Recovery in sight, challenges remain

NIFTY has declined by 4.8% since our last report (Jan10,2025) in an environment of tepid consumer demand, weak currency and geopolitical headwinds post resumption of office by President Trump in USA. Currency and FII lead headwinds abound as trade deficit is all set to cross USD250bn while decline in net FDI flows (USD38bn in FY22 to 0.5bn USD in FY25 YTD) is pressuring INR. While RBI has spent USD70bn+ in supporting INR, FII selling has also led to tight liquidity in markets.

We expect gradual recovery in domestic demand as 1) food inflation has peaked (declined from 10.9% in Oct 24 to 6% currently) 2) 25bps cut in repo rate by RBI and OMO will ease liquidity in next 3-6 months 3) Rs1000bn income tax cut for consuming class in India 4) increase in religious tourism and 5) 17% higher Govt capex allocation (including PSU and allocation to states).

India is unlikely to have any meaningful negatives of US policies as soft crude oil prices, geopolitical stability (If Russia-Ukraine war stops) and increased transfer of technology to India will neutralize costs of Trump tariffs. We expect markets to remain volatile in the near term but stabilize towards the end of 4Q25. We expect the impact of various Govt initiatives and monsoons (normal monsoons as per APEC climate center South Korea) to start getting reflected in improved consumer demand in 2Q26.

We believe India Capex story (Capital Goods, Infra, Ports, EMS, New Energy, Data centers, Railways, Defense), Healthcare (Hospitals, Pharma), Tourism (Aviation, Hotels, Accessories), Discretionary consumption (E-com, Jewellery, Food Services, Retail), Financialization (Capital market entities, Digital Public Infra) are some of the key themes to play for long term gains. We cut our base case NIFTY target to 25689 (27172 earlier) on Nifty EPS cut by 0.8/2.0/2.6% for FY25/26/27. We recommend selective buying for LT gains.

NIFTY EEPS has seen a cut of 0.8/2.0/2.6% for FY25/26/27 with 13.1% CAGR over FY24-27 (14.1% earlier) and EPS of Rs1147/1305/1473. Our EPS estimates are lower than consensus by 2/2.4/3.2% for FY25/26/27. NIFTY is currently trading at 17.5x 1-year forward EPS, which is at a discount of 7.4% to 15-year average of 18.9x.

▪ Base Case: We value NIFTY at 5% discount to 15-year average (18.9x) PE at 18 with Dec 26 EPS of 1431 and arrive at 12-month target of 25689 (27172 earlier).

Bull Case: We value NIFTY at PE of 18.9x and arrive at bull case target of 27041 (29263 earlier).

Bear Case: Nifty can trade at 10% discount to LPA with a target of 24337 (25082 earlier).

▪ Model Portfolio: We are turning overweight on Consumer on expected uptick in demand following tax cuts, decline in food inflation and cut in repo rate. We increase wight in Banks and Healthcare. We are adding Cipla and Astral Poly in the Model portfolio. We are increasing weight on Maruti Suzuki, ICICI Bank, Kotak Mahindra Bank, ABB, Bharat Electronics, Interglobe Aviation, ITC and Bharti Airtel. We are reducing weights in L&T, Titan, HUL, RIL, HCL Tech, HDFC AMC and small adjustment in others.

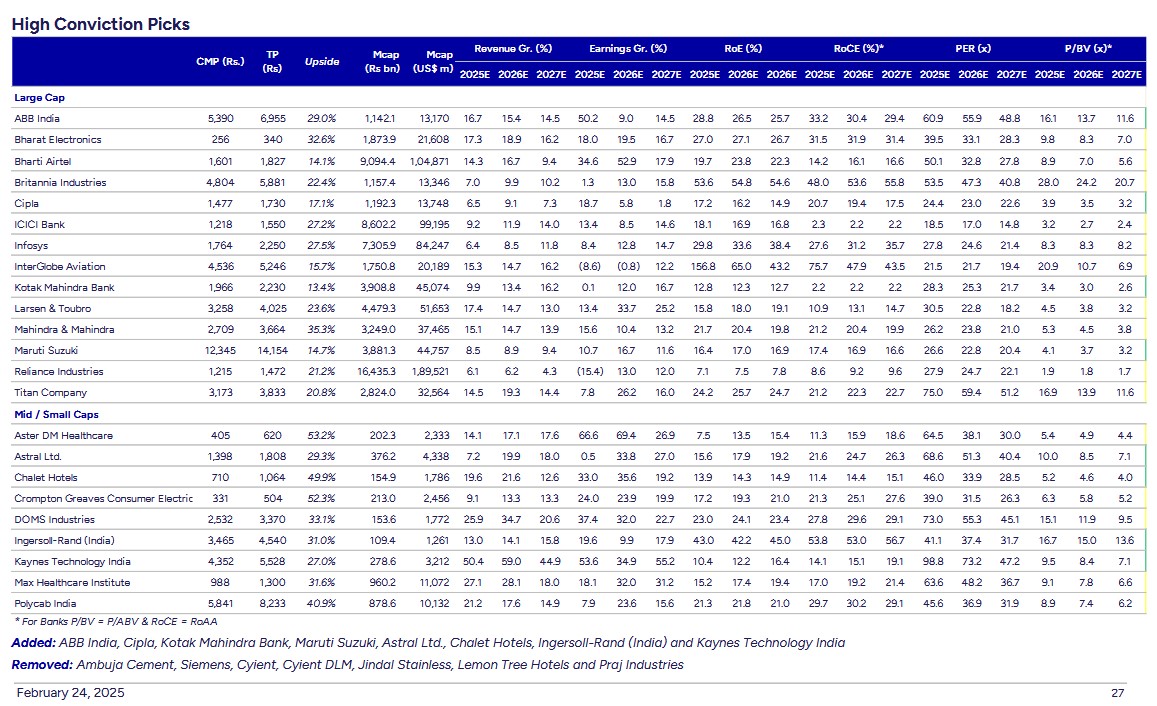

▪ High Conviction Picks: We are removing Ambuja Cement, Siemens, Lemon Tree, Praj, Jindal Stainless, Cyient and Cyient DLM from conviction picks, although we remain positive on Siemens, Lemon tree and Praj in LT. we are adding ABB, Astral Poly, Chalet Hotels, Cipla, Ingersoll Rand, Keynes Tech, and Maruti Suzuki in Conviction picks.