Route is moving up the value chain by shifting, from being a channel provider...

We met KVB MD and CEO B Ramesh Babu, to seek the outlook on...

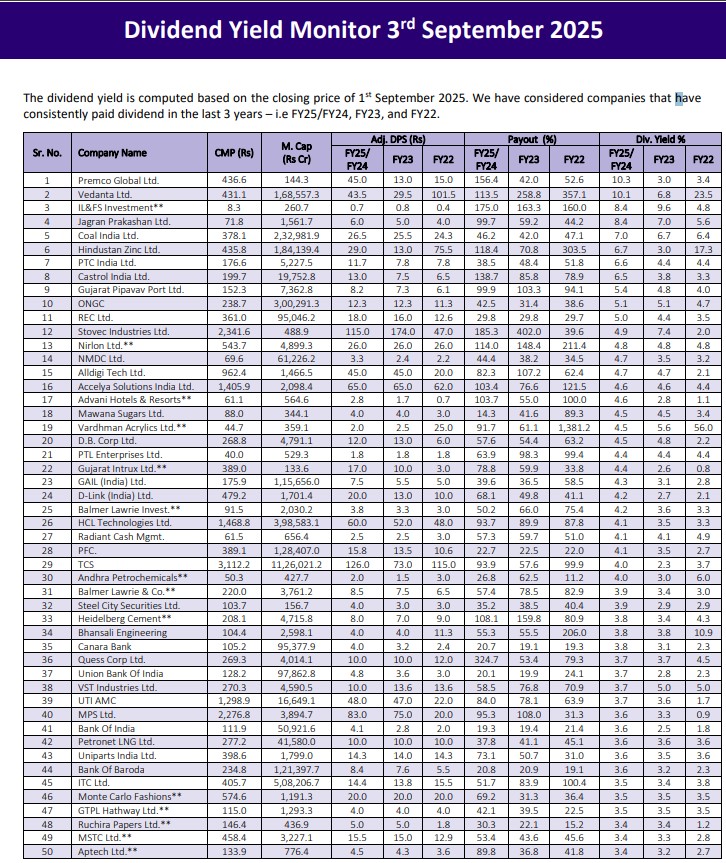

The dividend yield is computed based on the closing price of 1st September 2025....

We initiate coverage on SAMHI Hotels with a BUY rating and expect it to...

Piramal Pharma Solutions (PPS), the CDMO arm of Piramal Pharma, has announced a multi...

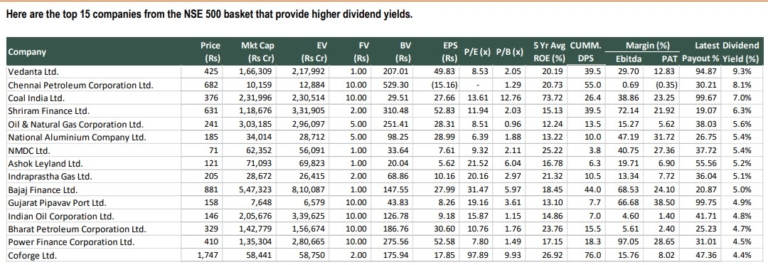

Here are the top 15 companies from the NSE 500 basket that provide higher...

SUEL stands to benefit from regulatory tailwinds mandating local content (ALMM for wind), a...

FY25 was a stellar year for Eureka Forbes (EFL), visible from a) step-up in...

FY25 was the year of transition of the bank under the new management spearheaded...

Adani Ports & SEZ (APSEZ) has transformed from a pure-play port operator into India’s...