Execution as a merged entity has been superior to its peers

Shriram Finance (SHFL) offers a well-diversified product suite and has emerged as a strong player across all its product segments. It has demonstrated strong execution capabilities and asset quality resilience while navigating multiple credit and economic cycles.

Even though things might appear to be moving slowly on the economic front in India, we believe that economic activity (such as infrastructure, real estate, and mining) will pick up in the next 3-6 months, resulting in healthy demand for commercial vehicles (CV). On the flipside, even if the new CV segment slows down, SHFL remains better positioned than its peers, owing to its strong foothold in the used CV segment.

The diversified composition of the company’s loan book has mitigated its exposure to the cyclicality of the CV business, a challenge faced in the past. By capitalizing on cross-selling opportunities within its non-auto portfolio, the company has strategically positioned itself to achieve a more balanced loan mix while maintaining healthy asset quality.

SHFL has demonstrated higher stability in its asset quality compared to its peers. Unlike the broader industry, the company’s CV and personal loan (PL) portfolios have healthy asset quality, with delinquencies well managed. We estimate credit costs to remain stable and range-bound between 2.3-2.4% (as % of gross loans) over FY26-27E.

SHFL has completed the sale of its housing finance subsidiary to Warburg Pincus for ~INR39b. We estimate SHFL to realize a post-tax exceptional gain of ~INR13b from this sale. Higher capitalization on the balance sheet could help it engage constructively with credit rating agencies for an upgrade.

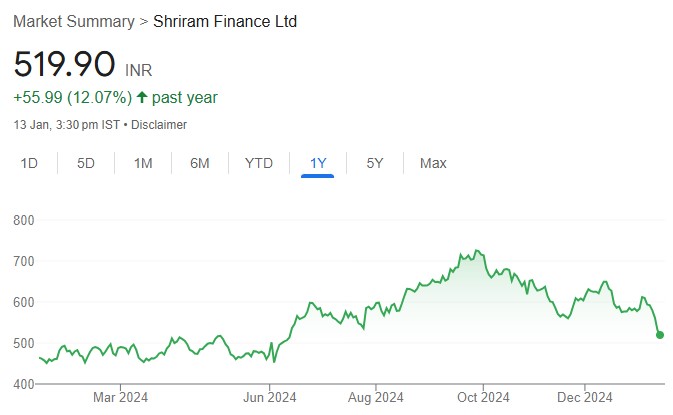

We expect SHFL to deliver a PAT CAGR of ~19% over FY24-27E and RoA/RoE of 3.3%/17% in FY27E. SHFL’s valuations have already re-rated from 1.2x to 1.5x 1-year forward P/BV over the last 12 months. We see scope for further re-rating if the company is able to sustain the execution on its AUM growth, margins and credit costs. SHFL is our TOP pick within our NBFC coverage with a TP of INR700, based on 1.7x FY27E P/BV.

Valuation and view: Good execution and strong visibility on earnings

SHFL is yet to fully tap its expanded distribution network (from the merger) to offer a much wider product bouquet to its customers. The company is effectively leveraging cross-selling opportunities to reach new customers and introduce new products, resulting in improved operating metrics and a solid foundation for sustainable growth.

The current valuation of ~1.3x FY27E BVPS is attractive for a ~19% PAT CAGR over FY24-27E and RoA/RoE of ~3.3%/17% in FY27E. SHFL is our top pick in the NBFC sector with a TP of INR700 (based on 1.7x FY27E BVPS).