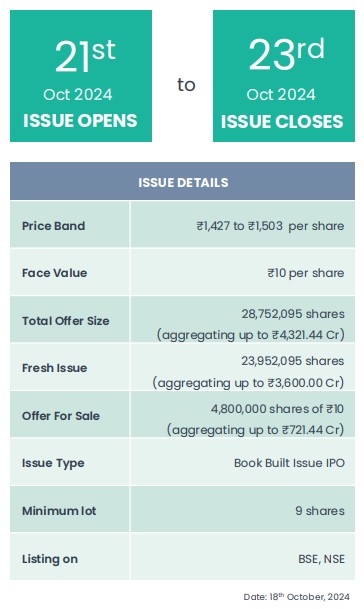

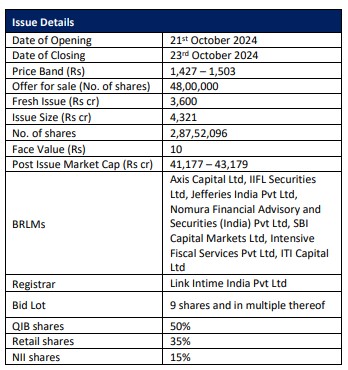

Waaree Energies Ltd IPO is a book built issue of Rs. 4,321.44 crores. The...

TIME is a) a leader in India and among the top 3 players...

Waaree Energies Ltd. is the largest manufacturer and exporter of solar PV modules in...

Sudarshan Chemical Industries Limited (SCIL) has entered into a definitive agreement whereby its wholly...

Kaynes Technologies (KAYNES) is rapidly scaling up its smart meter business to tap the...

IREDA is a systemically important non-deposit taking nonbanking financial company engaged in financing of...

Amid weak crude oil prices, the share price of Oil India (OINL) has declined...

Avalon Technologies (AVALON) stands out in the EMS landscape as the only player with...

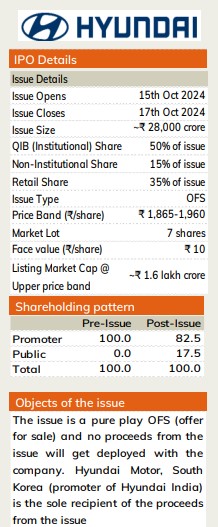

Hyundai Motors India (HMIL), is a part of South Korea based the “Hyundai Motor...

JTL Industries Ltd (JTL), a prominent player in the structural steel tubes and pipes...