The Little Champs Portfolio

The Little Champs Portfolio is a portfolio of about 15-20 sector leading franchises with a track record of prudent capital allocation, clean accounts & corporate governance and at the same time healthy growth potential. The portfolio stays away from names where there is doubt about the cleanliness of accounts or the integrity of the promoters (even though the business potential may sound promising) as the fruits of company’s performance may not get shared with minority shareholders. In addition, the portfolio churn is kept low (not more than 25-30% per annum) to reap the benefits of compounding as well as minimize trading costs.

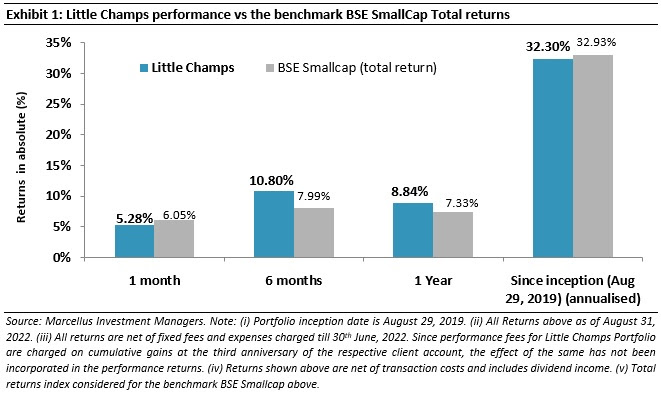

Since inception in August 2019, the Little Champs Portfolio has given an annualized return of 32.30% which is on par with the return of 32.93% given by the BSE Small Cap Index in the same period.

Addition of Vijaya Diagnostic Centre Limited to the Little Champs Portfolio

According to the latest announcement of the Marcellus PMS Fund, Vijaya Diagnostic, a mid-cap, has been added into the Little Champs Portfolio.

Vijaya Diagnostic was started by Dr. Surendranath Reddy in 1981. It has over the past four decades expanded to about 100 centres across Telangana and Andhra Pradesh.

According to research team, Vijaya Diagnostic has two key competitive advantages:

The first is that of customer Convenience: Vijaya has an integrated business model of radiology and pathology offers one-stop convenient solution for clients. Furthermore, the extensive network of hubs and spokes built by the company in and around Hyderabad gives Vijaya an upper hand in corporate tie-ups & wellness packages as well.

The second is the quality of the diagnosis: Vijaya’s quality edge over peers is attributable to its high-end equipment quality and – more importantly – the quality of the radiologists employed by it. Radiology reports are hugely dependent on the interpretations of the radiologist and Vijaya, due to its high-quality specialist radiologists, is often preferred for a second opinion by doctors on complex cases.

It is also pointed out that attracting new radiologist talent is dependent on the existing quality of radiologists as well as the volume of cases that the diagnostic chain can provide. As higher quality radiologists join Vijaya, more cases flow to them, creating a virtuous loop for the company.

It is stated that Vijaya has been a pioneer in bringing high end equipment technology into the country and as the business flourishes it allows the company to keep investing in cutting edge technology – driving further volumes.

Basis the above two factors, Vijaya has been able to gain a market share of ~20% in Hyderabad and foray into the other cities of Andhra Pradesh & Telangana in the recent years, it is emphasized.

ICICI Securities has recommended a buy for target price of Rs 597

ICICI Securities has recommended a buy of Vijaya Diagnostic on the following logic:

“We remain positive on the stock mainly due to the company’s B2C focus (95% of revenue in Q1FY23), highest margin within the industry and continued focus on deeper expansion in its dominant regions. These strengths synergise with supportive macro factors, including the likelihood of a faster shift of market to organised players. Further expansion in east, especially Kolkata, may drive medium to long-term growth. However, intense competition may affect near-term performance.”

Is there a saturation in the Diagnostic space?

It is worth noting that there a number of competitors in the diagnostic field such as Lal Pathlab, Metropolis, Ranbaxy, Thyrocare, Vijaya, Nidan Lab, Aspira Pathlab, Medinova etc.

Tata 1mg is a new entrant which announced aggressive pricing campaigns in certain metro cities. This has caused the stock price of all diagnostic companies to plunge.

Dr Lal Pathlabs, one of the stocks in the Marcellus Rising Giants portfolio, has lost 33% on a YoY basis.

However, Saurabh and his team are dismissive about the adverse long-term implications of the intense competition.

“Price competition has for a long time been commonplace in the diagnostics space and Dr. Lal has successfully warded off aggressive price competition in the past as well,” it was stated in a newsletter.

Gujarat Ambuja Exports removed from the Little Champs Portfolio

The induction of Vijaya Diagnostic has led to the exit of Gujarat Ambuja Exports from the Little Champs Portfolio.

“In order to allocate space for Vijaya Diagnostic Centre as warranted by the Little Champs position sizing framework, we decided to exit from Gujarat Ambuja Exports Limited. Gujarat Ambuja Exports had the lowest score in our position sizing framework for the portfolio and also ranked lower compared to Vijaya Diagnostic Centre,” it was tersely stated by Team Marcellus.