Saurabh Mukherjea’s PMS Fund has informed of the portfolio changes made to the Kings of Capital Fund.

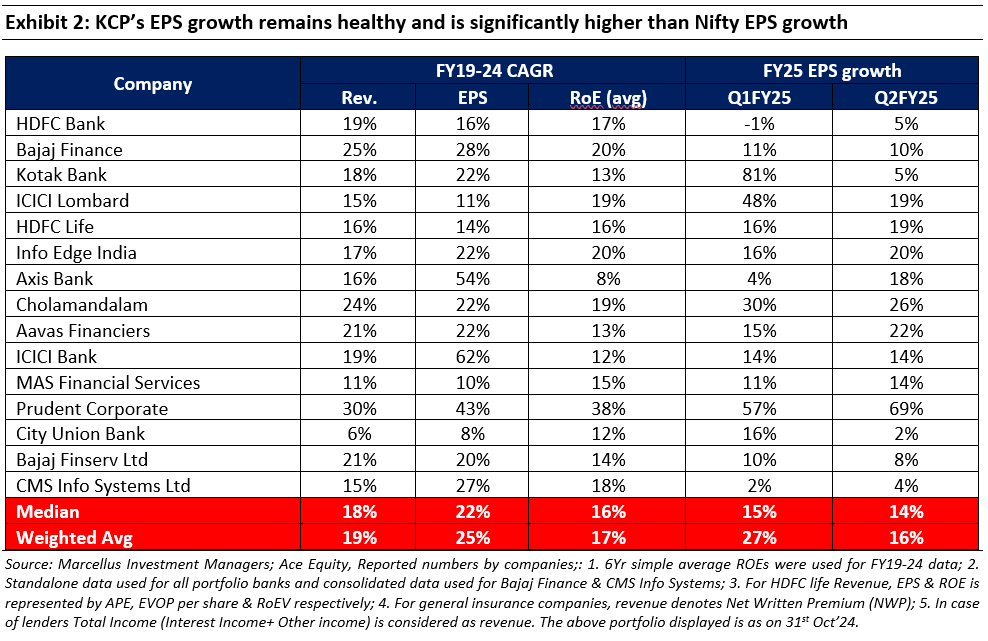

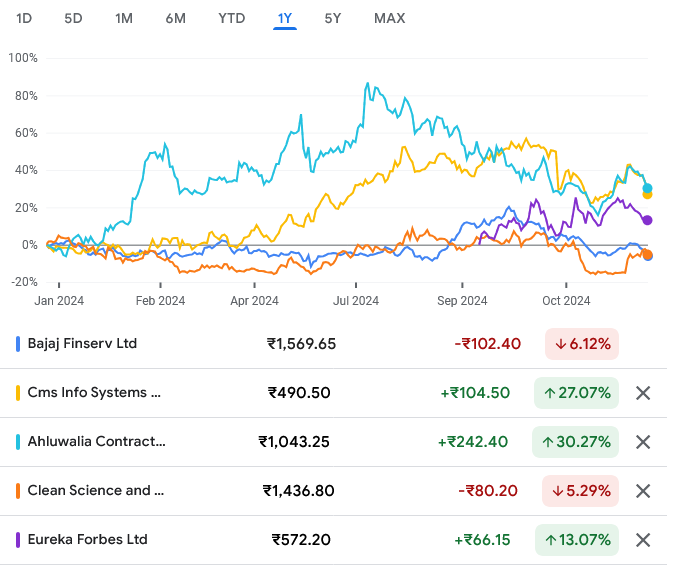

“Addition of Bajaj Finserv: We started adding Bajaj Finserv to the portfolio in July. Bajaj Finserv owns 51.3% stake in Bajaj Finance – one of the most profitable and best-managed NBFCs – and 74% stake in 2 insurance businesses – BAGIC and BALIC. BAGIC is one of the best run general insurers in the country, whilst BALIC has turned around in the last 3 years under the new management team. Bajaj Finserv’s new initiatives like Bajaj Finserv Health, FinServ Market Place & Bajaj Finserv AMC offer additional optionality. With all cylinders firing, it is a good way to take exposure to the Indian financial sector. When we started adding Bajaj Finserv, its derived holding company discount (on Bajaj Finance) was marginally lower than previous 5-year average. However, this has discount significantly narrowed over the past month post our purchase. This position was built by selling off some of our holding in Bajaj Finance. Given majority of the SoTP value of Bajaj Finserv continues to be contributed by its stake in Bajaj Finance, this addition does not result in any significant change in portfolio composition.

