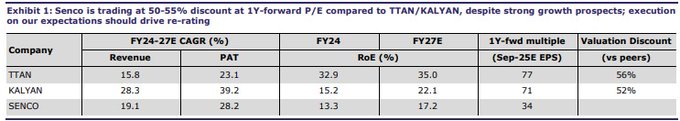

Outperformance should bridge valuation discount vs peers; BUY

We see significant re-rating scope for Senco, helped by our expectations of a strong pick-up/SSG outperformance in Q2 and valuation discount vs P N Gadgil (PNG) after its ~70% listing gain. Our checks suggest a strong pick-up in jewelry retail after a modest Q1, as intermediate cooling of gold prices rushed consumers to stores. In our view, Senco is now comfortably placed to meet or exceed its 18-20% annual growth guidance, despite only 11% growth in Q1. On a trailing basis (FY24 PAT), Senco is trading at a 45-55% discount to Titan/Kalyan and at ~25% discount to P N Gadgil. Given the strong execution in FY24/H1FY25E and relatively longer listing history, we believe the steep discount is unwarranted. Given the improved medium-term growth profile with a big 900bps duty cut and outperformance vs other retail formats, we are increasing our multiple by 15% to 36x EPS, and reiterate our BUY rating with a revised Sep-25E TP of Rs1,600/sh. Volatility in gross margin is a key downside.

Specializes in light-weight jewelry with a heavy look; brand is accessible: Senco offers the best brand accessibility vs peers in terms of product, price, and penetration in the eastern region. Senco leverages its multi-decadal relationship with karigars (in Kolkata) to offer relatively light-weight ornaments with a heavy look. This helps Senco to differentiate itself from players who offer heavier jewelry (higher grammage). Merchandise at stores is localized with focus on addressing the entire middle class of the local catchment through its light-weight jewelry. For all categories, Senco starts off with a <10gm offering, through which it is able to offer a similar look with 15-20% lower grammage than peers (channel checks). In other words, the key focus is on maintaining superior brand accessibility and generating higher footfalls, albeit at a lower ticket size vs peers (Rs65K ticket size vs Rs100-150K for TTAN/Kalyan). Focus remains on replicating eastern success in non-eastern regions: Senco has been investing in marketing, merchandizing, sales, and network expansion to strengthen its presence in non-eastern regions, majorly Delhi-NCR and Uttar Pradesh. Given its focus on brand creation in new non-eastern territories, we expect the initial expansion to be through company-owned stores (Rs250mn investment per store). After establishment of a strong brand in new territories, we expect further expansion to be driven by asset-light franchisee stores (FOFO model), thereby significantly aiding free cash flows for the company. We expect Senco to open 62 stores over FY24-27E on a base of 159 stores, equally divided between COCO and FOFO formats. While FOFO expansion is asset-light, the COCO expansion will entail a capex/WC investment of Rs8-10bn.

Unit metrics are comparable to most players; focus on franchisee-led expansion should help generate better returns: Senco’s modus operandi is to build its brand in Metros/Tier-1 cities, and then improve brand penetration through franchisee-led expansion (asset-light) in adjacent Tier-2/3 cities. While COCO stores generate a decent RoE of 13-14%, FOFO stores log much higher RoE of 40-50%, due to lower invested capital (Emkay estimate: Rs20mn warehouse inventory to support a FOFO store vs Rs250mn capital investment for a COCO store). Given that preference is relatively higher for high-margin, hand-made jewelry in eastern India, margin for Senco is better vs South-based jewelers like Thangamayil/Kalyan. However, revenue/store is relatively lower for Senco due to lower per-capita consumption in eastern India (200g/wedding vs 300-350g/wedding in southern India). But the same gets adjusted with the lower inventory requirement at store level. Better margins help Senco to still command a similar or better ROCE profile vs peers (ex-TTAN).