Marcellus’ Consistent Compounders Portfolio (CCP)

The Marcellus’ Consistent Compounders Portfolio (CCP) has a coverage universe of around 25 stocks, which have historically delivered a high degree of consistency in ROCE and revenue growth rates. The research team focuses on understanding the reasons why these companies have delivered healthy and consistent historical track record and which of these companies are likely to sustain their superior financial performance in future. Based on this understanding, a concentrated portfolio of companies with an intended average holding period of stocks of 8-10 years or longer is constructed.

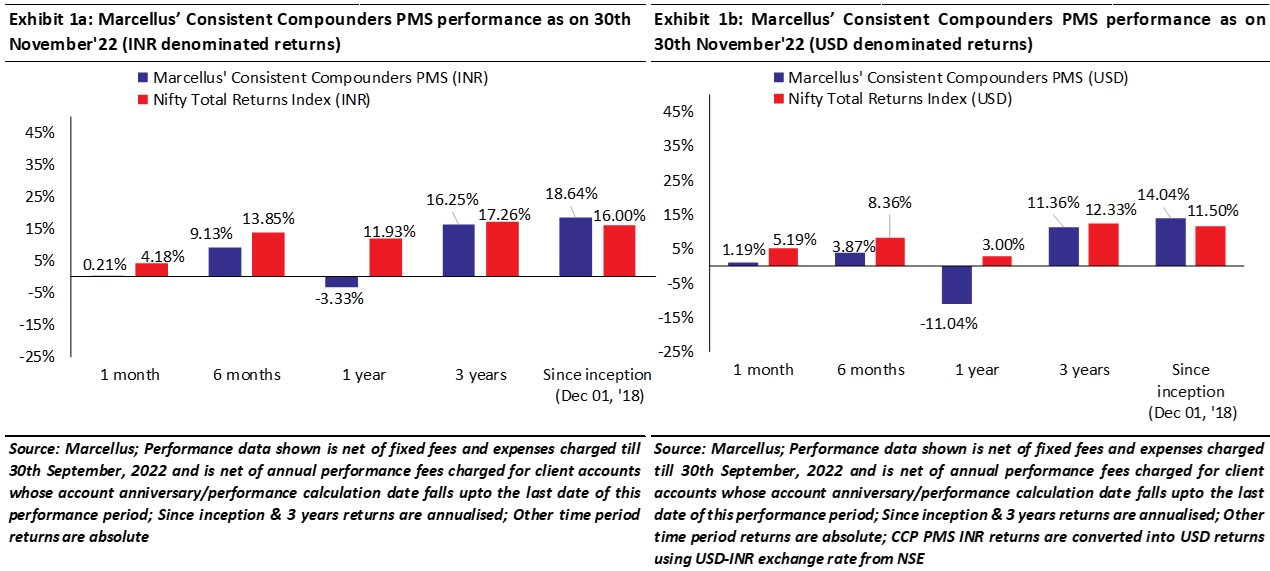

The latest performance of the PMS portfolio is shown in the charts below

As can be seen, the portfolio has generated a cumulative return of 98.2% or 18.6% CAGR over the last four years. It has outperformed the Nifty which delivered a CAGR of 16% in the same period.

The precise mechanics of how this impressive feat was achieved has been explained by Saurabh Mukherjea and his colleagues at the Marcellus PMS Fund in a webinar.

