Sterling Tools never lived up to its potential. It has now failed the ‘Forensic Accounting Test’

Dolly Khanna is usually the first discoverer of multibagger small and mid-cap stocks.

In the case of Sterling Tools, she had added it to her portfolio as far back as in August 2018 (see Dolly Khanna, Anil Kumar Goel & Vallabh Bhanshali Scoop Up Top Quality Micro-Cap Stock).

However, when the stock turned into a multibagger, Dolly quietly encashed her gains and quit the counter.

Perhaps, her sixth sense had alerted her that something was amiss in Sterling Tools.

Saurabh has now confirmed that Sterling Tools may be guilty of accounting malpractices and has failed the forensic test.

Naturally, he has dumped the stock like a hot potato.

“We have exited from Sterling Tools recently,” he said in a grim tone in his latest newsletter to his distinguished clients.

“The key reason for exit from Sterling Tools is deterioration in its accounting score under the Marcellus’ proprietary forensic accounting model triggered by below par scores on the following ratios:

(i) growth in auditor’s remuneration relative to the revenues;

(ii) contingent liabilities as % of networth;

(iii) miscellaneous expenses as % of total revenues; and

(iv) yield on cash and cash equivalents,” he added.

The other Little Champs stocks are all winners

Saurabh has issued the soothing assurance that despite the fiasco relating to Sterling Tools, the other stocks in the Little Champs portfolio are credible and potential winners.

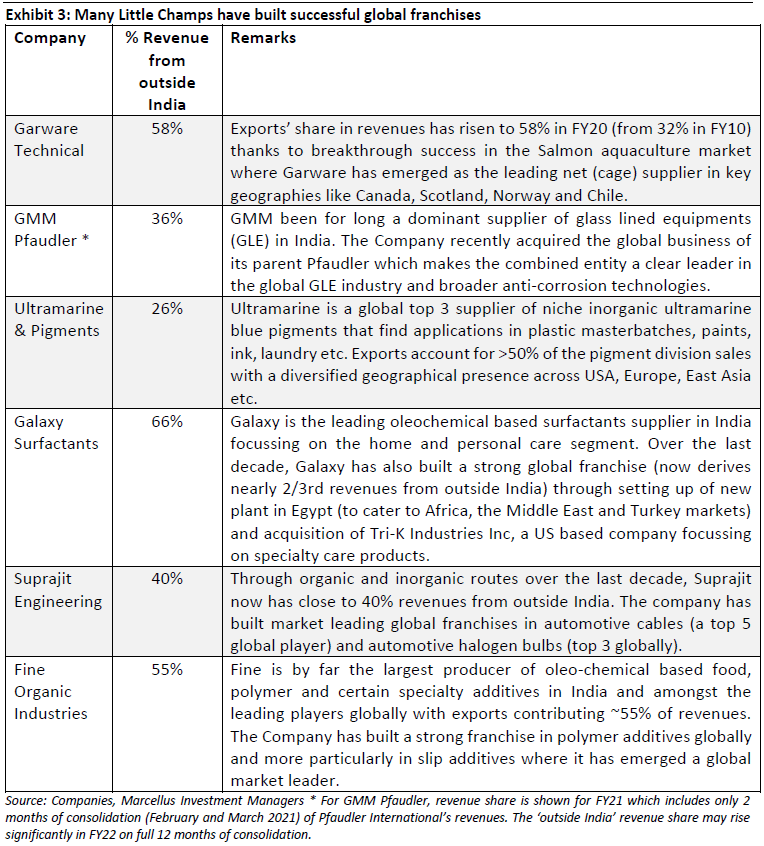

“A key objective of our Little Champs portfolio is to invest in ‘dominant’ franchises. This ‘dominance’ forms the key basis for Little Champs’ superior pricing power, profitability, RoCE and free cashflow generation. Given the smaller size of the companies that we target for the Little Champs portfolio (we typically invest in US$500 mn market cap companies), it is but logical that most of the portfolio companies, albeit dominant, cater to niche markets. In fact, in a way the unwavering focus/commitment to their niche markets is a key driving force behind Little Champs achieving & maintaining their dominance,” he has said.

Saurabh emphasized that the Little Champs have defied the growth challenges of their niche industries.

“Despite the above odds (i.e. high probability of hitting a growth ceiling after reaching a dominant position in the niche industry), the Little Champs portfolio companies have delivered weighted average revenues and profit CAGR of 11% and 20% respectively over FY16-21 against the backdrop of relatively muted revenue/ earnings growth seen across the broader Indian corporate landscape,” he said with understandable pride in his tone.

Thereafter, Saurabh has discussed in detail the merits of several core stocks in the Marcellus’ Little Champs portfolio, namely, Garware Technical Fibres, GMM Pfaudler, Suprajit Engineering, Mold-Tek Packaging and Fine Organics.

“Little Champs have focussed on innovations rather than pricing as the key differentiator to gain market shares. Their innovation, in turn, has been a result of relentless focus on a niche segment, often driven by a technocratic top management and a sound understanding of the customer needs,” he said, giving examples of Garware Technical Fibres and Fine Organics, both of whom have done this successfully.

He has also cited GMM Pfaudler and Suprajit Engineering as examples of companies which employ ‘processes – driving operational efficiencies’ and ‘integration of global operations’.

“The Little Champs are amongst those rare Indian companies to make a success out of their global acquisitions and/or generate healthy profits at their global manufacturing facilities. The key to this is:

(a) a well-defined vision for & long-term commitment to their global business;

(b) a clear roadmap for improving operational efficiencies through networking/collaboration with and sourcing from efficient Indian plants; and

(c) making the necessary investments to enhance the product portfolio & marketing muscle,” he has said.

Saurabh and Dolly did right thing by exiting Sterling Tools. The stock is up only 15% (annual return) in this bull market. Somewhere the market is not trusting it. I also sold the stock earlier at a loss because it was not moving. Now, from the auto sector, I have Suprajit Engg and Motherson Sumi in portfolio.