CDMO growth momentum likely to persist…

About the stock: Piramal Pharma Limited (PPL) is part of the Piramal group of companies. The company operates in 3 major segments.

• Contract development and manufacturing organisations (CDMO)

• Complex hospital generics (critical care)

• Consumer healthcare (OTC).

PPL owns 17 development and manufacturing facilities across India, US and UK with capabilities in sterile, API, formulations, drug discovery and manufacturing of nutrition products. The company holds 49% stake in AbbVie Therapeutics, JV with Allergan, and 33.33% in Yapan Bio which operates in the biologics / bio-therapeutics and vaccine segments.

Investment Rationale:

• Q2FY25 results- CDMO continues to provide strong momentum- Revenues grew ~17% YoY to ₹ 2242 crore on the back of ~24% growth in the CDMO business (59% of sales) to ₹ 1324. Complex Hospitals Generics (29% of sales) on the other hand grew 9% to ₹ 643 crore and India Consumer Business (12% of sales) grew ~8% to ₹ 277 crore. EBITDA grew ~29% YoY to ₹ 342 crore with 134 bps margin expansion to 15.2% driven by better operating leverage and despite 216 bps de-growth in GPM.

• CDMO business was driven by order inflows, especially for on-patent commercial manufacturing. The company also witnessed good demand for differentiated offerings with increase in customer enquiries and visits. In India Consumer Business, growth was driven by new launches and 18% growth in power brands. In Complex Hospitals Generics, the growth was driven by volume growth in inhalation anaesthesia portfolio in the US and emerging markets.

• Biosecure Act enactment postponed, but other growth levers intact – Despite likely delay in the enactment of US Biosecure Act for want of passage in the US Senate, we do not see growth related issues as the China rebalancing drive (which was started way before the Biosecure build-up) by global innovators is likely to continue. Other levers such as global consolidation in the CDMO space, improving US biotech funding and extended focus on some of the blockbuster themes (GLP-1, ADCs) are likely to maintain the orderbook momentum. The guidance for FY30E for US$ 2 billion revenues and around 25% EBITDA margins is irrespective of the positive implications of the Biosecure Act and hence provide better visibility. We roll forwards our estimates by introducing FY27E.

Rating and Target price

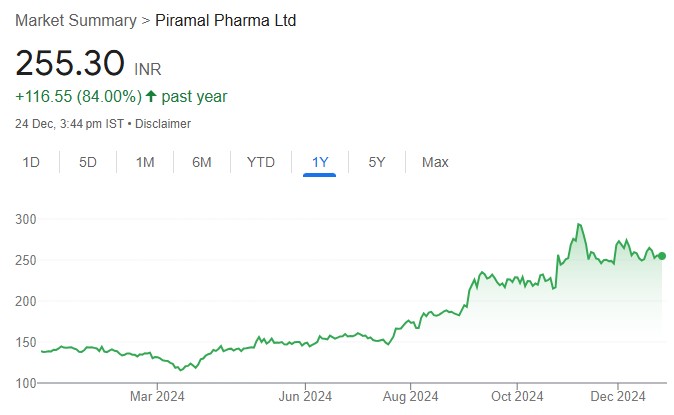

We now value PPL at ₹ 320 based on SoTP valuations, i.e. 21x FY27E CDMO EBITDA, 17x FY27E CHG EBITDA, 1.5x FY27E Consumer Healthcare Sales (earlier 1x), and 10x PAT from AbbVie JV.