Emerging long-tail risks in unsecured credit

India’s heterogenous unsecured retail credit market (US$160bn; 3-year CAGR at ~23%) has been in the headlines ever since the RBI clamped down on select categories of consumer credit. Our discussions with experts suggest that the RBI’s note of caution is largely centred on small-ticket personal loans (STPL) (ticket size

▪ Unsecured credit – a heterogenous asset class: The unsecured consumer credit market (US$160bn) is heterogenous and encompasses credit cards (US$30bn), salaried personal loans (US$105bn), and self-employed personal loans (US$23bn). Further bucketed by geography (markets), lender type, and ticket size, each cut offers a distinct view of the overall PL.

▪ So, where’s the froth? Basis our discussions with lenders and experts, we identify “small-ticket personal loans” (STPL) category (

▪ FinTech repository – an impending systemic need: The larger issue with the STPL and MTPL categories is the fact that 60-80% of such credit lines are a blind spot to the entire ecosystem. We argue that the RBI’s proposal to set up a FinTech repository is essential to mitigate the systemic “blind spots”.

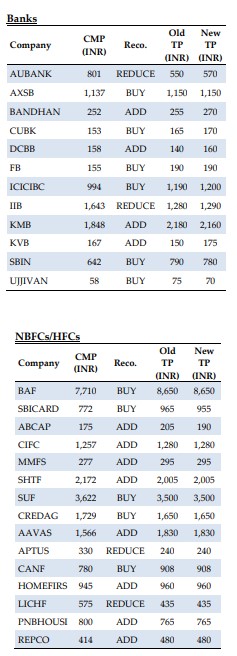

▪ Investment implications: While the demand for unsecured credit has been strong during H1FY24, incremental growth is likely to come under pressure, especially as lenders begin transmitting the higher risk premium into their pricing of personal loans. Further, given the RBI’s hawk-eye focus on this segment, we believe that the growth in consumer loans will need to materially decelerate. As tail-end volumes dissipate, we expect the unit economics of fringe players to be severely tested. Our top picks are ICICIBC (TP: INR1,200) and SBIN (TP: INR780) among large banks; and BAF (TP: INR8650) and SBICARD (TP: INR955) among NBFCs.

Click here to download the research report on Bank and NBFC stocks by HDFC Sec