Portfolio Performance and Update on Fundamentals of Marcellus PMS portfolios

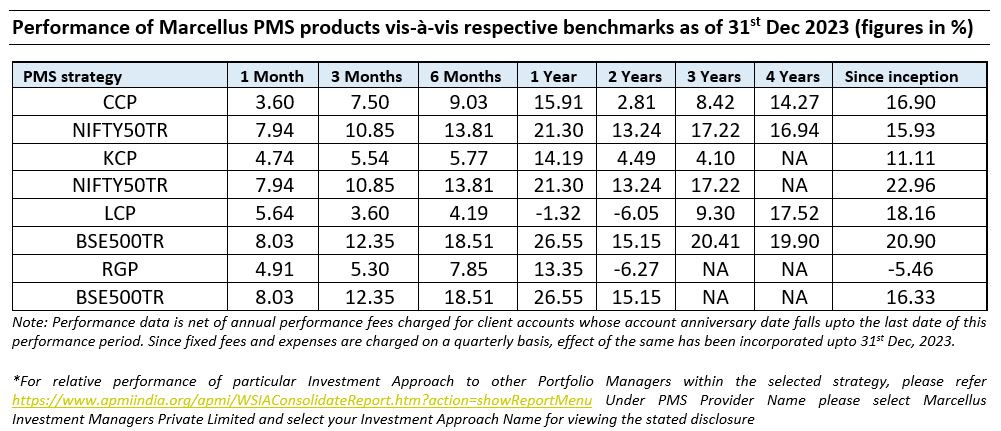

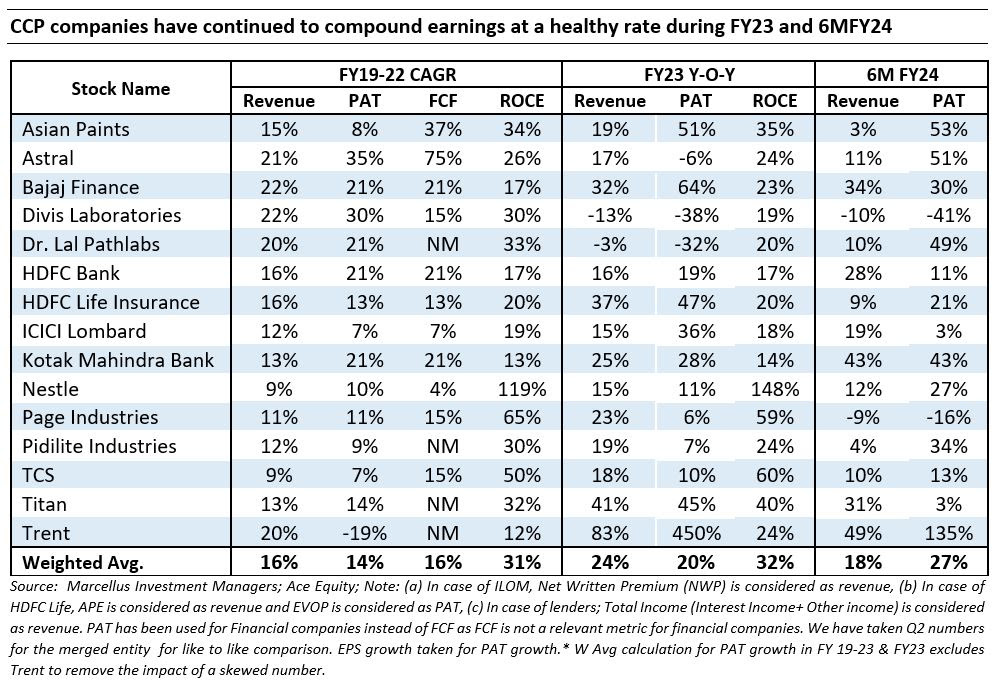

Saurabh Mukherjea has come clean on the performance of the various schemes managed by Marcellus. The Marcellus’ CCP portfolio generated 16% returns and underformed Nifty 50 by 6%.

