Banks Sectorial Credit

Increased risk weight could impact growth ahead

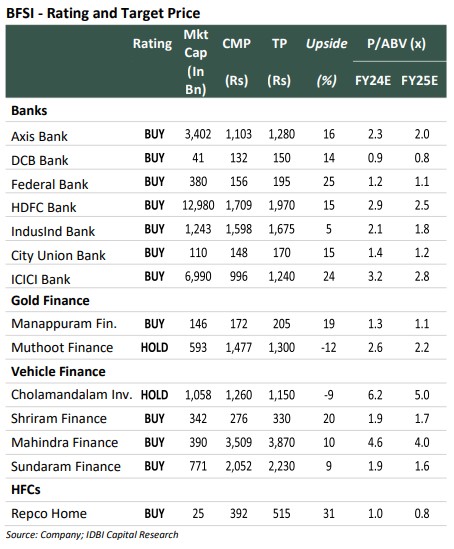

Banking sector (non-food) credit improved sequentially in Nov’23 to 20.8% YoY (@16.3% YoY ex HDFC Ltd) vs 19.8% in Oct’23. Driven by HDFC Ltd individual loans, retail portfolio grew by 30.1% YoY (@18.6% ex HDFC Ltd) while services segment grew by 25.4% YoY (@21.9% ex HDFC Ltd) and industry grew by 6.6% YoY (@6.1% ex HDFC Ltd). Credit to NBFCs (up 21.5% YoY) as well as other personal loans (up 24.3% YoY) witnessed a marginal uptick during Nov’23 on a MoM basis. Deposit growth, after remaining under pressure during FY23 witnessed strong growth and stood at 13.6% as on 17 Nov’23 (as compared to 9.6% on 24 Mar’23). Going forward, we need to watch for impact of increased risk weight changes in personal loans, credit cards and NBFC on credit growth for FY24. Among our banking coverage, our top picks are HDFC bank, ICICI bank and City Union Bank.

Deposit rate growth moderating; Similar trend observed in lending rates: Since pause in repo rate hike by RBI, the WADTDR (weighted average domestic term deposit rate) increase has been moderating and the same increased by 5bps MoM whereas WALR on fresh rupee loans which decreased by 7 bps MoM in Nov’23 Vs an increase of 4 bps in Oct’23. As of Nov’23, the weighted average domestic term deposit rate on outstanding deposits stood at 6.85%, whereas the weighted average lending rate on outstanding rupee loans was 9.25% and outstanding fresh rupee loans stood at 8.60%.

Outlook: Banking credit growth witnessed strong growth in FY23 and continued to outpace deposit growth during the year. Going forward, we expect credit growth to remain in the range of 14-15% (higher base impact) and would be led by higher retail credit growth coupled with revival of corporate credit. We also expect housing sector credit to witness positive growth traction led by pausing of repo rate by the central bank as well as strong focus of the government led affordable housing scheme.