Senco Gold One of the largest organised jeweller in East; initiating, with a Buy

An all-India retailer of gold and diamond jewellery at various prices, Senco Gold has major market share in East with ~79% of its store presence (FY23) in the east India. With its focus on light-weight jewellery and extensive retail network, it aims to cater to a wider customer base. Its key strengths are innovation, intricate designs, product quality & finish and ability to recognize consumer preferences and market trends. We build in 23%/28%/36% revenue/EBITDA/PAT CAGRs over FY24-26. We initiate coverage on the company with a Buy, valuing it at 28x FY26e P/E to arrive at a TP of Rs1,277.

Focus on light-weight jewellery, asset-light franchisee model. Senco’s USP is its light-weight jewellery across prices, helping maximise its customer base. Its network of 90 COCO stores is supported by 65 franchisees and various online platforms. Its hub-and-spoke approach helped it expand to new regions and lever the logistical efficiency of stocks and return on capital. The COCO stores brought ~65% of FY23 sales; franchisees/online, ~32%/3%.

Efficient operating model. The vast variety of its jewellery is handcrafted by skilled karigars, third-party vendors or in-house. Most of the gold required is sourced via banks’ gold-loan facilities, with hedging policies minimising the risks of gold-price fluctuations. The company has an effective inventory management system and focuses on levering technology to drive efficiencies.

Financials. Over FY24-26, we expect a 23% revenue CAGR driven by SSSG and store expansion, a 15.3% FY26 gross margin with better studded and product mixes and 28%/36% EBITDA/PAT CAGRs. We expect 21.4%/14.4% RoE/ RoCE and 135 working capital days by FY26 largely due to fewer inventory days. Net debt would rise to Rs11bn by FY26. We expect the turnaround in OCF generation (cumulative Rs2.3bn over FY24-26) driven by higher profitability and lower inventory.

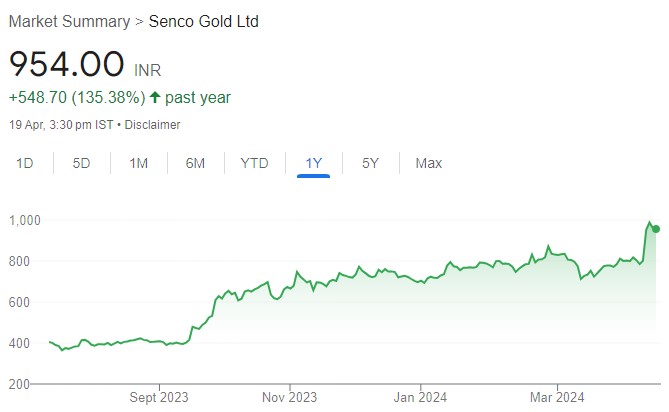

Valuation. We initiate coverage of Senco Gold with a TP of Rs1,277 (28x FY26e P/E). At the CMP, the stock is valued at 28.5x/21.2x FY25e/FY26e P/E. Risks: More working capital, higher regulatory requirements, keener competition.

Click here to download research report on Senco Gold by Anand Rathi