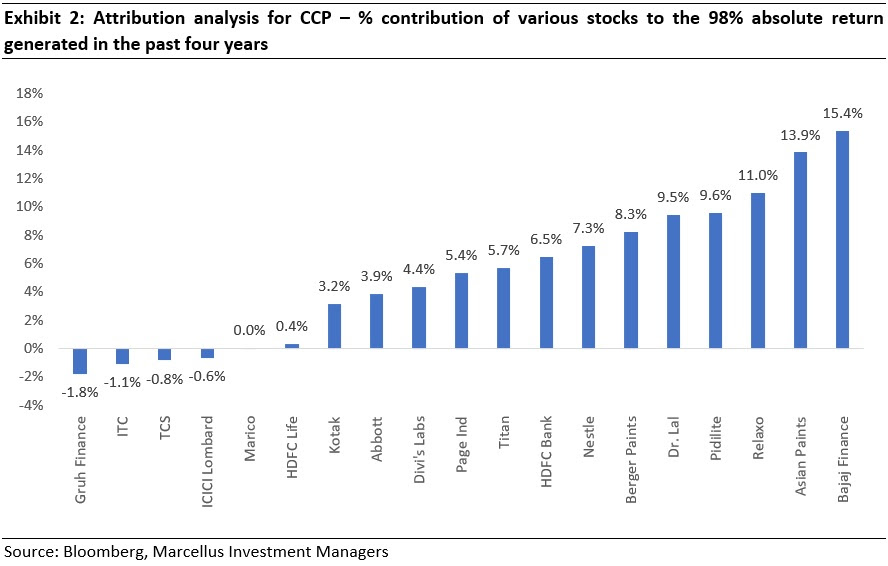

Bajaj Finance is the largest contributor of gains

Not surprisingly, Bajaj Finance contributed 15.4% to the overall returns followed by Asian Paints (13.9%), Relaxo (11%) and Pidilite (9.6%).

What is notable is that the share price returns of the investee companies do NOT have a steep gradient over 4 years – almost all CCP companies delivered between 15% and 30% share price CAGR over the last 4 years. This implies that the volatility is very low.

Stock selection is more important than position sizing

Team Marcellus has drawn three key conclusions from the fact that most stocks have delivered 15%+ total returns CAGR over the last four years. These are the following:

(1) Since the performance of all constituent stocks is broad-based, stock selection has added more value to the CCP portfolio than position sizing.

(2) Since fundamentals (revenues, earnings and free cash flows) of all CCP constituents consistently compound at a healthy rate (15-30% CAGR over the last four years), share prices of these stocks have also consistently compounded at a healthy rate of 15-30% CAGR over these four years.

(3) Position sizing within the portfolio plays a role in significantly reducing the risks embedded in the portfolio – measured by our proprietary Longevity Framework.

It is also pointed out that the shallow gradient of total returns across stocks over four years hides a phenomenon that prevails over shorter time horizons. This phenomenon offers an opportunity to add extra layers of performance to the overall portfolio.

Even the highest quality stocks suffer due to short-term factors. Buy aggressively at that time

Team Marcellus has rightly pointed out that the stock prices of even the highest quality franchises tend to go through short term gyrations as a result of a prevailing short term narrative (eg. the spring 2020 narrative that Covid-19 will damage the Bajaj Finance franchise) or extrapolation of short-term weakness in business (eg. the market’s reaction to the Covid-19 drug Molnupiravir becoming less relevant for Divis).

Such short-term dislocations (and the extent of it) are near impossible to predict beforehand. However, they do provide excellent opportunities to rebalance exposure to such dislocated stocks, it is stated.

For instance, stocks such as Dr. Lal Pathlabs, Titan and Bajaj Finance were amongst the worst performers in the Jan-Jun 2022 period. However, these three stocks were amongst the best performers in the Jun-Nov 2022 period).

In 2022, as the share prices of stocks like Divis Labs (Oct ’21 – Nov ‘22) and Dr. Lal Pathlabs (Sept ’21 – June ‘22) saw a significant correction, Marcellus increased the position size of these stocks significantly in its portfolios.

Similarly, when Bajaj Finance’s stock price almost halved between Jan’20-Apr’20 leading to a decline in its portfolio weight, Marcellus rebalanced the portfolio by increasing the weight of the stock. By Dec’20 the stock had recovered nicely and delivered 128% returns with overall portfolio benefiting immensely from the higher weight.