Very big myth that Indian valuations are expensive

Kela first dealt with the canard which has been spread by some vested interests that the valuations of Indian stocks are “expensive” and should not be bought until and unless they reach lower levels.

“To my mind, it is a big misnomer. This is actually a big myth that India valuations are very expensive because there is a more certainty of earning in India,” he stated in a categorial tone.

“If I am a three-five-year investor, I do not think markets are expensive and the other thing is the quality of balance sheet India has,” he added.

Kela cited the examples of ICICI Bank and HSBC Bank. These companies will certainly grow. Whether the growth will be 15% or 25% is the only question.

“This is a very big myth that Indian valuations are expensive,” he repeated again for emphasis.

Pharma stocks are a good buy now

It is an elementary principle of investing as advocated by Warren Buffett, Peter Lynch and Rakesh Jhunjhunwala and other Gurus that one should buy good quality stocks when they are not in demand and are cheap.

Kela revealed that he is applying this doctrine in the context of Pharma stocks.

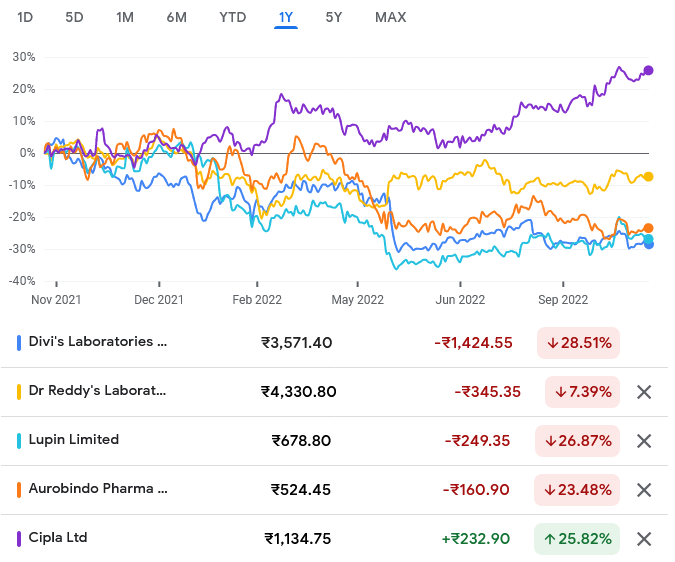

“One new thing in my portfolio is that I have added has more weightage on pharma because again this sector has not done well and in the last 12-18 months returns have been negative. A lot of companies have gone 50% negative while the majority of these companies have still reported good profits. Their PE multiple has compressed,” he stated.

He explained that the poor show of the Pharma companies is because USFDA has not conducted Plant visits and has did issued new approvals either of plants or of individual products. The absence of new products has meant that the competition for new products has increased and there is pricing pressure specifically in the US generic market.

“I think that is now reversing. We have seen incremental visits coming from USFDA and a lot of product approvals and the plant approvals are also coming for these companies,” he added.

Kela also stated that the rupee depreciation is positive for Pharma companies and is adding to their competitiveness because the majority of them are export-oriented.

The third reason offered by Kela in favour of buying Pharma stocks is that the logistics costs have dropped 70% from the peak. “One big factor which not many people talk about pharma companies is logistics cost because ultimately you are moving thousands of tonnes of material up and down both import and exports and I was reading somewhere that the logistics cost between India and China has gone down as much as 70% from the peak. China is our biggest trade partner for pharmaceuticals in terms of import of material etc. so that will again be kind of a tailwind for this sector,” he said.

Kela added that if investors have a medium term perspective, they should buy the right Pharma companies. These companies have a good earnings profile, generating cash. The EBITDA to cash convergence is very high, they generate very high ROE and high ROC and now they are trading at attractive valuations.

Russian Pharma market of $12 billion is up for grabs

Kela also explained that a giant market of $12 billion in Russia is opening up for Indian companies because all the US companies are leaving the Country.

“The Russian market for pharma is $12 billion. It is a very large country which was predominantly serviced by global companies whether it is Glaxo or all of those companies were present. Russia shutting shops now does not mean pharmaceutical consumption will go down to zero. When I speak to companies where I have invested, they are already sensing a good opportunity to enter the Russian market. Now obviously this is not like selling cement or buying coal which can happen the next day. Here one needs to build distribution and brands,” he said.

Kela also emphasized that there are only 75 pharmaceutical manufacturing facilities in Russia which is pathetically low. In fact, just one location in India named Baddi itself has more than 75 manufacturing facilities. Even if Indian companies can capture a couple of Billion of the $12-billion market, it is worthwhile, he said. “Apart from the US, worldwide there is acceptance in Russia of Indian generic pharma products,” he added.

China and other Asian countries are also a big market for Indian Pharma.

“So there is margin of safety in terms of valuation wherever bottom up the companies are cheap and stocks have not done well but one knows the capex has happened or over the two-three years, the numbers could be good. I do not talk about individual stocks but I can tell you there are many opportunities there,” Kela concluded.

Saurabh Mukherjea has recommended Divi’s Labs

It is worth recalling at this stage that Saurabh Mukherjea of Marcellus has issued a strong recommendation to buy Divis Labs.

“No other Indian pharma company has that strength of relationship with firms like Pfizer, Glaxo, Mylan. Divi’s will have a power packed pipeline given especially what is happening in China. China makes 10 to 20 times more API than India does. There is a clear directive from the highest levels of American government to the American pharma companies to source more from India, less from China and if there is one company that will make money on that redirection of API sourcing, that will be Divi’s,” he said (see “We are delighted investors are selling Divi’s Labs. We are buying it daily”: Saurabh Mukherjea).

“As you can understand, we are delighted about the fact that people sold down Divi’s on the back of this sort of brokerage research. We wanted to capitalise on that. There is a clear restructuring of global API sourcing lines against China in favour of India and our deduction from that is in favour of Divi’s and therefore we remain buyers of Divi’s on a daily basis,” he added.

Havent these names already had a strong run given the pandemic. Comps get tougher.

Gokulram Arunasalam