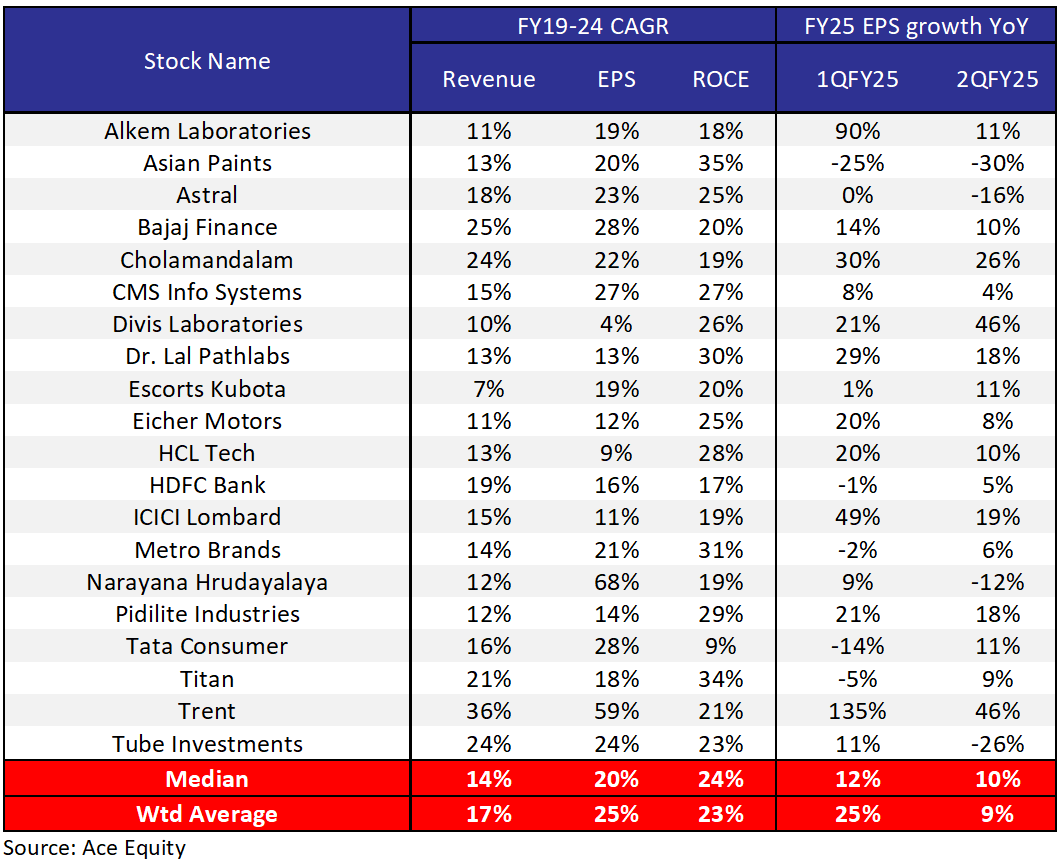

Addition of CMS Info Systems Limited: We started adding CMS to the portfolio in July. CMS is a business services company with leadership in cash management market, a growing presence in ATM managed services market, and now expanding into tech solutions (remote monitoring and software). On back of its scale and a strong balance sheet (net cash company with healthy return ratios), it is well placed to benefit from healthy ATM rollouts (capex heavy), increased outsourcing activity of support functions by banks and tightening regulatory compliance. Stronger growth in RMS segment and diversification into bullion-logistics and loan collections will drive revenue growth & diversification of revenues. The biggest risk is acceleration in replacement of cash by digital payment modes and hence material reduction in cash in circulation.

