Company Overview:

Popular Vehicles and Services Limited is a top automobile dealership in India, operating with a fully integrated business model. The company’s services include selling new vehicles, repairing and servicing them, distributing spare parts and accessories, facilitating sale and exchange of pre-owned vehicles, operating driving schools, and selling third-party financial and insurance products. The company’s three key segments include passenger vehicles, commercial vehicles, and electric two-wheeler & three-wheeler vehicles.

Key Highlights:

1. Key Business Segments:

(a) Sales of Vehicles: (i) The company sells Maruti Suzuki, Honda, and JLR passenger vehicles ranging from economy to luxury models, including electric vehicles. In 1HFY24, they sold 16,476 passenger vehicles across all dealerships. (ii) The company sells commercial vehicles made by Tata Motors (Commercial), BharatBenz, and Maruti Suzuki. In FY23, the company was the fourth largest Tata Motors (Commercial) dealership in terms of sales volumes. As of 1HFY24, the company sold 793 BharatBenz vehicles and 85 Maruti Suzuki commercial vehicles. (iii) The company entered the electric two-wheeler and three-wheeler vehicles segment in 2021 and operates electric two wheeler and three-wheeler vehicle dealerships of Ather and Piaggio, respectively.

(b)Other Business Verticals Includes: Services & repairs, pre owned vehicles, spare parts & accessories distribution, sales of third party financial and insurance products and driving schools.

2. Expansive network of 432 touchpoints: As of Dec’23, the company has a network of 61 showrooms, 133 sales outlets, 32 pre-owned vehicle showrooms, 139 authorized service centers, 43 retail outlets, and 24 warehouses. These are spread across 14 districts in Kerala, 8 districts in Karnataka, 12 districts in Tamil Nadu, and 9 districts in Maharashtra. The company’s sales outlets and booking offices complement showrooms, while retail outlets facilitate the sale of spare parts and accessories.

3. Capturing organic and inorganic growth opportunities: The company acquired a spare parts distributor in Karnataka in FY19 to expand the business. The acquisition contributed to a turnover of Rs 17.5 cr, accounting for 12.0% of total turnover and 7.3% of EBITDA as of 1HFY24. The company also acquired service centers and showrooms from Maruti Suzuki in Kerala and BharatBenz in Tamil Nadu and Maharashtra. The company has successfully integrated these acquisitions and achieved organic growth, adding 22 showrooms, 23 sales outlets, and 47 service stations from FY21 to FY23.

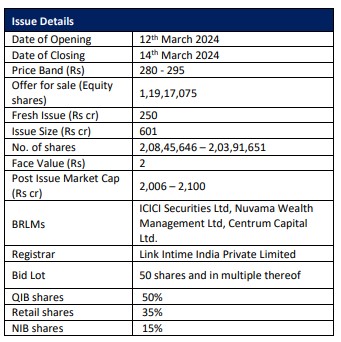

Valuation: The company is valued at FY23 P/E and 1HFY24 annualised P/E multiple of 32.85x and 26.3x respectively at the upper price band on postissue capital. The company is raising Rs 250 cr through fresh issue, of which Rs 192 cr will be used to reduce the debt. In FY23, the company is the 7th largest Maruti Suzuki dealer under Arena and 9th under Nexa in India by volume. Ranked fourth in Tata Motors Commercial dealership sales during FY23, the company contributed 76.7% and 48.0% of sales in Kerala and Tamil Nadu as of 1HFY24. The company’s Revenue/PAT has grown significantly at a CAGR of 30%/41% from FY21-FY23. Indian Passenger and commercial vehicle market is expected to grow at the CAGR of 8% and 6% from FY23- FY28 giving an edge to the company’s growth. We recommend to subscribe the issue for long term investment horizon.

Click here to download SBI Securities’ Popular Vehicles and Services Limited IPO Note