The Siva group appears to be a big-ticket corporate house in South India. Their website is sivagroup.in. They have a number of investment companies called Abhi Ambi Financial Services Ltd, Sterling Futures & Holidays Ltd, Siva Trade Consultancy Pvt. Ltd etc. These investment companies are collectively known as the “Sterling group” in SEBI’s order.

The Sterling group are/ were clients of Sharekhan and bought and sold large quantities of securities through them.

The shocking thing is that Sharekhan used the buy and sell orders placed by the Sterling group to do “front-running” in those stocks, i.e. it would buy or sell the stocks in advance so as to profit from the price movement which would occur when the Sterling group’s orders were placed. It also manipulated the price at which the stock was bought/ sold by the client.

SEBI has given numerous examples to prove the fact of front-running.

One example relates to the transactions in KS Oil. The order states thus:

“Three buy orders were placed by Ratha (Sterling Group), one each at 09:34:46 Hrs, 09:35:33 Hrs and 09:35:54 Hrs for 3,00,000, 4,00,000 and 4,00,000 shares respectively. All the three orders were placed at Rs. 40.45 i.e., the same price at which sell orders were placed in Viraj’s account. The LTP at the time of buy order placed by Ratha was Rs. 40.40, Rs. 40.30 and Rs. 40.35 respectively. The start of entry of sell orders in Viraj’s account was 30 seconds in advance to the start of buy orders being placed by Ratha. The buy order price was later increased to 41.00 for 1,45,110 shares in the third buy order of Ratha.”

There are numerous other examples given by SEBI where the trading analysis, manner of trading/order placement pattern observed, timing and duration of phone calls, etc shows that Sharekhan is guilty of front-running.

The worst part of this unethical and illegal activity is that Sharekhan’s clients have suffered a loss or been deprived of their just profits.

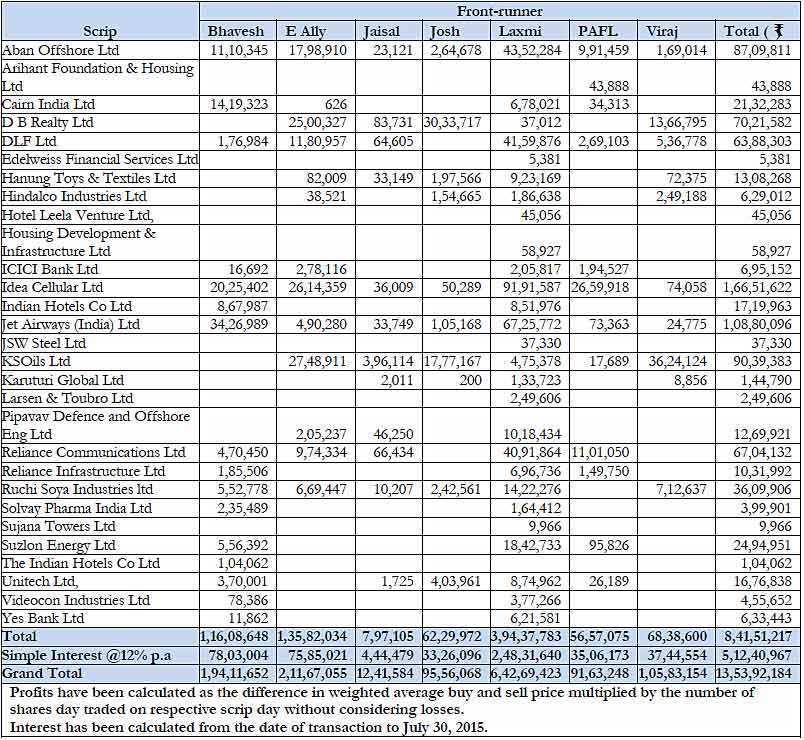

SEBI has directed that the front-runners must disgorge their ill-gotten profits and also pay interest thereon.

This loss and interest has been quantified by SEBI at Rs. 14.70 crore. Sharekhan has been directed to pay the said amount within 7 days of passing of the order.

However, the order is silent on whether the said amount will be passed over to the Siva/ Sterling group or will be retained by SEBI.

Logically, the amount should be paid to the Siva/ Sterling group.

However, the worrying part is whether there are any other such front-running scams undertaken and whether more claimants will come forward with their tale of woe against Sharekhan’s nefarious activities.

The other worrying part is that BNP Paribas, the European Bank, is in talks to buy Sharekhan for a whopping consideration of Rs. 2,200 crore. We will have to see whether the SEBI order will impact that transaction.