Outlook & Guidance: We remain positive about the company’s long-term prospects.

Current Valuation: DCF-based valuation

Current TP: Rs 2,560/share (Earlier TP: Rs 2,560 /share).

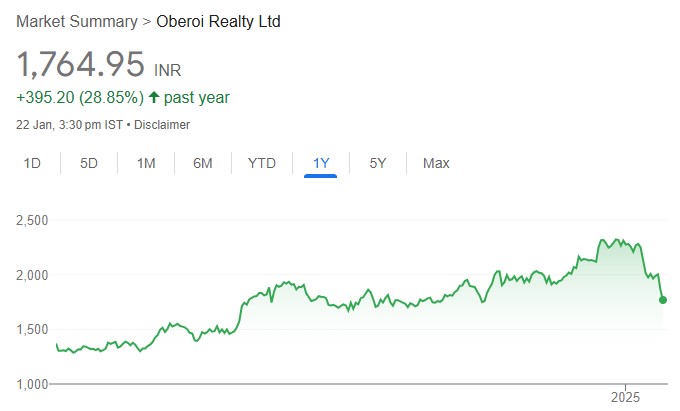

Recommendation: With a 38% upside from the CMP, we maintain our long-term BUY rating on the stock.