Company Overview: Medi Assist Healthcare Services Limited provides third-party administration services to insurance companies through the wholly owned subsidiaries, Medi Assist TPA, Medvantage TPA (from Feb’23) and Raksha TPA (from Aug’23). Its a holding company and has nine subsidiaries of which four are direct subsidiaries and five are indirect subsidiaries. The company provides third party facilities between (a) insurance companies and their policy holders, (b) insurance companies and healthcare providers (such as hospitals) and (c) the Government and beneficiaries of public health schemes. Medi Assist TPA had a market share of 14.8% of the retail health insurance market and 41.7% of the group health insurance market and a cumulative retail and group segment share of 33.7% serviced by third party administrators, as of FY22.

Key Highlights:

1. Business Verticals: The company works as a facilitator between the insurance companies and the policyholders/health care providers. The company also helps the government to provide various public beneficiary schemes. It also provides other healthcare and ancillary services such as hospitalization services, call centre services, customer relations and contract management services, billing services and claims processing services through the company and other subsidiaries, IHMS, Mayfair India, Mayfair UK, Mayfair Group Holding, Mayfair Philippines and Mayfair Singapore.

2. Attractive contracts with a pan-India healthcare provider network: The company has developed a pan-India healthcare provider network which comprises of 18,754 hospitals across 1,069 cities and towns and 31 states (including union territories) in India as of 1HFY24. During 1HFY24, the company has processed claims amounting to Rs 7,950 cr and settled 3.05 mn claims comprising 1.37 mn in-patient claims and 1.68 mn domiciliary or out-patient claims.

3. Technology driven infrastructure: The company’s technology-driven infrastructure and services are custom-built and assist various stakeholders such as insurance companies, hospitals, insurance brokers and insurance agents in the operations and are scalable, comprehensive, easy to use and secure. This enables to offer a comprehensive healthcare solution to the customers encompassing an extensive in-patient and outpatient network, on-demand health services, robust management of fraud, waste and abuse as well as effective medical inflation control.

4. Strong growth in the group segment: The company has serviced over 9,500 group accounts across sectors to help administer the insurance requirements of their employees. As of Mar’23, Medi Assist TPA and Medvantage TPA managed around Rs 128.2 bn of group health insurance premiums which grew at the CAGR of 37% from Mar’21, representing 27.6% of India’s overall group health insurance market.

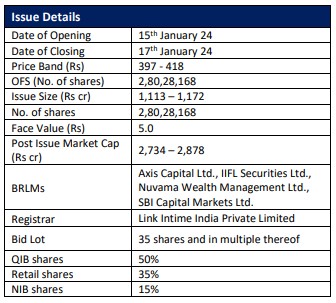

Valuation: The company is valued at FY23 P/E and EV/EBITDA multiple of 38.9x and 22.3x based on the upper price band on post-issue capital. The company has consistently delivered healthy financial performance with its Revenue/EBITDA/PAT growing at a CAGR of 25.1%/25.7%/40.8% from FY21- FY23. As of FY23, the company holds 17.3% of the total premium served in the TPAs industry and contributes around 28.6%/48.8%/56.4% of Revenue/EBITDA/PAT of the total TPAsindustry. Premium serviced by TPA’s is expected to grow at a CAGR of 24%+ with penetration expected to increase further to 61.2% from 54.7% during FY22-FY28F on back of enhanced value proposition to insurers by TPAs.

Click here to download Medi Assist Healthcare Services Limited IPO Note by SBI Securities