Public Sector Banks: Well poised for Re-rating 2.0

1% RoA – from aspirational to sustainable; valuations remain attractive

► In our last sector report on public sector banks (PSBs) titled ‘Public Sector Banks: The Homecoming of RoA!’ published in Jan’23, we argued that underlying earnings quality for PSBs improved significantly and that PSBs were well positioned to sustainably deliver 1% RoA – which looked aspirational at that time.

► PSBs have demonstrated significant improvements in their operating parameters and the combined profitability of six PSBs under our coverage has thus improved to ~INR912b in FY23 from a loss of INR295b in FY18.

► We estimate PSBs to sustain ongoing earnings traction, aided by improved loan growth, margin stability and controlled credit costs thus driving continued rerating of the sector. A reflection on PSBs valuation history may cause trading multiples to look constrained however the quality of earnings, growth outlook and broader re-rating in PSU entities will nevertheless enable steady performance of the sector.

► Select PSBs now guide for RoA of 1.2% in FY25 which implies scope of continued earnings upgrade. Over FY23-26, we estimate earnings CAGR of 24% for PSBs vs. 19% for private banks (adjusted for HDFC Bank merger). We believe that the changing narrative on interest rates may further fuel the sector earnings & growth outlook.

► For top six PSBs under our coverage, we estimate PAT of INR1.5t/INR1.7t in FY25/FY26. We expect sector RoA/RoE to improve to 1.2%/17.9% by FY26. Several PSBs have raised capital from the market and have a healthy Tier-1 ratio, which should aid business growth, particularly as the capex cycle revives post general elections.

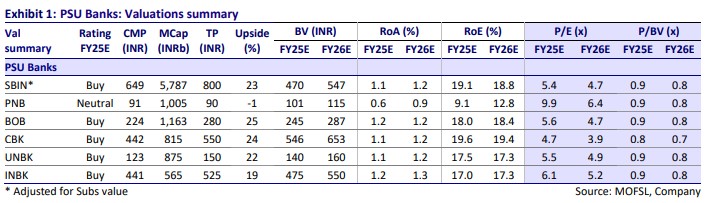

► We thus estimate ABV of our coverage PSBs to grow at a healthy 16-22% range over FY24-26. We introduce FY26E and roll-forward target prices for our PSBs coverage universe. Top picks: SBIN, BOB and CBK

Valuations and view: Earnings outlook steady; well poised for Re-rating 2.0 PSBs have delivered a strong performance since FY22, with the Nifty PSU Bank Index outperforming the Nifty-50/Bank Nifty by 87%/ 78%. We earlier resumed coverage on the entire PSB sector in CY21 enthused by their improving business/earnings outlook. We estimate top six PSBs under our coverage to report PAT of INR1.5t/INR1.7tn in FY25/FY26, while sector RoA/RoE improves to 1.2%/17.9% by FY26E. Several PSBs have raised capital from the market and have shored up their capitalization levels, which will enable healthy balance sheet growth, particularly as the capex cycle recovers after the general elections. We thus estimate ABV for our coverage PSBs to grow at a healthy 16-22% range over FY24-26. We believe that sustained and consistent performance on return ratios and a conducive macroenvironment can drive further re-rating of the sector. We introduce FY26E and rollforward target prices for our PSBs coverage universe. We thus revise our TP for SBI (INR800), BoB (INR280), INBK (INR525), UNBK (INR150), CBK (INR550), PNB (INR90). Top picks: SBIN, BOB and CBK.

Click here to download the report on Top 6 PSU Banks to buy by Motilal Oswal