He pointed out that the culprits for the underperformance in CY2023 were Page Industries, Kotak Mahindra Bank and Pidilite. However, he assured that these three will also pull up their stocks and start performing soon.

“From a quality, consistency and longevity perspective, we believe our CCP portfolio companies are likely to generate stronger fundamentals and share price performance over the long term compared to the top performers of Nifty50, and hence we see the underperformance of 2024 as being temporary with a strong likelihood of reversal in future,” he said in a soothing manner.

As regards the Kings of Capital Portfolio, Saurabh pointed out that large private banks have continued to underperform the broader indices during YTDFY24 and is now the worst performing sub sector in the broader market during this financial year. This is despite healthy growth and no concerns on asset quality. As a result, well run large private banks such as HDFC Bank and Kotak Bank continue to trade at valuations which are near 10-year lows while the broader markets in general and small and mid caps in specific have continued to re-rate upwards.

He assured that the fundamentals of HDFC Bank and Kotak Bank have only improved vs. their own history as RoAs, growth and market share gains have continued/ improved. “We therefore believe this is a good time to buy these high quality banks as opportunities to buy great companies at great valuations are far and few in between. Buying into such opportunities have historically rewarded investors handsomely in the long term,” he said.

Home First Finance replaced by MAS Financial Services

Saurabh said that though Home First Finance’s business continues to do well with the company achieving 15%+ RoEs (vs. 11-12% when it entered the portfolio) and healthy growth, its valuation (~4.5x FY24 P/B) offers little margin of safety while MAS Financial Services offers similar RoEs as Home First along with healthy growth at almost half the valuations.

MAS Financial lends to retail NBFCs and understands the needs of such NBFCs better than most other lenders. It is able to offer tailor made solutions and a quicker turnaround time to such NBFCs whose only other source of funding is PSU banks, he added.

