Unlocking Treasures

NBFC | Gold Finance Sector Thematic

Leading players well adapting to changing times

Key Points

We interacted with the managements of banks/NBFCs/fintechs and did our channel checks with branches of different category of lenders in key hubs of Kerala and Mumbai known for their high activity in the gold loan segment. Our conclusion is that the market potential for gold loans to grow is huge with enough space for different categories of lenders to co-exist in a profitable manner. Banks are competing in the segment by offering lower rates to ETB customers in higher ticket sizes and the activity is higher in agri gold loans which qualify for PSL. NBFCs are competing on service levels, TAT and ease of processing. A leading NBFC’s branch we visited in Kerala has been able to get customers transferred from banks in that area, with ticket sizes in range of Rs 0.1-0.3mn.

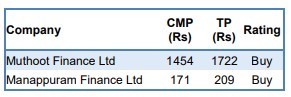

In terms of our pecking order in gold loan NBFCs, we are positive on Muthoot Finance because of its strong customer acquisition and retention measures, entry into new geographies and segments and it has been growing on strong internal accruals (CAR at 30.3%). We maintain our ‘Buy’ rating on Muthoot Finance Ltd with a revised SOTP based target price of Rs 1722 (valued at 2.5x December 2025E ABV plus subsidiary value per share of Rs 66.8 per share) as against Rs 1527 earlier (based on 2.1x September 2025E consolidated ABV).

In the case of Manappuram Finance, besides growth being back in its core business, we are positive on the company’s growth potential as a diversified lender. However, being on track with its diversification plans is key to re-rating. We have valued the standalone Gold Loan business at 1.1x Dec. 2025E ABV, which leads to standalone value per share of Rs147.90. Adding subsidiary value per share of Rs60.70 (net of holding company discount of 20%), we have raised our TP to Rs209 (from Rs200 earlier, valued at 1.14x consolidated Dec. 2025E ABV). Maintain ‘Buy’.

Click here to download the file Unlocking-Treasures–Gold-Finance-Sector-Thematic-16-January-2024