Value creation via formalisation and demerger

Quess Corp Ltd (Quess) is India’s largest staffing/business services company with its business spread across staffing (WFM), facility management (OAM), BPO (GTS) and a platform (job portal Foundit). It is a leader in the flexi-staffing and facility management segment and is well placed to benefit from macro tailwinds like (1) formalisation of labour force, (2) proposed new labour laws, (3) push for creating a manufacturing hub through various PLI schemes, (4) creating internship opportunities, and (5) job generation in tier-2/3 cities. These initiatives will drive a sustainable mid-teen growth for the flexi-staffing sector. Quess has built multiple businesses through various acquisitions (FY17-22) but post-covid, the company has focussed on execution, driving organic growth, efficient capital allocation, debt reduction, and cash flow improvement.

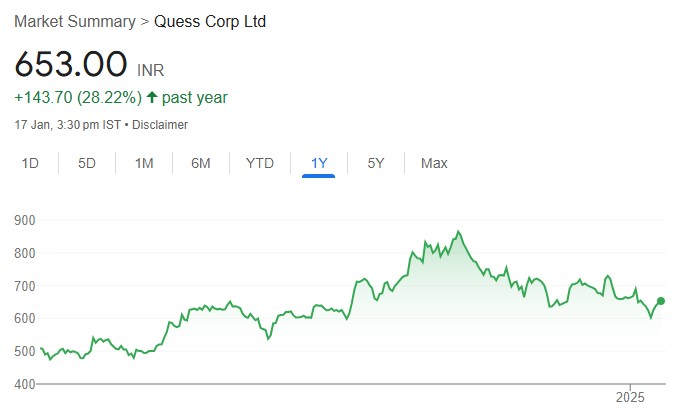

The company achieved a strong revenue CAGR of 18% over FY19-24, but the margin has declined from 5.4% in FY19 to 3.6% in FY24 leading to a muted 4% PAT CAGR. We expect a 12% revenue CAGR over FY24-27E, led by volume growth in WFM, accelerating growth in facility management, and higher demand for AI-driven CLM services in the GTS segment. Margins will gradually improve with change in business mix, reduction in Foundit losses, and stable corporate costs, leading to an EBITDA CAGR of 16% over FY24-27E, in our view. The planned demerger into three independent entities will result in (1) value unlocking for each segment, (2) higher management focus, and (3) better capital allocation based on strategic priorities. We initiate coverage on Quess with a BUY rating and SoTP based target price of INR 930, assigning 15/10/12x EV/EBITDA to WFM/GTS/OAM segments and 4x EV/sales to Foundit, the implied P/E and EV/EBITDA multiple is 22/13x. The stock is trading at a P/E of 19/15x FY26/27E with RoE improving to 17% in FY27E.