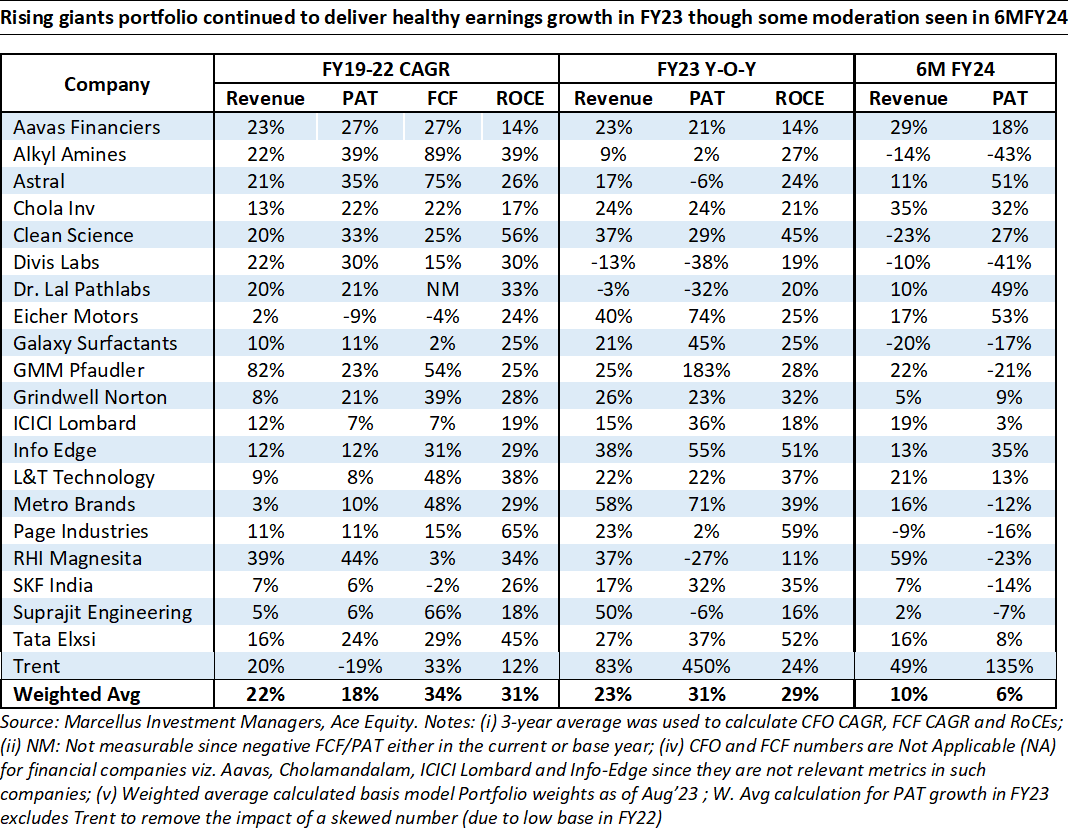

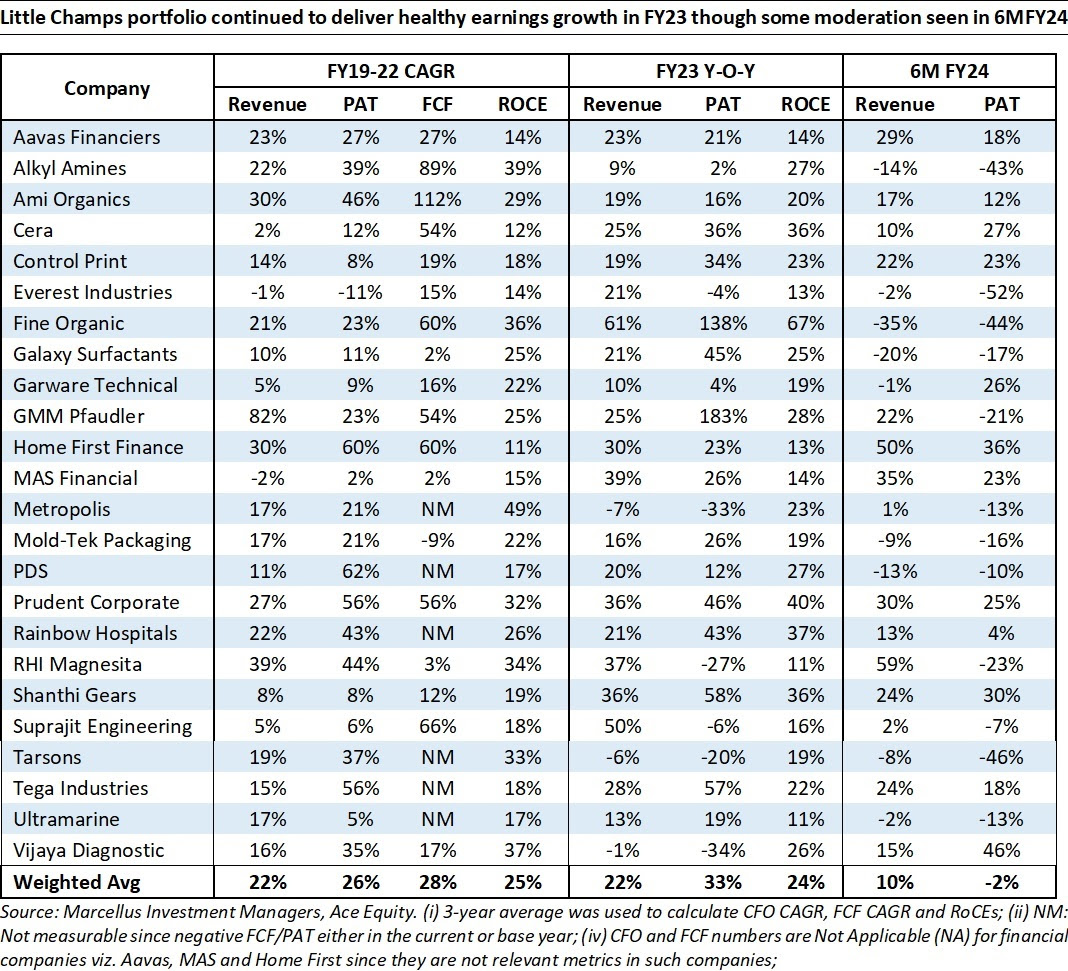

Little Champs and Rising Giants portfolio companies are facing headwinds

Saurabh said that the reason for the unerperformance of the Little Champs and Rising Giants portfolio is because the portfolio companies are facing headwinds owing to the demand-supply mismatch and weak sentiments and this has adversely affected their performance.