Additions to the Rising Giants PMS portfolio (as of November 30, 2024)

Ahluwalia Contracts India Limited

We see massive opportunities in building construction coming up over the next 3-5 years, led by multiple sub-segments, including railway station redevelopment, airport terminals, hospitals, educational institutions, private residential real estate, commercial real estate etc.

ACIL is very well placed to take advantage of these opportunities, given its pre-qualifications, bidding and execution experience and strong balance sheet. In a sector with low entry barriers, every cycle sees a churn in the key players in the market, with many old stars dying and new ones entering. However, ACIL has survived multiple cycles and for most of its history maintained pretty good ROCEs (10-year average of 24.9%) and a debt-free balance sheet, the latter being rare in this sector.

They have achieved this through:

A conservative approach to bidding;

Limited adventures in capital allocation; and

Focus on execution, with a high degree of the promoters’ direct involvement.

The first two are the result of learnings from mistakes, which we believe are now ingrained in their functioning. Resultantly, the company today has progressed to competing with the likes of L&T in building construction projects, with individual order sizes of Rs25bnr+. For context, the company’s F24 revenues were ~Rs38.6bn.

Key risks: Significant slippages in execution, political developments which impact Government functioning (Government accounts for significant portfolio of order book/revenues).

Exit from the Rising Giants PMS portfolio (as of November 30, 2024)

Eureka Forbes

During the course of recent channel checks on the water purifier industry in general and Eureka Forbes in particular, the investment teams came across the following challenges:

A. Increasing competitive intensity in WPs

From 2-3 players’ dominated market around 5 years back, the playing field has now expanded to about 6-8 credible players – fighting for a limited shelf space and providing a lot of options for the customers to choose from.

A. O. Smith and PureIT (earlier part of HUL) merger can be a potent force combining the product innovations of A.O. Smith with network of PureIT.

B. Formal channels cutting Eureka out of service/ service accessories (particularly filters)

Retailers are now pushing their own AMC at the point of Sale which includes tying up with service providers like Onsite Go, Reliance ResQ etc. To add to the woes, we found that whilst earlier these third party service providers were sourcing critical components like filters (part of AMC) from the respective brand company (like Aquaguard), it is now also being sourced from third parties. Hence, Eureka is increasingly getting stripped off of this critical component of revenue. The only saving grace is that those customers who DON’T opt for the extended AMC (usually ~80% of total WP buyers) at the point of sale are generally tapped by Eureka at the end of 12 months of free warranty.

C. Scope for improvement in service quality

Whilst the management has been taking actions to improve the service quality/experience (app, turnaround time, campaign around genuine service/filters), we continue to receive feedback regarding scope for improvement in service (eg: the turnaround time).

Furthermore, since its entry into the portfolio in March 2024, Eureka Forbes’ share price has increased by ~30% (till the date of the exit decision by the Investment Committee) which has restricted the expected IRR on the stock. In view of the above (challenges but limited IRR), it was decided to exit from the stock.

Additions to the Little Champs PMS portfolio (as of November 30, 2024)

Clean Science & Technology

Clean Science and Technology Ltd. (CSTL) is a leading manufacturer of chemicals for polymer, packaged food, pharma and cosmetics industry. It is the global market leader in the manufacturing of MEHQ, which is a polymerization inhibitor and also in manufacturing of BHA & Ascorbyl Palmitate which are used as antioxidants in edible oil and packaged food industries. CSTL’S advantage lies in its proprietary catalytic manufacturing processes which have alternate starting points compared to conventional processes used by peers and which have higher yields and lower waste / effluent generation. The Company has also done forward and backward integration for its core products which has allowed it to have better control on its cost structures and also to drive better value from its portfolio. In addition to the products which have global leadership (in terms of market share), CSTL has been building its product portfolio very aggressively by getting into adjacencies where the addressable market size is multi-folds larger than core products, and which are more technically complex – for instance the recent foray into Hindered Amine Light Stabilisers (HALS) where Clean is the only domestic manufacturer of the product. This provides both – greater moats and longer growth runway for the company. In the last five years, company has delivered revenue CAGR of 15% and PAT CAGR of 20% with average ROCE (pre-tax) of 43%.”