We upgrade the financials, with positive EBITDA now expected in FY28. Considering another inflection...

IRM expects the strong growth recorded in CNG volumes in Q1FY26 (+21% YoY) to...

ICIL’s stock price has corrected by 34% from its high and is currently trading...

FY25 was a turnaround year for Inox Wind Ltd. (IWL) with revenues more than...

VRLL is well-positioned for long-term growth, supported by its strategic focus on profitable contracts,...

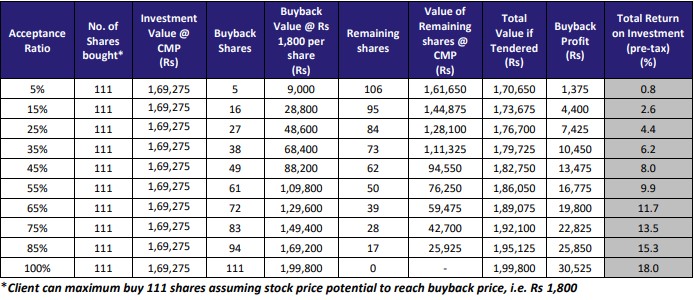

The board of directors of Infosys Ltd had approved buyback proposal on 11th September,...

We initiate coverage of Brigade Hotel Ventures Ltd. (BHVL) with a BUY rating and...

Amber Enterprises India (Amber) is a leading manufacturer and solution provider for room air-conditioner...

Long term growth prospects at PCBL remain unchanged however since quantum jump in numbers...

Ellenbarrie Industrial Gases (ELLEN), with a legacy of over five decades, is among the...