However, he assured that the prospects of the companies are good. “We remain sanguine about the medium-long term prospects of our portfolio companies; and (ii) given the current valuation levels, any uptick in earnings can result in disproportionate gains in the share prices for the portfolio companies,” he confirmed.

New stocks added to the Little Champs portfolio

Saurabh announced that four top-quality stocks have been added to the Little Champs portfolio. These are the following:

Everest Industries:

Everest is a reputed player in the asbestos roofing market and with renewed focus on architects and contractors, new product launches and operating efficiencies, it is expected to report healthy revenue growth in this business along with improvement in profitability.

It should be noted that the elite MASSACHUSETTS INSTITUTE OF TECHNOLOGY holds 9.89% of the equity capital of Everst Industries. There are also a number of wellknown HNIs like YASHKUMAR POONAMCHAND GOLECHHA, BHADRA JAYANTILAL SHAH, ASHOK KUMAR GOEL, CHETAN JAYANTILAL SHAH and TARBIR SHAHPURI who hold big chunks of the Company.

Control Print:

Control Print is well known to us because it is one of Dolly Khanna‘s favourite stocks and has pride of place in her portfolio of multibagger stocks. Dolly holds 2,03,582 shares of Control Print. S.SHYAM holds 2,16,307 shares and SHIVANI TEJAS TRIVEDI holds 1,60,342 shares.

Saurabh has pointed out that Control Print is the 3rd largest player in the Indian coding & marking industry. Coding & marking industry provides printers for variable information for packaging and branding & identification for industrial products like pipes, cables, wires etc. CP dominates the industrial segment of coding & marking industry with significant market share in pipes & steel industries mainly through sales of Continuous Ink Jet printers and Large Character printers.

Ami Organics:

Ami Organics has created skill and competency in handling multiple chemistries allowing it to offer multiple routes of synthesis for any given intermediate. This enables the Company in partnering with a higher number of clients who have used varied routes of synthesis for their dossier filings. In addition to its wide chemistry capabilities, the Company has a big basket of products (~350-400) which provides visibility on growth as more and more of the products get commercially scaled up, Saurabh said.

Ashish Kacholia holds 7,76,474 of Ami Organics. The other distinguished shareholders are Vanaja Sundar Iyer, Dhwani Girishkumar Chovatia, Malabar India Fund Limited, Morgan Stanley Asia (Singapore) Pte and Bofa Securities Europe Sa – Odi.

Shanthi Gears:

Saurabh explained that Shanthi Gears Ltd is an Industrial Gearing Solutions company supplying gears and gearboxes to different industries. Tube Investments of India Ltd (TII) brought 70% stake in the company for around Rs.465 crores in 2011-12. SGL manufactures all types of gears and mainly caters to customers in Steel industry (30% of revenues), material handling (10% of revenues), Power sector (10%), Mining & off-highway industries (10%), Plastic and Tools (10%), Exports (7%) and other industries (23%).

Durgesh S Shah, a noted intellectual, holds 9,74,114 shares. Other HNIs named Dhanesh S Shah and Nimesh Sumatilal hold big stakes in the Company.

Addition to the Rising Giants portfolio

SKF India is the sole addition to the Rising Giants portfolio. SKF’s sources of competitive advantage include: (i) Access to technology of Parent, (ii) stickiness of customers (SKF was the company that supplied bearings to the first 2W from Bajaj and the relationship continues till this day); (iii) its asset light strategy generating better ROCEs in India; and finally (iv) its Rotating Equipment Performance (REP) offering, Saurabh exlained.

There are no HNI investors in SKF India. However, well known Mutual Funds like Sbi Blue Chip Fund, Kotak Emerging Equity Scheme, Mirae Asset Large & Midcap Fund and Hdfc Mid-Cap Opportunities Fund hold 25.91% of the equity capital.