Merger Drives Less Cyclicity; More Stability!

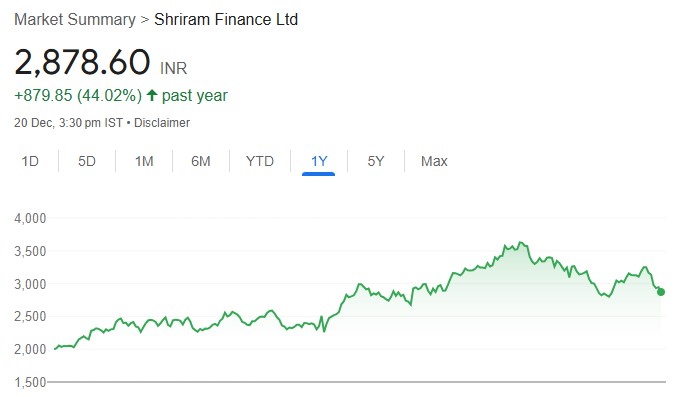

We initiate coverage on Shriram Finance Ltd (SFL) with a BUY recommendation and a target price of Rs 3,825/share, implying an upside of 30% from the CMP. Born out of the merger of Shriram Transport Finance (SHTF), a pioneer in used CV financing and Shriram City Union Finance (SCUF), a diversified retail-focused NBFC – ‘Shriram Finance (SFL)’ is the flagship company of the Shriram Group. The company provides lending services from its diversified product suite. It has been able to deliver strong AUM growth of ~20% CAGR over the 2 years post-merger, while continuously improving asset quality. We remain confident in SFL’s ability to continue its growth trajectory and expect a strong 17/17/19% CAGR AUM/NII/Earnings growth over FY24-27E, driven by (i) Healthy growth primarily in the non-vehicle segment, (ii) Stable NIMs supported by a diversified borrowing franchise and a favourable mix of better-yielding segments, (iii) Gradually declining Opex ratios driven by improving productivity, and (iv) Steady to marginally better credit costs. We expect RoA/RoE delivery to remain healthy at 3.2-3.3%/16-17% over FY25-27E.

Investment Thesis

Dominant Position in Used CV Financing; Market Share Gains Likely SFL primarily provides financing for used CVs (~94% mix), which are tailored to address the needs of its target customers. The used-CV financing market continues to remain dominated by unorganized players, commanding a ~50-55% market share. However, SFL has managed to improve its market share over the past 15 years to ~30% from 12-13%. In the coming decade, SFL expects to further improve its market share by 6-8%. This will be supported by (i) Underpenetration of organized players offering huge market opportunity, (ii) Financing opportunity of Rs 1,800 Bn triggered through replacement demand for 1.45 Mn new as well as pre-owned trucks, and (iii) Expectations of buoyant growth in freight capacity of 1.25x GDP growth.

Merger Enables Portfolio Diversification; Helps Reduce CV Cyclicity

The merger between e-SHTF and e-SCUF enabled the rechristened entity – SFL to diversify from the primary vehicle financing business into a retail-focused small-ticket size portfolio with the introduction of Gold Loans, 2-Wheeler Loans, MSME Loans, and Personal Loans. As a result, the share of the CV portfolio has declined to 46% in Sep’24 vs 52% in Sep’22. The portfolio diversification ensuing the merger would enable the merged entity to steer clear of the cyclicality of the CV financing business. Going forward, SFL’s AUM mix is expected to remain largely stable with a marginal shift of 2-3% towards the non-vehicle segments. We expect SFL to deliver a strong ~17% CAGR AUM growth over FY24-27E, primarily driven by the non-CV segment.

Asset Quality to Remain Steady

Despite significant exposure to the used-CV segment, the company has been able to maintain range-bound credit costs, which can be credited to its structured and relationship-based recovery mechanism. Currently, macro challenges in the form of (i) Lower government capex and (ii) Lower urban consumption indicated by slowing volumes pose challenges for the CV portfolio. Despite a slight 20-30bps dip in Collection Efficiency (CE), the management remains confident of weathering these challenges and maintaining asset quality and credit costs at current levels. Apart from the CV portfolio, SFL remains better placed than its peers in terms of asset quality in the Personal loans portfolio. Additionally, it remains insulated with no exposure to the troubled MFI segment. The management has also indicated that there is no customer overlap with MFI customers in any of SFL’s segments.

Healthy RoA/RoE Delivery to Continue

We expect SFL’s NIM should find support from the company’s diversified borrowing profile, with an emphasis on retail deposits and securitization to optimize the cost of funds (CoF). Similarly, SFL’s domain expertise in the used-CV segment enables the company to enjoy pricing power. Its favourable geographical mix with a prominent presence in rural markets, optimal mix between NTC and ETC customers, and identification of better-yielding segments to drive AUM growth should help support yields. Additionally, improving employee and branch efficiency along with the successful implementation of cross-sell exercise reflecting in productivity metrics should aid opex ratio improvement. This coupled with steady credit costs should ensure strong RoA/RoE delivery of 3.2-3.3%/16-17% over FY24-27E.

Valuation & Recommendation

We initiate coverage on Shriram Finance (SFL) with a BUY recommendation. This is supported by a) Potential to improve market share in the used-CV segment, b) Reduced cyclicity with lower dependence on the CV portfolio, c) Diversification of portfolio ensuring healthy AUM growth, d) Steady Asset Quality with lower mix of unsecured loans and e) Potential to deliver healthy return ratios. We value the stock at 2.2x FY27E ABV (vs. its current valuations of 1.7x FY27E ABV) and arrive at a target price of Rs 3,825/share, implying an upside of 30% from the CMP.