Vishal Mega Mart (VMM) is one of India’s largest offline-first value retailers, catering to...

Kalyan Jewellers was founded by T S Kalyanaraman – who has over 45 years...

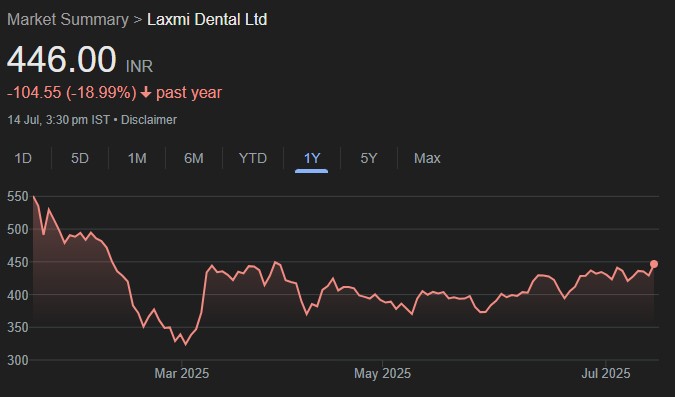

Laxmiden’s business encompasses three high-growth pillars: custom labs (crowns and bridges), aligner solutions (clear...

At 23.6x 1-year forward multiple, TCS trades at a 4% discount to its average...

Abbott’s core portfolio productivity is the highest in the industry — at Rs 12.5mn...

We reiterate BUY on Anant Raj with an unchanged TP of Rs800. The company...

We initiate coverage on Tips Music Ltd (Tips Music) with a BUY rating and...

SDL remains a top pick in the southern premium housing space, with strong recall,...

Symphony Ltd is India’s undisputed leader in the organised air cooler market with a...

Marks meaningful step forward in realization group strategic vision. Simplification of group structure and...