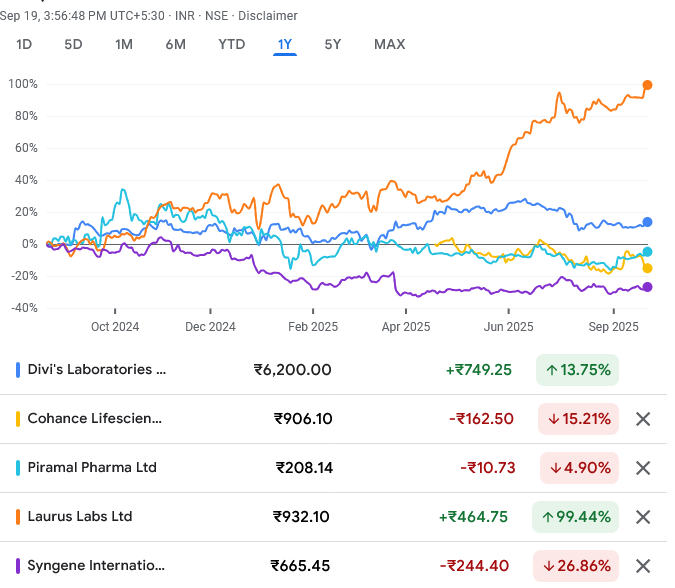

With strong fundamentals, capacity-led growth, and differentiated positioning, JP Morgan views both Divi’s Labs...

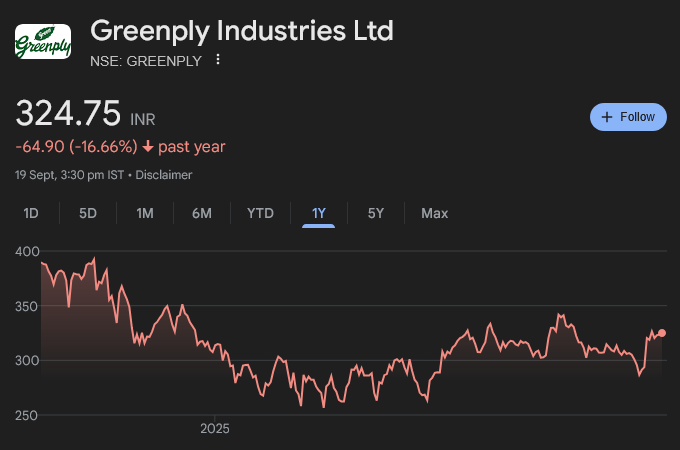

We reiterate GREENPLY INDUSTRIES LTD as our TOP-PICK from our coverage universe. We remain...

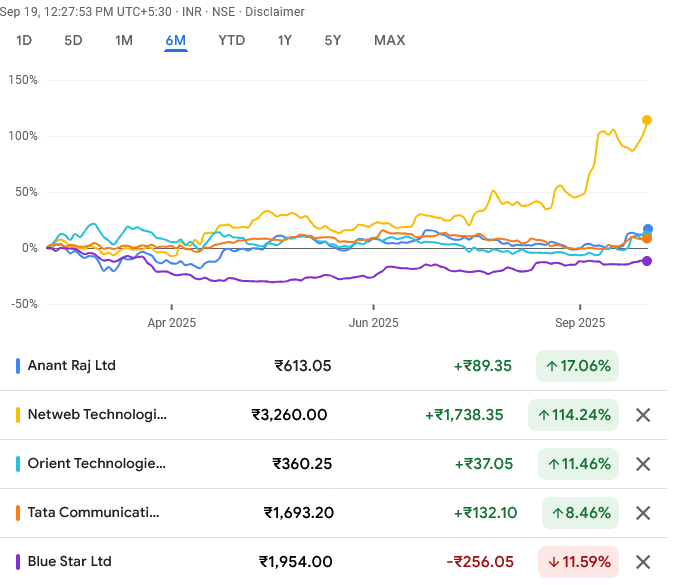

Data centers offer a promising long-term investment theme, but success hinges on execution and...

To secure the best talent, firms are hiring interns straight out of Indian Institutes...

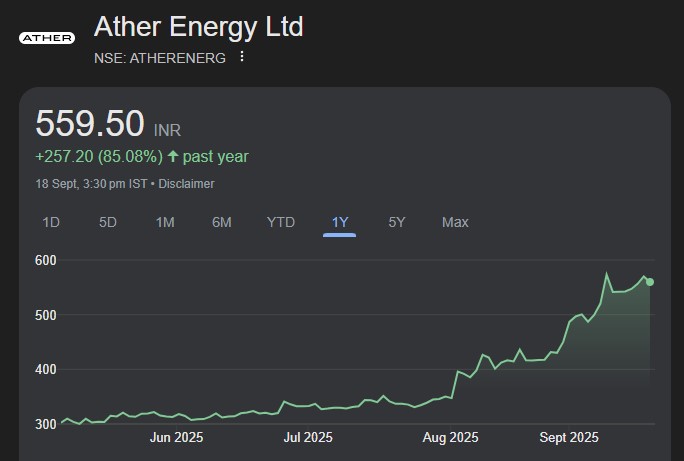

We upgrade the financials, with positive EBITDA now expected in FY28. Considering another inflection...

IRM expects the strong growth recorded in CNG volumes in Q1FY26 (+21% YoY) to...

ICIL’s stock price has corrected by 34% from its high and is currently trading...

FY25 was a turnaround year for Inox Wind Ltd. (IWL) with revenues more than...

VRLL is well-positioned for long-term growth, supported by its strategic focus on profitable contracts,...

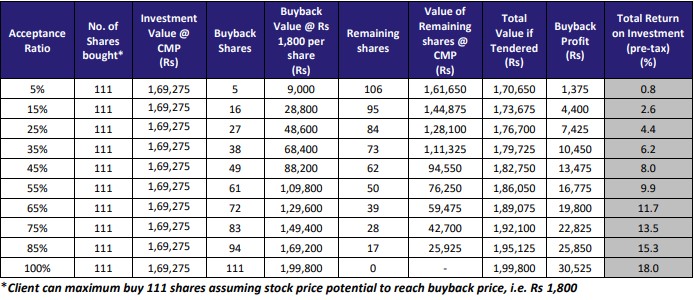

The board of directors of Infosys Ltd had approved buyback proposal on 11th September,...